Tango Therapeutics Repeat Insider Selling Not A Positive Indicator

Tango Therapeutics, Inc. (NASDAQ:TNGX) shareholders might have a reason to worry after multiple insiders sold their shares over the last year. When evaluating insider transactions, knowing whether insiders are buying is usually more beneficial than knowing whether they are selling, as the latter can be open to many interpretations. However, when multiple insiders sell stock over a specific duration, shareholders should take notice as that could possibly be a red flag.

Although we don't think shareholders should simply follow insider transactions, we would consider it foolish to ignore insider transactions altogether.

See our latest analysis for Tango Therapeutics

The Last 12 Months Of Insider Transactions At Tango Therapeutics

The President, Barbara Weber, made the biggest insider sale in the last 12 months. That single transaction was for US$115k worth of shares at a price of US$12.62 each. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. The good news is that this large sale was at well above current price of US$6.98. So it is hard to draw any strong conclusion from it.

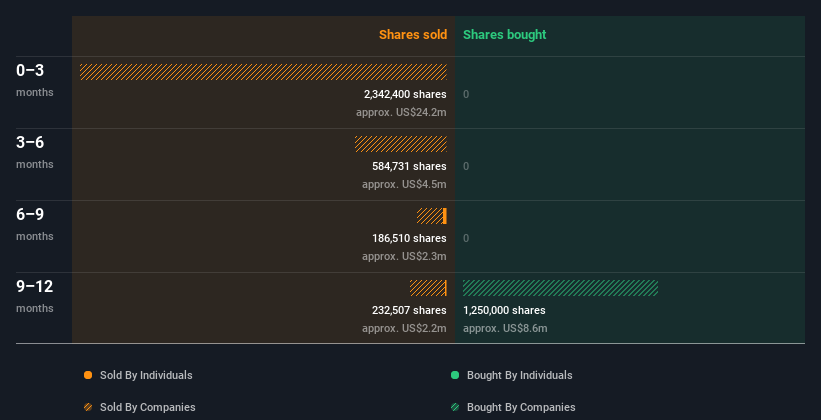

Insiders in Tango Therapeutics didn't buy any shares in the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

I will like Tango Therapeutics better if I see some big insider buys. While we wait, check out this free list of undervalued and small cap stocks with considerable, recent, insider buying.

Insider Ownership

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. It appears that Tango Therapeutics insiders own 1.8% of the company, worth about US$13m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About Tango Therapeutics Insiders?

The fact that there have been no Tango Therapeutics insider transactions recently certainly doesn't bother us. We don't take much encouragement from the transactions by Tango Therapeutics insiders. But we do like the fact that insiders own a fair chunk of the company. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. For example, Tango Therapeutics has 4 warning signs (and 1 which is significant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if Tango Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10