Unveiling Three Undiscovered Gems in Hong Kong with Strong Potential

As global markets grapple with geopolitical tensions and economic fluctuations, the Hong Kong market has shown resilience, highlighted by a significant rise in the Hang Seng Index. Amidst this backdrop of cautious optimism, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking opportunities in this dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Uju Holding | 21.23% | -4.96% | -15.33% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 14.22% | -1.39% | -14.93% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

Click here to see the full list of 170 stocks from our SEHK Undiscovered Gems With Strong Fundamentals screener.

Here we highlight a subset of our preferred stocks from the screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited is an investment holding company involved in the extraction and sale of coal products in the People’s Republic of China, with a market capitalization of HK$13.91 billion.

Operations: The company generates revenue primarily from the extraction and sale of coal products in China. Its financial performance is influenced by its ability to manage production costs effectively.

Kinetic Development Group, a smaller player in the oil and gas sector, has been making waves with its impressive financial performance. Over the past year, earnings surged by 39%, outpacing the industry's 4.6% growth. Trading at 56% below estimated fair value suggests potential undervaluation. The company's debt management is commendable, with a reduced debt-to-equity ratio from 28% to 12% over five years and interest payments well-covered at a robust 163x EBIT coverage.

- Navigate through the intricacies of Kinetic Development Group with our comprehensive health report here.

Understand Kinetic Development Group's track record by examining our Past report.

Bank of Gansu (SEHK:2139)

