Solana’s Uptrend Strengthens, But Investors’ Moves Raise Doubts

- Solana surges 40% to $210 but faces strong resistance at $221, stalling its momentum toward the $245 target.

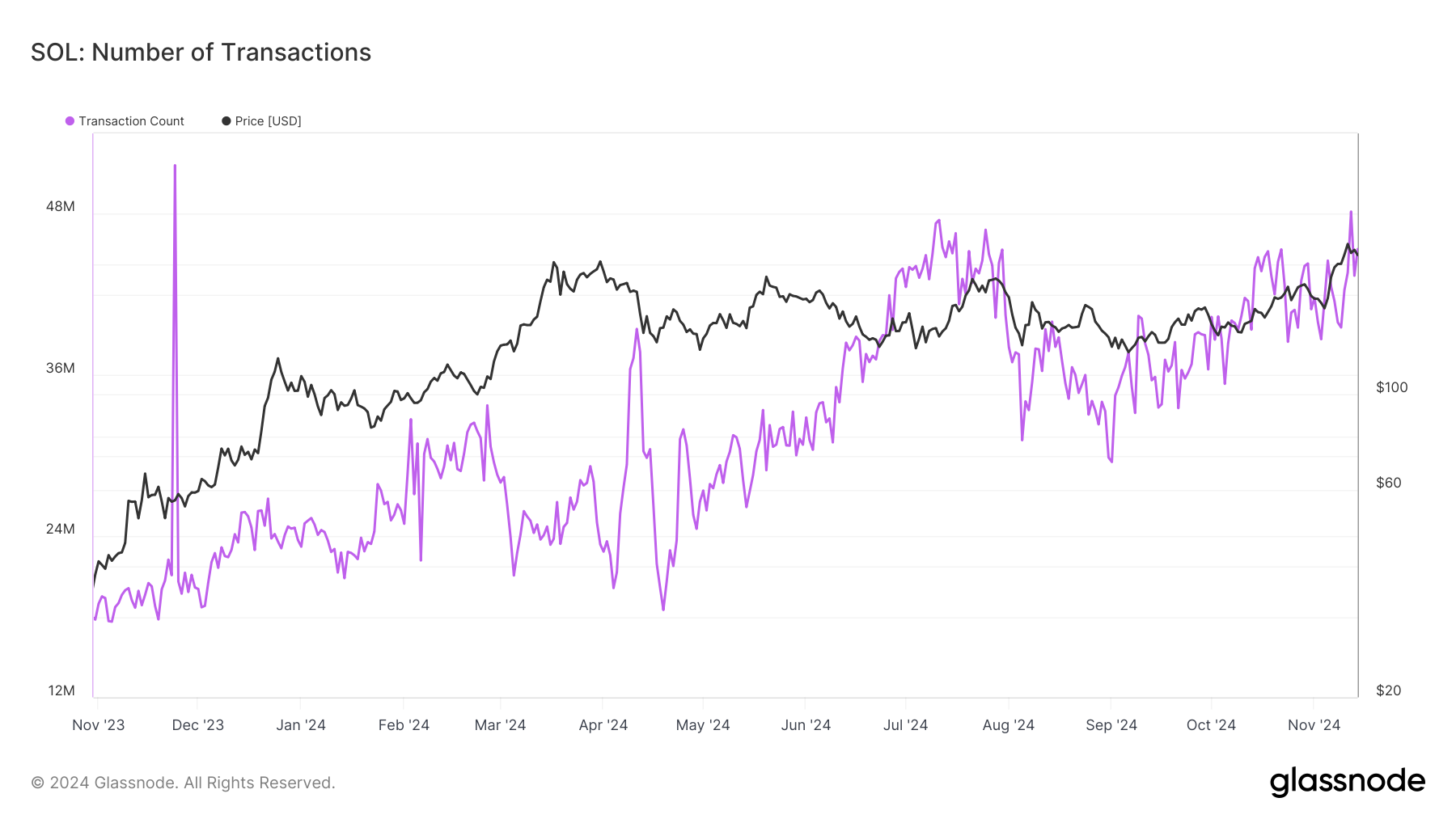

- Network transactions hit a yearly high, but moderate activity raises concerns about sustaining SOL’s rally without stronger engagement.

- SOL risks a drop below $201 if profit-taking intensifies, with $186 as a key support if the current uptrend falters.

Solana (SOL) price has seen a remarkable 40% surge in recent weeks, climbing to $210. Despite this bullish uptrend, SOL is encountering challenges at the $221 resistance level, which could signal a potential reversal.

Investor activity on the Solana network suggests the momentum might face hurdles in sustaining further gains.

Solana Investors Need Motivation

Transaction activity on the Solana network has increased significantly during the recent price rally. The network recently hit a yearly high in transaction count, highlighting growing interest among participants. However, this increase falls short of expectations, given the current hype surrounding Solana ETFs and broader market bullishness.

