What is the Russell 2000 Index?

The Russell 2000 Index, launched by FTSE Russell in 1972, features a selection of U.S. companies ranked from 1001 to 3000 by market capitalization. These small-cap companies may be lesser-known than their larger counterparts in the S&P 500, but they offer access to a wide range of industries—finance, healthcare, industrials, tech, consumer goods—and boast the potential for remarkable growth.

Why Should You Care About the Russell 2000?

The Russell 2000 isn’t just a list of small companies; it’s a window into the innovative, high-growth segment of the U.S. economy. These nimble, smaller businesses are often able to adapt quickly to changes in the market—especially during economic recoveries. While their total market cap is just a fraction of the S&P 500, their flexibility and growth potential can be game-changers.

A Look at Historical Performance:

During the 2001 dot-com crash: With the Federal Reserve cutting interest rates multiple times, the Russell 2000 weathered the storm, showing volatility but ultimately outshining large-cap indices.

In the 2007-2008 financial crisis: Small caps initially took a hit, but thanks to aggressive rate cuts by the Fed, they were among the first to rebound, outperforming large-cap stocks as markets stabilized.

In 2019, amid global economic slowdowns and trade tensions: The Russell 2000 proved its resilience again, benefiting strongly from the Fed’s rate cuts as small-cap stocks surged.

Source https://www.cmegroup.com/education/featured-reports/equities-comparing-russell-2000-vs-sandp-500.html

Small companies, being more dependent on bank loans, tend to react more dramatically to interest rate cuts—often making them bigger winners when rates go down.

Risks You Should Be Aware Of

While small caps offer impressive growth potential, they’re also more vulnerable to economic swings. During market downturns or when investor sentiment shifts, these stocks tend to experience sharper price declines. So while the rewards can be big, so can the risks.

What Does the Future Hold?

Historically, the Russell 2000 has delivered strong returns in low-rate environments. Take the period from 1975 to 1983, when small-cap stocks delivered much higher average annual returns than their large-cap peers. This shows that, in the right macroeconomic conditions, small caps can offer huge rewards.

But what about now? While the AI boom in 2022 fueled massive gains in large-cap tech stocks, small caps lagged behind. This creates an intriguing opportunity—historically, when large caps have soared, small caps eventually catch up. So, investors could soon see funds shifting into these smaller companies, especially those that show high earnings flexibility.

How Can You Invest in the Russell 2000?

