Spreads such as vertical spreads and calendar spreads, and combinations including straddles & strangles are all commonly used strategies for options traders. Some two-legged combinations can reduce both sellers risk and buyers cost, thus improving the certainty of options trading.

There are two problems to be addressed, however. The first is margin requirement, which is essential to improve portfolio yield rate, and the second is strategy building.

Here is the good news: margin discounts are already applied for all two-leg combinations on Tiger Trade, including covered calls & puts, vertical spreads, calendar spreads, short straddles & strangles, and protective puts & calls.【Click the link to view the details】

With the margin problem solved, how can you solve the problem of strategy building. Simple - Tiger Trade has launched an automatic calculator named Multi-leg Analysis to show data of each strategy, such as maximum profit and loss as well as the margin requirement. You are able to compare different contracts and scenarios more efficiently. Let us introduce this tool to you and explain how to use it in detail.

First, you need to update the app to version 8.0.6 of Tiger Trade.

Select a contract on the individual stock options chain page to visit an option details page.

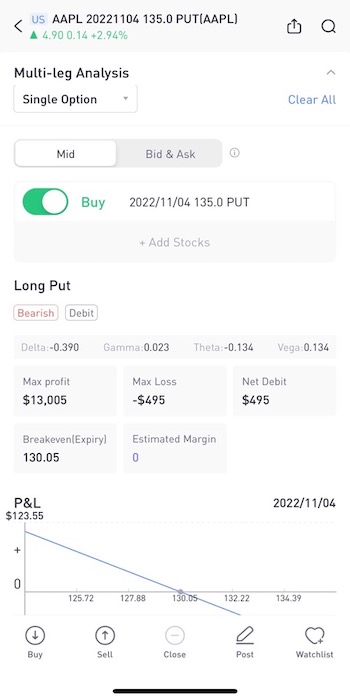

1. Suppose we sell an AAPL put that expires in 45 days. An option with the following expiry and strike price AAPL20221104 135.0PUT is selected. Scroll down to the bottom to see the "Multi-leg Analysis";

2. The default setting of the module is to buy the current option. If we want to calculate the profit and margin of shorting the put instead we can change "buy" to "sell";

3. The profit and loss chart displays the profit and loss curve as at the expiration date.

4. In this situation, if you feel that the risk of a short put is too high, you can also click on "Single Option" and select Vertical Spread in the drop-down menu for risk hedging; if you are bullish, you can choose "Bull Vertical ", and conversely if you are bearish you can choose "Bear Vertical ";

5. If the strike price returned by the system is not what you want, you can click to change, and the chart will be recalculated accordingly;

6. After the spread is selected, the maximum profit, maximum loss, net income, breakeven point, estimated margin, and of course, the corresponding Greeks of the spread are automatically calculated above the chart. It should be noted that the maximum profit and loss, income, break-even point, etc. are all estimates after the portfolio expires.

After the above operations have generated a combination that matches your needs, you can jump to the corresponding contract details page to place an order. Or you can add them to your watchlist with one click. Combination order functions are already on the development schedule, so stay tuned.

Please be reminded again, that the Tiger Trade app needs to be updated to version 8.0.6, and you need to open a prime account in order to use the strategy builder.

For option combination trading, you also need to open a margin account in Tiger and activate the options trading function. If you do not have an account, click link or open an account in the Tiger Trade app

If you have never traded options, you can learn and try with a demo account of options on Tiger Trade.