3 ASX Penny Stocks With Market Caps Over A$20M

The Australian market is experiencing a cautious start to the week, with the ASX 200 expected to open lower amid global trading slowdowns and ongoing domestic economic challenges. Despite these broader market conditions, penny stocks—often associated with smaller or newer companies—continue to capture investor interest due to their potential for growth at accessible price points. While traditionally seen as speculative, some penny stocks exhibit strong financial foundations, offering intriguing opportunities for those seeking value beyond the mainstream indices.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.79 | A$231.32M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.99 | A$324.01M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.545 | A$337.98M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.685 | A$825.78M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$2.05 | A$115.32M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.16 | A$69.71M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.98 | A$491.35M | ★★★★☆☆ |

Click here to see the full list of 1,047 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Ai-Media Technologies (ASX:AIM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ai-Media Technologies Limited offers technology-driven captioning, transcription, and translation services across Australia, New Zealand, Singapore, Malaysia, North America, and the United Kingdom with a market cap of A$166.01 million.

Operations: The company generates revenue of A$66.24 million from its Internet Software & Services segment.

Market Cap: A$166.01M

Ai-Media Technologies Limited, with a market cap of A$166.01 million, has demonstrated resilience despite being unprofitable. The company reported A$66.24 million in revenue for the year ending June 2024, reducing its net loss to A$1.34 million from the previous year's A$4 million. Ai-Media is debt-free and maintains a strong cash position with sufficient runway for over three years, supported by positive free cash flow growth of 35.2% annually. Although trading below estimated fair value and experiencing significant insider selling recently, it continues to reduce losses at a rate of 23.3% per year over five years while forecasting substantial earnings growth ahead.

- Navigate through the intricacies of Ai-Media Technologies with our comprehensive balance sheet health report here.

- Gain insights into Ai-Media Technologies' future direction by reviewing our growth report.

Duratec (ASX:DUR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Duratec Limited, along with its subsidiaries, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure in Australia and has a market cap of A$390.66 million.

Operations: Duratec's revenue is primarily derived from its Defence segment at A$220.16 million, followed by Mining & Industrial at A$155.64 million, Buildings & Facades at A$111.33 million, and Energy at A$46.64 million.

Market Cap: A$390.66M

Duratec Limited, with a market cap of A$390.66 million, stands out for its debt-free status and high-quality earnings. The company's revenue is primarily driven by its Defence segment, contributing A$220.16 million. Although Duratec's earnings growth over the past year (11.6%) lagged behind the industry average, its five-year annual growth rate of 24.8% remains impressive. Despite a less experienced management team with an average tenure of 1.8 years, the board is seasoned and experienced with an average tenure of 14.3 years. Duratec trades at a discount to estimated fair value and forecasts suggest continued earnings growth at 14.38% annually.

- Get an in-depth perspective on Duratec's performance by reading our balance sheet health report here.

- Assess Duratec's future earnings estimates with our detailed growth reports.

Foresta Group Holding (ASX:FGH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Foresta Group Holding Limited operates in Australia, focusing on the manufacture and sale of pine chemicals and wood pellets, with a market capitalization of A$24.73 million.

Operations: Foresta Group Holding Limited does not have any reported revenue segments.