Simply Wall St Value Rating: ★★★★★★

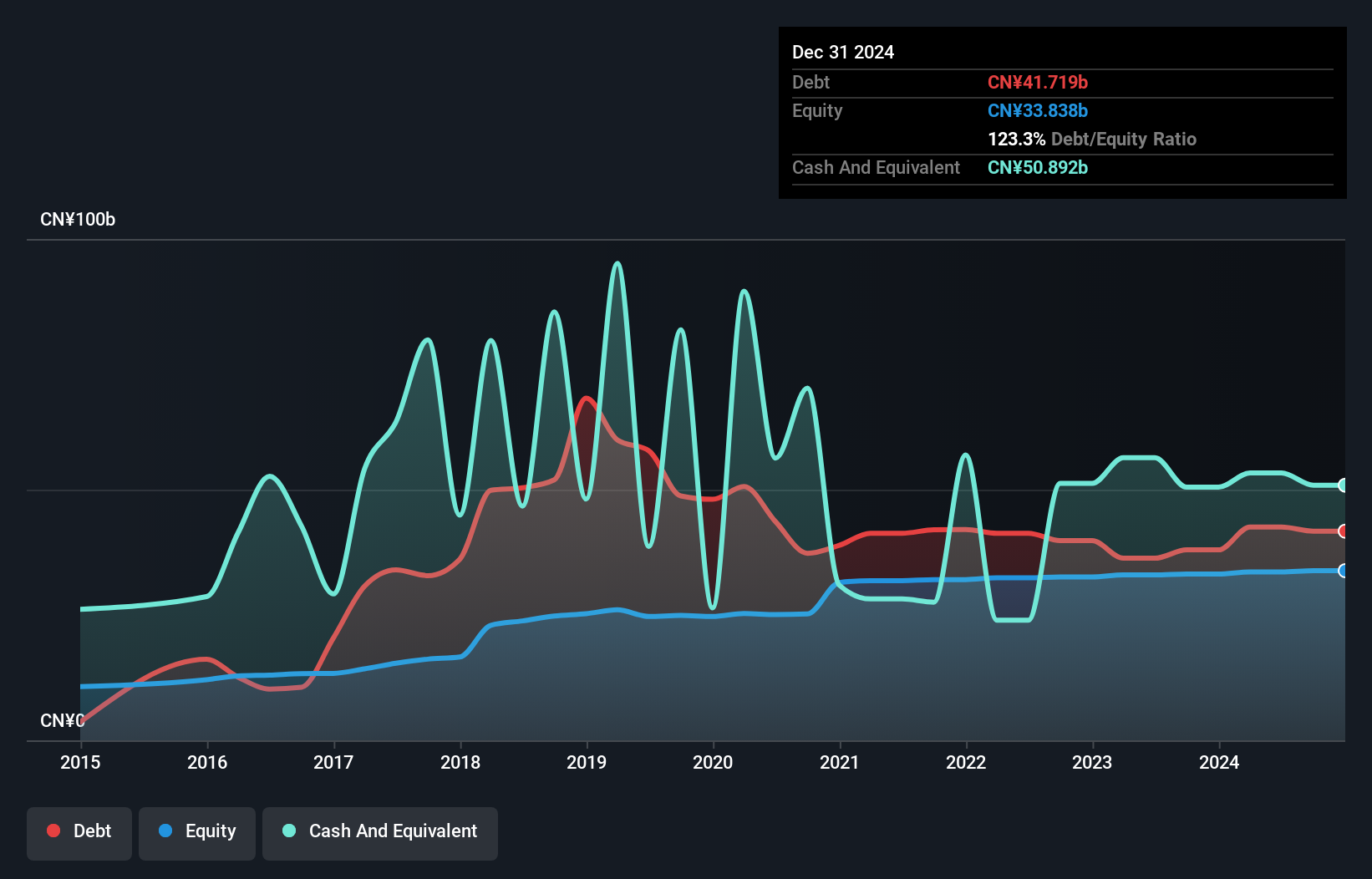

Overview: Bank of Gansu Co., Ltd., along with its subsidiary Pingliang Jingning Chengji Rural Bank Co., Ltd., offers a range of banking services in the People’s Republic of China and has a market capitalization of approximately HK$5.27 billion.

Operations: Bank of Gansu generates revenue primarily through retail banking (CN¥2.10 billion) and corporate banking (CN¥1.21 billion), with financial market operations contributing negatively (CN¥-368.60 million).

Bank of Gansu, with total assets of CN¥422.2 billion and equity of CN¥33.6 billion, stands out for its prudent management in a volatile market. The bank's deposits amount to CN¥333.6 billion against loans of CN¥228.0 billion, reflecting solid financial health supported by 86% low-risk funding sources like customer deposits. Despite a 6.4% annual earnings drop over five years, it maintains a competitive price-to-earnings ratio at 7.6x compared to the Hong Kong market's 11x, suggesting potential value for investors seeking stability amidst volatility in share prices recently observed over three months.

- Take a closer look at Bank of Gansu's potential here in our health report.

Review our historical performance report to gain insights into Bank of Gansu's's past performance.