This moderate network activity raises concerns about the sustainability of the rally. If Solana fails to attract more significant user engagement, its price momentum might falter, especially as broader market cues begin to stabilize.

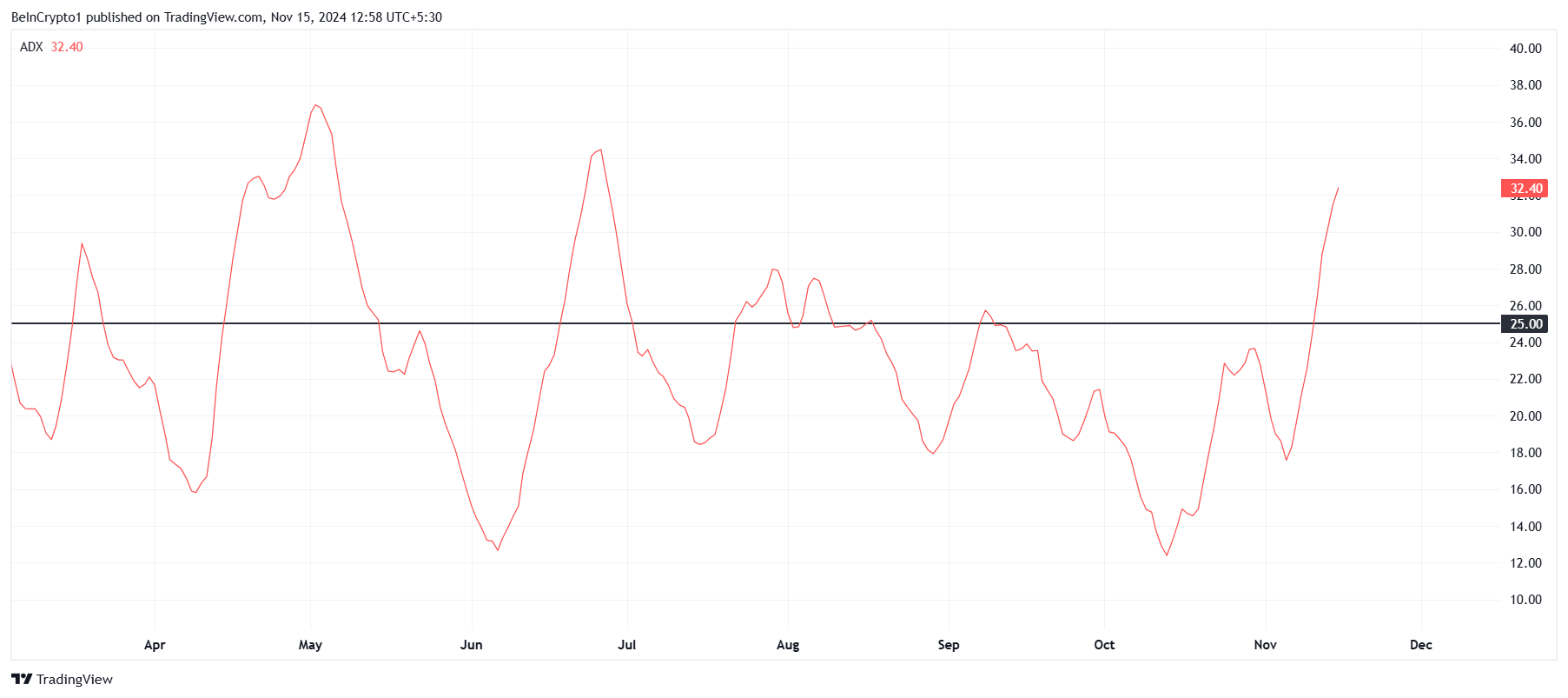

Solana’s macro momentum remains strong, supported by technical indicators. The Average Directional Index (ADX) is at 32, well above the 25.0 threshold, confirming a strong uptrend. This suggests that Solana could continue its upward trajectory if investors remain active.

However, investor participation will be crucial in sustaining this momentum. Should engagement wane, the current uptrend could lose its strength, potentially triggering a correction in SOL’s price.

SOL Price Prediction: Barriers Halt Growth

Solana is currently trading at $210, holding steady above its support level of $201. Despite the recent rally, the “Ethereum killer” is struggling to break past the $221 resistance level, which remains a significant barrier to reaching $245.

The mixed sentiment indicates that SOL may consolidate between $201 and $221 until a clearer directional trend emerges. This range-bound movement could dominate the short-term outlook unless broader market conditions shift dramatically.

However, if investors opt for profit-taking, Solana could see a decline below the $201 support level. Such a drawdown would invalidate the current bullish-neutral outlook, potentially sending SOL to $186, marking a significant setback for the altcoin’s rally.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10