Market Cap: A$24.73M

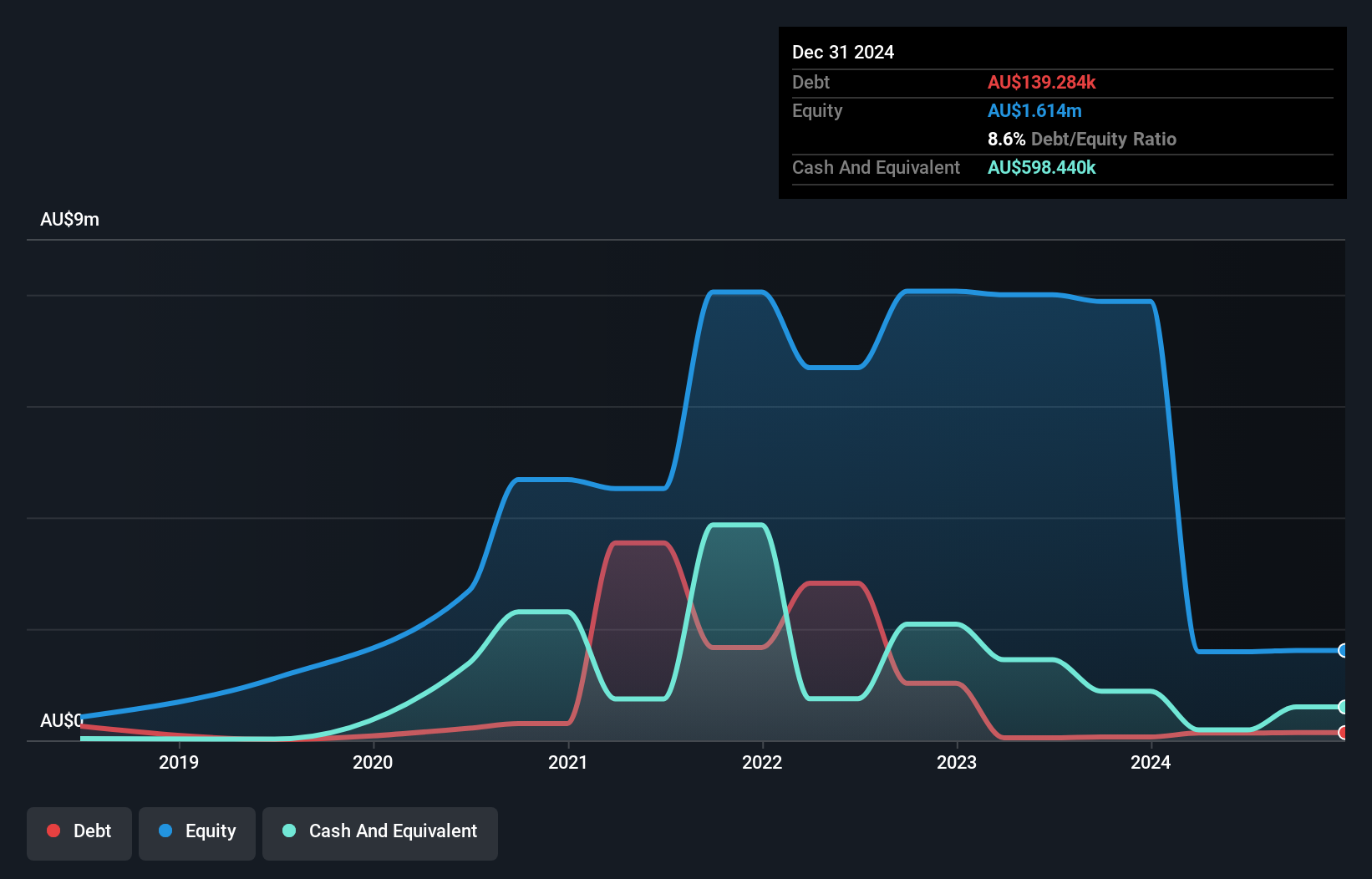

Foresta Group Holding Limited, with a market cap of A$24.73 million, remains pre-revenue and unprofitable, reporting a net loss of A$11.03 million for the year ended June 30, 2024. The company has more cash than debt but lacks significant revenue streams and faces challenges such as recent insider selling and shareholder dilution. Its management and board are relatively inexperienced with an average tenure of 1.6 years. Recent events include a follow-on equity offering to raise A$1.1 million, indicating ongoing capital needs despite having raised additional funds previously through fixed-income offerings.

- Jump into the full analysis health report here for a deeper understanding of Foresta Group Holding.

- Examine Foresta Group Holding's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Gain an insight into the universe of 1,047 ASX Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10