Armstrong World Industries, Inc. (NYSE:AWI) reported better-than-expected earnings for the third quarter on Tuesday.

The company posted quarterly earnings of $1.81 per share which beat the analyst consensus estimate of $1.75 per share. The company reported quarterly sales of $386.60 million which missed the analyst consensus estimate of $386.69 million.

“With another quarter of record setting sales and strong earnings growth, we continue to demonstrate our ability to deliver growth despite muted market conditions through operational execution and our investments in strategic acquisitions, innovation and digital initiatives,” said Vic Grizzle, President and CEO of Armstrong World Industries. “As market demand continues to stabilize, we are well positioned to deliver full year double-digit top and bottom-line growth with industry-leading margin performance through strong Mineral Fiber Average Unit Value improvement, market-driven innovation, operational excellence and Architectural Specialties growth.”

Armstrong World raised its FY24 adjusted earnings guidance from $6.00-$6.15 to $6.15-$6.25 per share.

Armstrong World shares gained 0.8% to trade at $141.09 on Wednesday.

These analysts made changes to their price targets on Armstrong World following earnings announcement.

- UBS analyst John Lovallo maintained Armstrong World Indus with a Neutral and raised the price target from $136 to $144.

- Evercore ISI Group analyst Stephen Kim maintained the stock with a In-Line and raised the price target from $127 to $140.

- Truist Securities analyst Keith Hughes maintained Armstrong World Indus with a Buy and raised the price target from $148 to $162.

- Loop Capital analyst Garik Shmois maintained the stock with a Hold and raised the price target from $135 to $145.

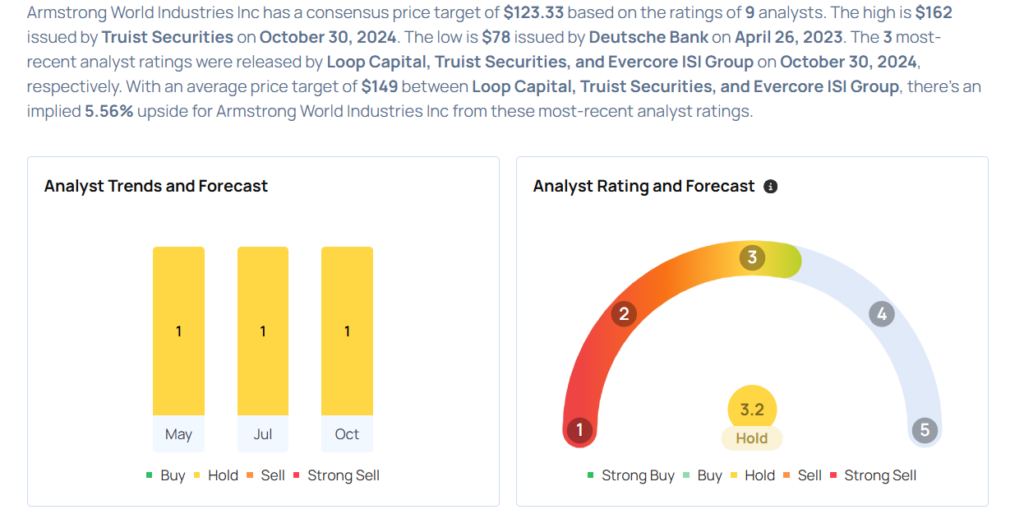

Considering buying AWI stock? Here’s what analysts think:

Read More:

- Top 3 Tech And Telecom Stocks Which Could Rescue Your Portfolio For October