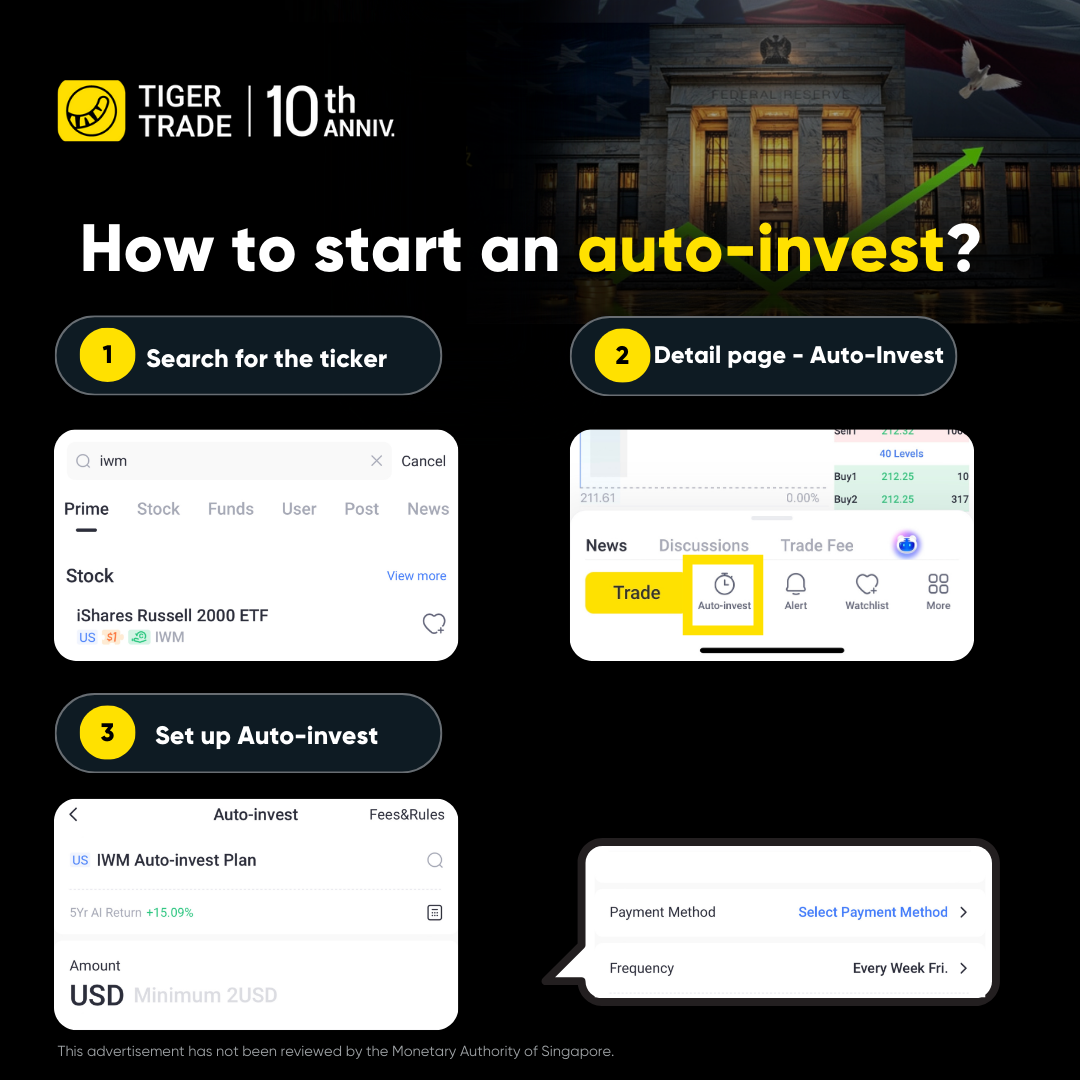

Investing in individual small-cap stocks can be risky, but there’s a simpler way to get exposure: ETFs. IWM, the ETF that tracks the Russell 2000, allows you to buy into the entire index with just one trade. On Tiger Trade, you can start investing in IWM with as little as $1 and even set up daily, weekly, bi-weekly, or monthly automatic investments to take advantage of dollar-cost averaging and reduce the impact of market volatility.

Other small-cap ETF

Vanguard Small-Cap ETF (VB)

VB continues to track the CRSP US Small Cap Index, now with 1,402 stocks. The ETF’s largest sectors include industrials, financials, and consumer discretionary, with technology comprising a significant part. The median market cap has increased to $7.5 billion, positioning it in the mid-cap range. VB maintains its low expense ratio of 0.05%, costing just $5 per year on a $10,000 investment, making it a cost-effective option for passive investors in small-cap stocks.

Dimensional U.S. Small-Cap Value ETF (DFSV)

Dimensional’s DFSV selects small-cap stocks in the value range using quantitative rules. Historically, small-cap value stocks have been among the strongest performers in the U.S. stock market across various periods. DFSV’s past performance over the last decade has remained strong, with an annualized return of 9.08%, outperforming its Russell 2000 Value Index benchmark. The ETF charges a fee of 0.31%.

Disclaimer

Not financial advice. Investment involves risk. The price of investment instruments can and do fluctuate, and any individual instrument may experience upward or downward movements, and under certain circumstances may even become valueless. Past performance is not a guarantee of future results.

This advertisement has not been reviewed by the Monetary Authority of Singapore.