Should Shareholders Have Second Thoughts About A Pay Rise For Oakridge International Limited's (ASX:OAK) CEO This Year?

Key Insights

- Oakridge International's Annual General Meeting to take place on 21st of November

- CEO Con Unerkov's total compensation includes salary of AU$200.0k

- Total compensation is 52% below industry average

- Oakridge International's three-year loss to shareholders was 85% while its EPS was down 60% over the past three years

The disappointing performance at Oakridge International Limited (ASX:OAK) will make some shareholders rather disheartened. There is an opportunity for shareholders to influence management to turn the performance around by voting on resolutions such as executive remuneration at the AGM coming up on 21st of November. We think most shareholders will probably pass the CEO compensation, based on what we gathered.

See our latest analysis for Oakridge International

How Does Total Compensation For Con Unerkov Compare With Other Companies In The Industry?

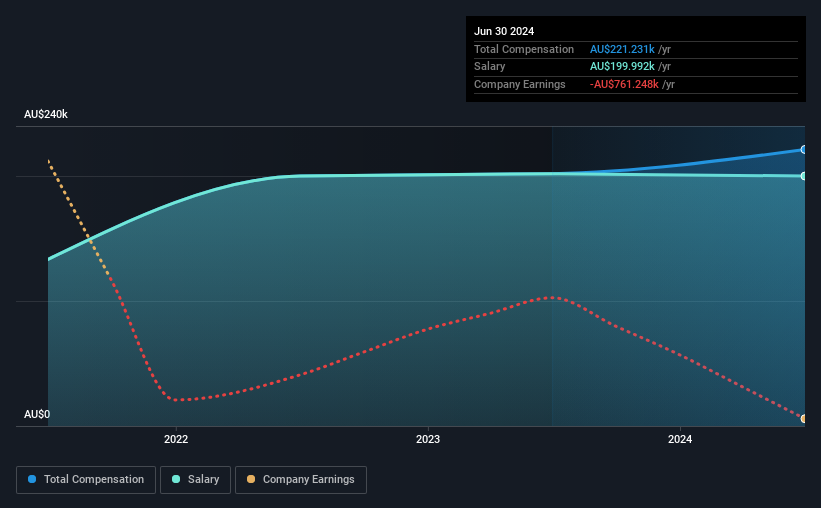

Our data indicates that Oakridge International Limited has a market capitalization of AU$1.6m, and total annual CEO compensation was reported as AU$221k for the year to June 2024. Notably, that's an increase of 9.6% over the year before. In particular, the salary of AU$200.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Australian Software industry with market capitalizations below AU$309m, reported a median total CEO compensation of AU$456k. In other words, Oakridge International pays its CEO lower than the industry median. Furthermore, Con Unerkov directly owns AU$714k worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | AU$200k | AU$202k | 90% |

| Other | AU$21k | - | 10% |

| Total Compensation | AU$221k | AU$202k | 100% |

Speaking on an industry level, nearly 61% of total compensation represents salary, while the remainder of 39% is other remuneration. Oakridge International pays out 90% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Oakridge International Limited's Growth

Over the last three years, Oakridge International Limited has shrunk its earnings per share by 60% per year. It saw its revenue drop 6.7% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Oakridge International Limited Been A Good Investment?

Few Oakridge International Limited shareholders would feel satisfied with the return of -85% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 4 warning signs for Oakridge International that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10