Mohawk Industries, Inc. (NYSE:MHK) reported better-than-expected results for its third quarter, after the closing bell on Thursday.

The company posted quarterly earnings of $2.90 per share which beat the analyst consensus estimate of $2.89 per share. The company reported quarterly sales of $2.719 billion which beat the analyst consensus estimate of $2.700 billion.

Chairman and CEO Jeff Lorberbaum stated, “We delivered a solid performance in soft market conditions, which reflects the positive impact of our sales initiatives, productivity and restructuring actions as well as lower input costs, partially offset by pricing and mix pressure. Due to our increased earnings and management of working capital, we generated free cash flow of $204 million in the quarter, for a total of $443 million year to date. This year, we are investing approximately $450 million in capital projects focused on growth, reducing costs and asset maintenance.”

Mohawk shares gained 2.6% to trade at $134.23 on Monday.

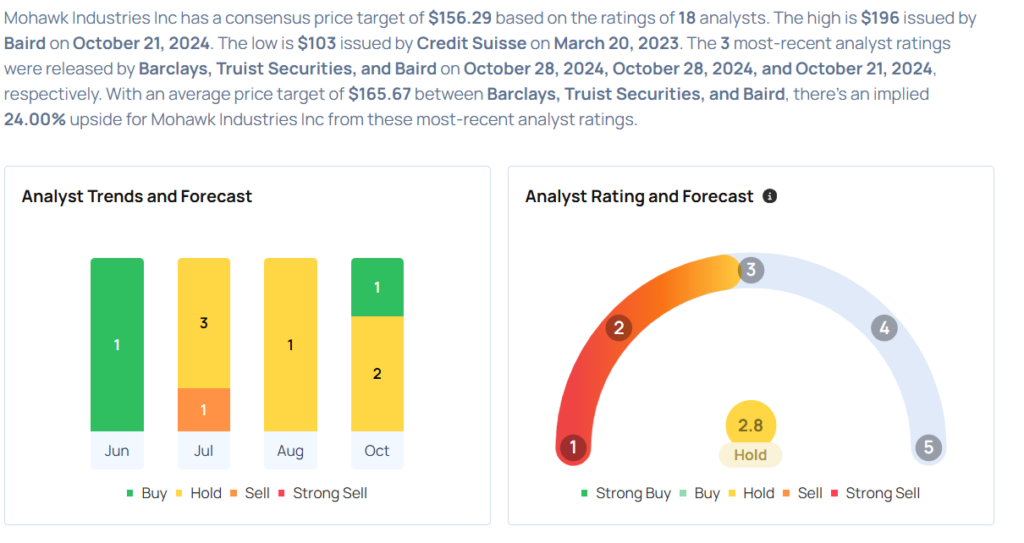

These analysts made changes to their price targets on Mohawk following earnings announcement.

- Truist Securities analyst Keith Hughes maintained Mohawk Industries with a Buy and lowered the price target from $184 to $155.

- Barclays analyst Matthew Bouley maintained the stock with an Equal-Weight and cut the price target from $161 to $146.

Considering buying MHK stock? Here’s what analysts think:

Read More:

- Top 3 Industrials Care Stocks That Plunge This Month