We Wouldn't Be Too Quick To Buy UMS Integration Limited (SGX:558) Before It Goes Ex-Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that UMS Integration Limited (SGX:558) is about to go ex-dividend in just 3 days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. Therefore, if you purchase UMS Integration's shares on or after the 10th of October, you won't be eligible to receive the dividend, when it is paid on the 25th of October.

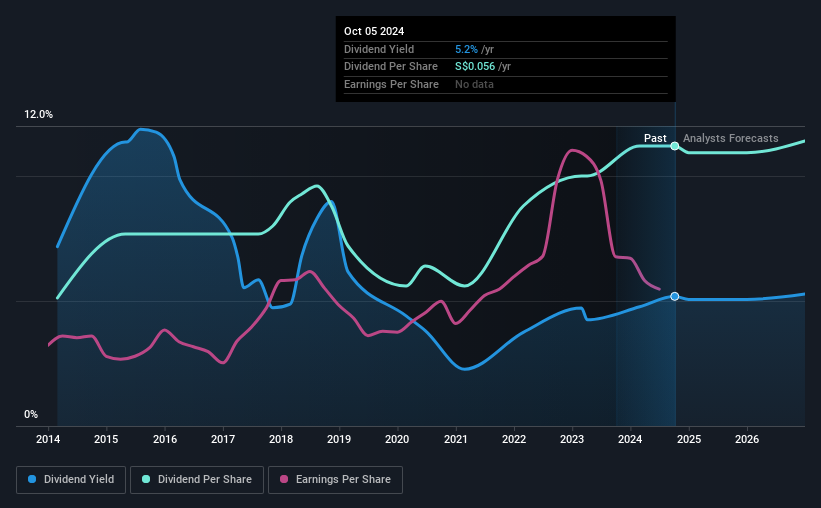

The company's next dividend payment will be S$0.01 per share. Last year, in total, the company distributed S$0.056 to shareholders. Based on the last year's worth of payments, UMS Integration stock has a trailing yield of around 5.2% on the current share price of S$1.08. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether UMS Integration can afford its dividend, and if the dividend could grow.

See our latest analysis for UMS Integration

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. It paid out 77% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be worried about the risk of a drop in earnings. A useful secondary check can be to evaluate whether UMS Integration generated enough free cash flow to afford its dividend. Over the last year, it paid out dividends equivalent to 239% of what it generated in free cash flow, a disturbingly high percentage. Our definition of free cash flow excludes cash generated from asset sales, so since UMS Integration is paying out such a high percentage of its cash flow, it might be worth seeing if it sold assets or had similar events that might have led to such a high dividend payment.

UMS Integration paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Were this to happen repeatedly, this would be a risk to UMS Integration's ability to maintain its dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If earnings fall far enough, the company could be forced to cut its dividend. That explains why we're not overly excited about UMS Integration's flat earnings over the past five years. Better than seeing them fall off a cliff, for sure, but the best dividend stocks grow their earnings meaningfully over the long run. Earnings have been growing somewhat, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

UMS Integration also issued more than 5% of its market cap in new stock during the past year, which we feel is likely to hurt its dividend prospects in the long run. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the past 10 years, UMS Integration has increased its dividend at approximately 8.1% a year on average.

The Bottom Line

Has UMS Integration got what it takes to maintain its dividend payments? In addition to earnings being flat, UMS Integration is paying out a reasonable percentage of its earnings as profits. However, the dividend was not well covered by free cash flow. Bottom line: UMS Integration has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

With that being said, if you're still considering UMS Integration as an investment, you'll find it beneficial to know what risks this stock is facing. In terms of investment risks, we've identified 2 warning signs with UMS Integration and understanding them should be part of your investment process.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10