Why Shangri-La Asia's (HKG:69) Earnings Are Better Than They Seem

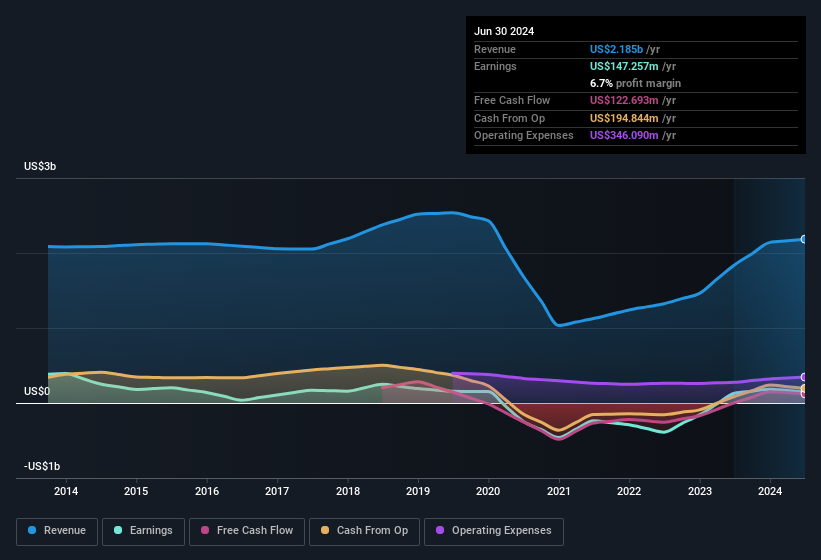

The market seemed underwhelmed by last week's earnings announcement from Shangri-La Asia Limited (HKG:69) despite the healthy numbers. Our analysis suggests that shareholders might be missing some positive underlying factors in the earnings report.

See our latest analysis for Shangri-La Asia

How Do Unusual Items Influence Profit?

For anyone who wants to understand Shangri-La Asia's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit was reduced by US$24m due to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. If Shangri-La Asia doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Shangri-La Asia's Profit Performance

Unusual items (expenses) detracted from Shangri-La Asia's earnings over the last year, but we might see an improvement next year. Because of this, we think Shangri-La Asia's earnings potential is at least as good as it seems, and maybe even better! And the EPS is up 13% over the last twelve months. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. If you want to do dive deeper into Shangri-La Asia, you'd also look into what risks it is currently facing. You'd be interested to know, that we found 1 warning sign for Shangri-La Asia and you'll want to know about this.

This note has only looked at a single factor that sheds light on the nature of Shangri-La Asia's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10