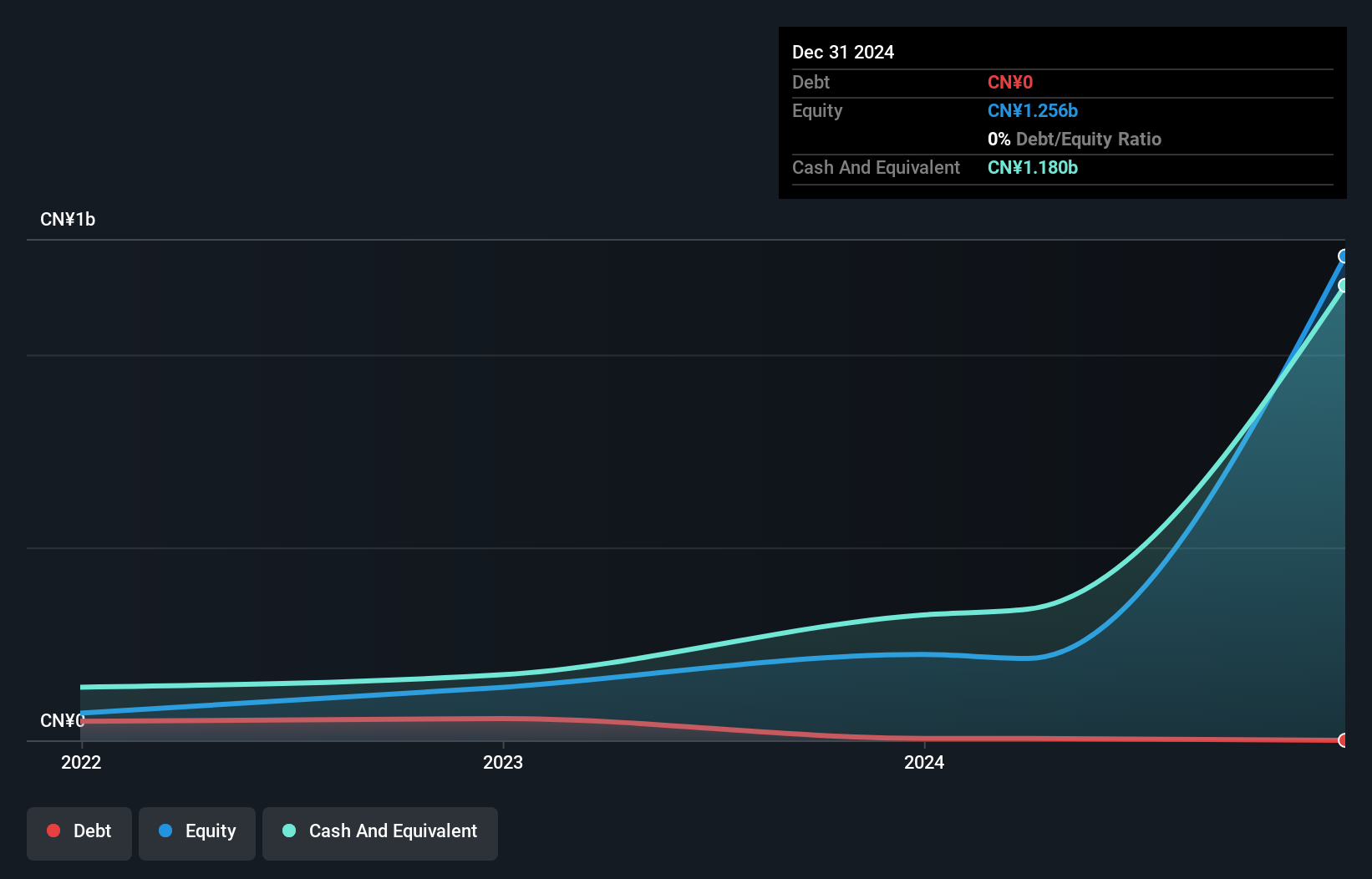

Carote (SEHK:2549)

Simply Wall St Value Rating: ★★★★★☆

Overview: Carote Ltd is an investment holding company that offers a variety of kitchenware products to brand-owners and retailers under the CAROTE brand, with a market capitalization of approximately HK$3.21 billion.

Operations: Carote Ltd generates revenue primarily from its Branded Business segment, which accounts for CN¥1.58 billion, while the ODM Business contributes CN¥210.80 million. The company's financial performance is reflected in its net profit margin trends over recent periods.

Carote has recently completed an IPO, raising HK$750.62 million by offering shares at HK$5.78 each, with a slight discount of HK$0.14 per share. This emerging player boasts high-quality earnings and is trading at 81.7% below its estimated fair value, suggesting potential for appreciation. Over the past year, Carote's earnings surged by 92%, outpacing the Consumer Durables industry's growth of 20%. Despite its illiquid shares, this financial performance paints a promising picture for investors seeking opportunities in Hong Kong's market landscape.

- Click here and access our complete health analysis report to understand the dynamics of Carote.

Examine Carote's past performance report to understand how it has performed in the past.

Where To Now?

- Investigate our full lineup of 170 SEHK Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Gansu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10