BlackRock’s ETHA Joined the $1 Billion ETF Club in Two Months

- BlackRock's Ethereum ETF (ETHA) reached over $1 billion in asset value, just two months after its launch.

- Crypto ETFs, including Bitcoin and Ethereum, saw inflows surge last week, boosting market recovery sentiment.

- BlackRock's Bitcoin purchases outpaced ETF sales, signaling strong confidence in Bitcoin's potential as a "safe haven."

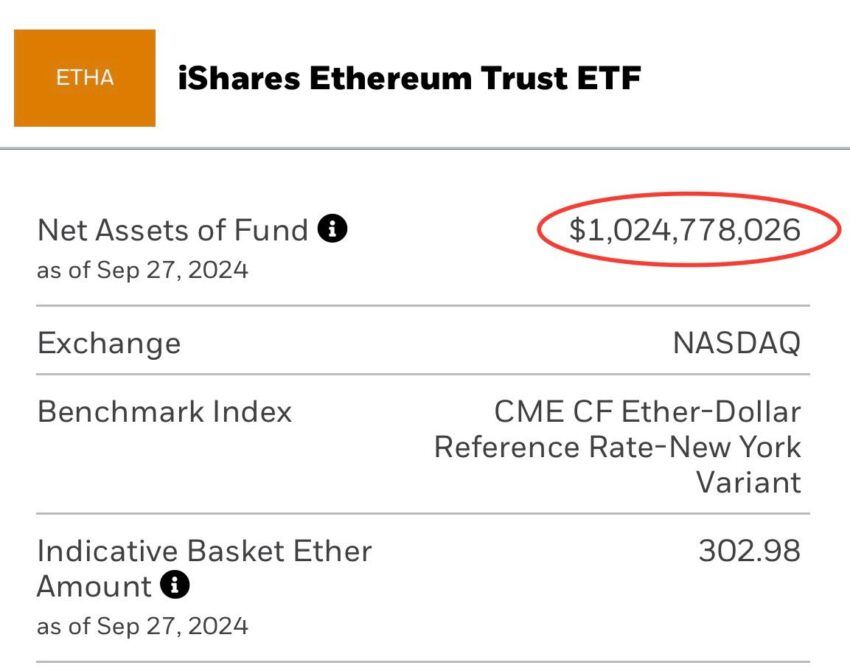

BlackRock asset management firm has hit a new milestone in its spot Ethereum ETF (exchange-traded fund) offering, breaching the $1 billion mark in total asset value in a record two months.

It comes after a favorable week of trading, during which Bitcoin (BTC) and Ethereum (ETH) ETFs recorded multi-week highs as crypto markets recovered.

BlackRock Hits Key Milestone With ETHA

According to Sosovalue data, BlackRock’s Ethereum ETF (ETHA) reached a significant milestone after Friday’s inflows, bringing its total net asset value to over $1 billion just two months after its launch.

This achievement makes ETHA the second Ethereum ETF to surpass $1 billion in value, following Grayscale’s Ethereum Mini Trust (ETH). Nate Geraci, President of the ETF Store, noted that this milestone places BlackRock’s ETHA among the top 20% of the 3,700 ETFs currently available in the US market.

Read more: How to Invest in Ethereum ETFs?

BlackRock’s watershed moment comes after crypto ETFs recorded a favorable week. As BeInCrypto reported, both Bitcoin and Ethereum ETFs hit multi-week highs in inflows, signaling growing optimism for a crypto market recovery. Bitcoin ETFs attracted $1.11 billion in inflows, while Ethereum ETFs recorded $84.6 million — the highest since August.

Notably, three out of five trading days last week saw positive net inflows for Ethereum ETFs, marking the second consecutive week of gains since their debut in late July.

The renewed optimism comes amid a paradigm shift in the US macroeconomic space, instigated by the Federal Reserve’s interest rate decision. With the stance inspiring increased liquidity, investors continue to bet on crypto market recovery, with Bitcoin holding well above $65,000.

BlackRock Bought More Bitcoin This Week Than Any ETF Sold

As BlackRock advances its Ethereum ETF, it is also ramping up efforts in its Bitcoin portfolio. As BeInCrypto reported, the firm’s BTC stash is steadily closing in on Binance.

Data from Arkham shows that BlackRock bought more Bitcoin this week than any ETF has sold in the past three weeks. Specifically, the firm acquired 5,894 BTC, valued at $387.68 million, over four days, signaling a strong accumulation trend.

This buying spree follows three years of skepticism, with BlackRock now holding approximately $23.86 billion worth of Bitcoin. Further purchases were reported by Lookonchain, including an additional 1,684 BTC worth $110.7 million on Saturday, September 28. These acquisitions have brought BlackRock’s total Bitcoin holdings to around 365,310 BTC, valued at over $24.039 billion.

Read more: Who Owns the Most Bitcoin in 2024?

Robbie Mitchnick, BlackRock’s head of digital assets, notes Bitcoin’s immunity to risks such as currency debasement and political turmoil. BlackRock suggests that Bitcoin’s scarce, non-sovereign, and decentralized nature makes it a potential flight-to-safety asset. The firm also believes that global instability could drive long-term adoption of Bitcoin as a store of value.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10