The AI semiconductor market in the US has been witnessing a remarkable surge, with Application - Specific Integrated Circuits (ASICs) emerging as a focal point of intense interest. However, a closer look, as presented by Morgan Stanley's research, reveals a more complex scenario than the market's exuberant expectations suggest.

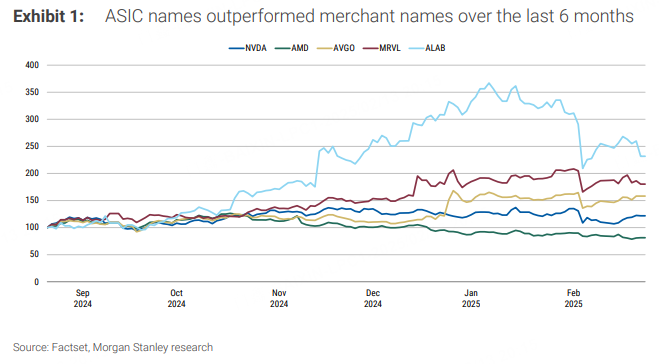

In recent times, the market has been bullish on ASICs, anticipating that they will outperform the merchant silicon offered by industry giants like NVIDIA (NVDA.O) and AMD (AMD.O). The past six - month performance shows that ASIC - related stocks have outpaced those of merchant GPU manufacturers. This has led to a significant shift in investment momentum, with market participants pricing in substantial growth potential for ASICs.

However, Morgan Stanley argues that this enthusiasm might be overblown. Despite the market's optimism, merchant silicon is expected to outgrow ASICs in 2025. The assumption that ASICs will easily succeed while AMD's ambitious AI revenue targets are met with skepticism seems unfounded. After all, both face challenges in competing with established players like NVIDIA.

ASICs vs. Merchant GPUs: A Comprehensive Comparison

Performance and Cost

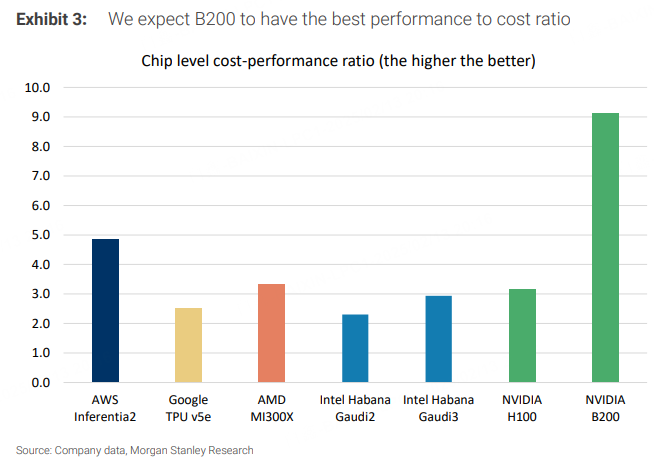

Advocates of ASICs claim that these chips, designed for specific applications, can outperform general - purpose GPUs in niche scenarios and are more cost - effective. For instance, an ASIC might cost $3,000, significantly less than NVIDIA's H100 which is priced at $20,000. But the reality is more intricate. NVIDIA invests heavily in R&D, around $16 billion this year alone. This allows the company to maintain a 4 - 5 - year development cycle, with three design teams working in sequence to achieve an 18 - 24 - month architectural upgrade cycle, each packed with 5 years of innovation. NVIDIA also invests billions in connectivity technologies and software ecosystems. In contrast, the development budget for an ASIC is typically less than $1 billion.

Moreover, when considering the total cost of ownership, the advantage of ASICs diminishes. The system costs for ASICs can be higher. NVIDIA has created a 72 - GPU NVLINK domain over copper, while ASICs often rely on more expensive optical technology. High - bandwidth memory costs are similar, with NVIDIA having an edge in purchasing power for new High - Bandwidth Memory (HBM) due to its monopsony position. Additionally, the cost of Chip - on - Wafer - on - Substrate (CoWoS) technology is higher for many ASICs. And let's not forget the software aspect. NVIDIA's CUDA (Compute Unified Device Architecture) Software Development Kit (SDK) is widely used, making it easier for customers to handle software changes and run different workloads. In contrast, developing and deploying software for ASICs is often challenging and time - consuming.

Market Share and Competitive Landscape

In 2024, NVIDIA accounted for $98 billion of processor revenue, AMD had $5 billion, Broadcom (AVGO.O) $8 billion, and Alchip/MRVL (Marvell Technology Group Ltd, MRVL.O) combined had about $2 billion. This gives merchant silicon approximately a 90% market share, while ASICs hold only 10%. Morgan Stanley predicts that the merchant silicon's share will increase slightly in 2025.

Although ASICs have growth opportunities in certain areas, they face fierce competition. For example, MediaTek (2454.TW) is expected to challenge Broadcom within the Google TPU ecosystem, and Alchip (3661.TW) may pose a threat to Marvell within the Amazon Trainium ecosystem. Additionally, NVIDIA's dominant position in the data center market, with its extensive global cloud presence and mature ecosystem, is difficult to challenge.

Investment Ratings and Outlook for Major Companies

Based on the above - mentioned analysis, Morgan Stanley has provided different investment ratings and outlooks for relevant companies.

NVIDIA (NVDA.O): A Top Pick

NVIDIA remains Morgan Stanley's top pick in the semiconductor sector. Despite facing risks such as US export controls, the long - term prospects are promising. With the booming development of generative AI, the demand for AI/ML hardware solutions is on the rise, and NVIDIA's data center business is expected to be the main growth driver in the next 5 years. The company also has growth opportunities in AI/ML software & services, networking, and autonomous driving. Morgan Stanley has set a target price of $152.00 for NVIDIA, with an estimated 2025 earnings per share (EPS) of $4.75, corresponding to a price - to - earnings ratio of approximately 32 times.

Broadcom (AVGO.O): Overweight with Caution

Broadcom also has a significant share in the AI market and is expected to grow as hyperscale capex increases. However, it is currently in a transition period for its AI business, with some customer businesses experiencing fluctuations. The market has high expectations for its 2027 revenue. Morgan Stanley maintains an overweight rating on Broadcom but will closely monitor market expectations. The target price is set at $246.00, corresponding to a 39 - times price - to - earnings ratio based on its 2026 ModelWare EPS of $6.30.

Other Companies: On the Sidelines

For companies like AMD, Marvell Technology Group Ltd (MRVL.O), Astera Labs Inc (ALAB.O), and Micron Technology Inc. (MU.O), Morgan Stanley suggests a wait - and - see approach. AMD has made some progress in the AI field, but the high market expectations leave little room for it to exceed expectations. Marvell has AI - related growth opportunities but has a relatively high valuation and significant stock - based compensation expenses. Astera Labs is a leader in AI connectivity but is already fully valued. Micron's memory business faces market volatility, and although its AI business provides some growth momentum, its overall future remains uncertain.

Conclusion

In summary, while ASICs have attracted significant attention in the AI chip market, they face numerous challenges when competing with general - purpose GPUs. General - purpose GPUs, with their strong R&D capabilities, mature ecosystems, and wide range of applications, are likely to maintain their dominant market position in the short term. Investors should carefully consider various factors before making investment decisions in the AI semiconductor market.