I-Mab Leads Our Spotlight On 3 US Penny Stocks

As the S&P 500 and Nasdaq hit record highs, the U.S. stock market continues its post-election rally with optimism among investors. Amidst this backdrop, penny stocks remain a fascinating segment of the market, often representing smaller or newer companies that can offer unique opportunities for growth. While the term 'penny stocks' might seem outdated, they still hold relevance for those looking to explore investments beyond established giants; here we spotlight three such stocks that stand out for their financial strength and potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.46 | $2B | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.83 | $5.94M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $145.16M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.99 | $91.9M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.24 | $8.91M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.88 | $2.51B | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9381 | $86.31M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.81 | $401.48M | ★★★★☆☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

I-Mab (NasdaqGM:IMAB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: I-Mab is a clinical-stage biopharmaceutical company focused on discovering, developing, and commercializing biologics for immuno-oncology and immuno-inflammation diseases primarily in the United States, with a market cap of approximately $79.46 million.

Operations: I-Mab has not reported any revenue segments.

Market Cap: $79.46M

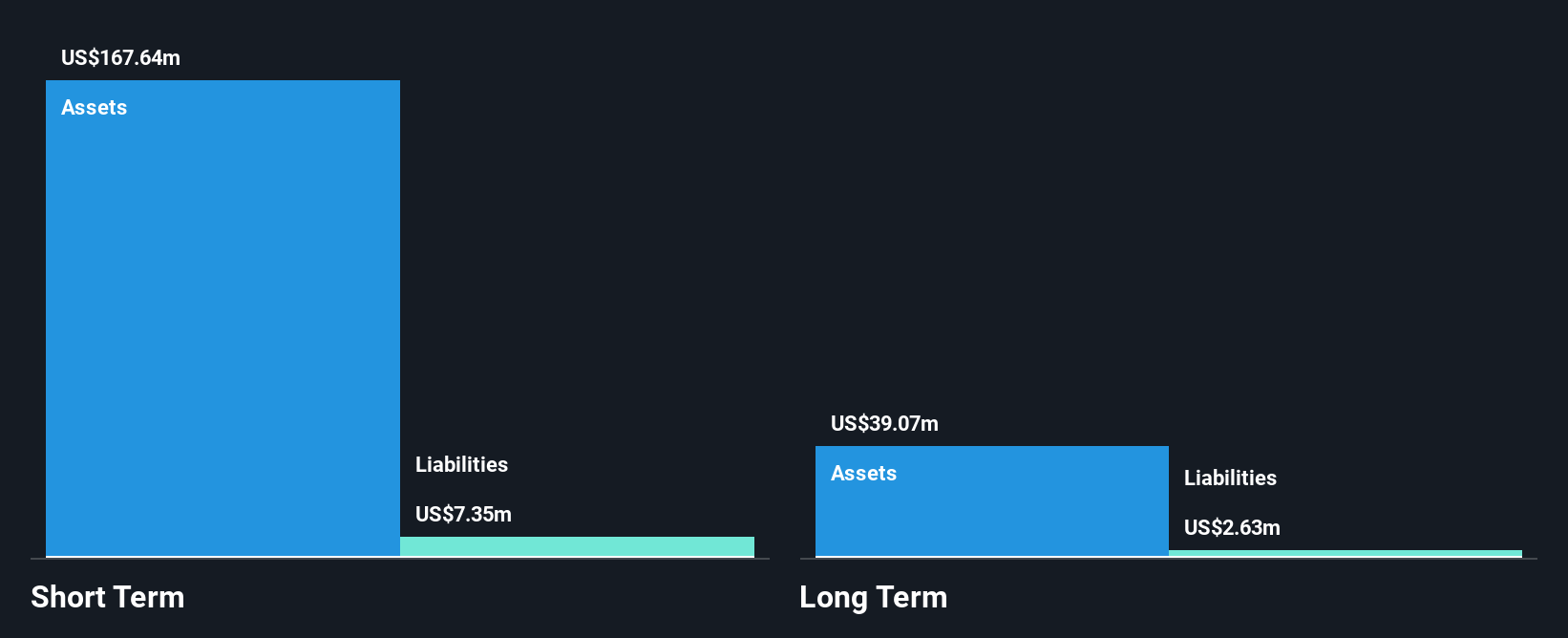

I-Mab, with a market cap of approximately US$79.46 million, is a pre-revenue clinical-stage biopharmaceutical company. Despite its lack of significant revenue, the company maintains strong short-term financials with assets totaling US$188.2 million against liabilities of US$11.8 million and remains debt-free. Recent executive changes include the appointment of Sean Fu as CEO, bringing over 20 years of experience in life sciences to the role. The stock has experienced high volatility but has not seen meaningful shareholder dilution recently. I-Mab's ongoing Phase 1 study for givastomig shows promising results in advanced cancer treatments.

- Take a closer look at I-Mab's potential here in our financial health report.

- Examine I-Mab's earnings growth report to understand how analysts expect it to perform.

Acumen Pharmaceuticals (NasdaqGS:ABOS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Acumen Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company focused on developing targeted therapies for Alzheimer's disease, with a market cap of approximately $141.19 million.

Operations: Acumen Pharmaceuticals, Inc. does not currently report any revenue segments as it is focused on developing therapies for Alzheimer's disease.

Market Cap: $141.19M

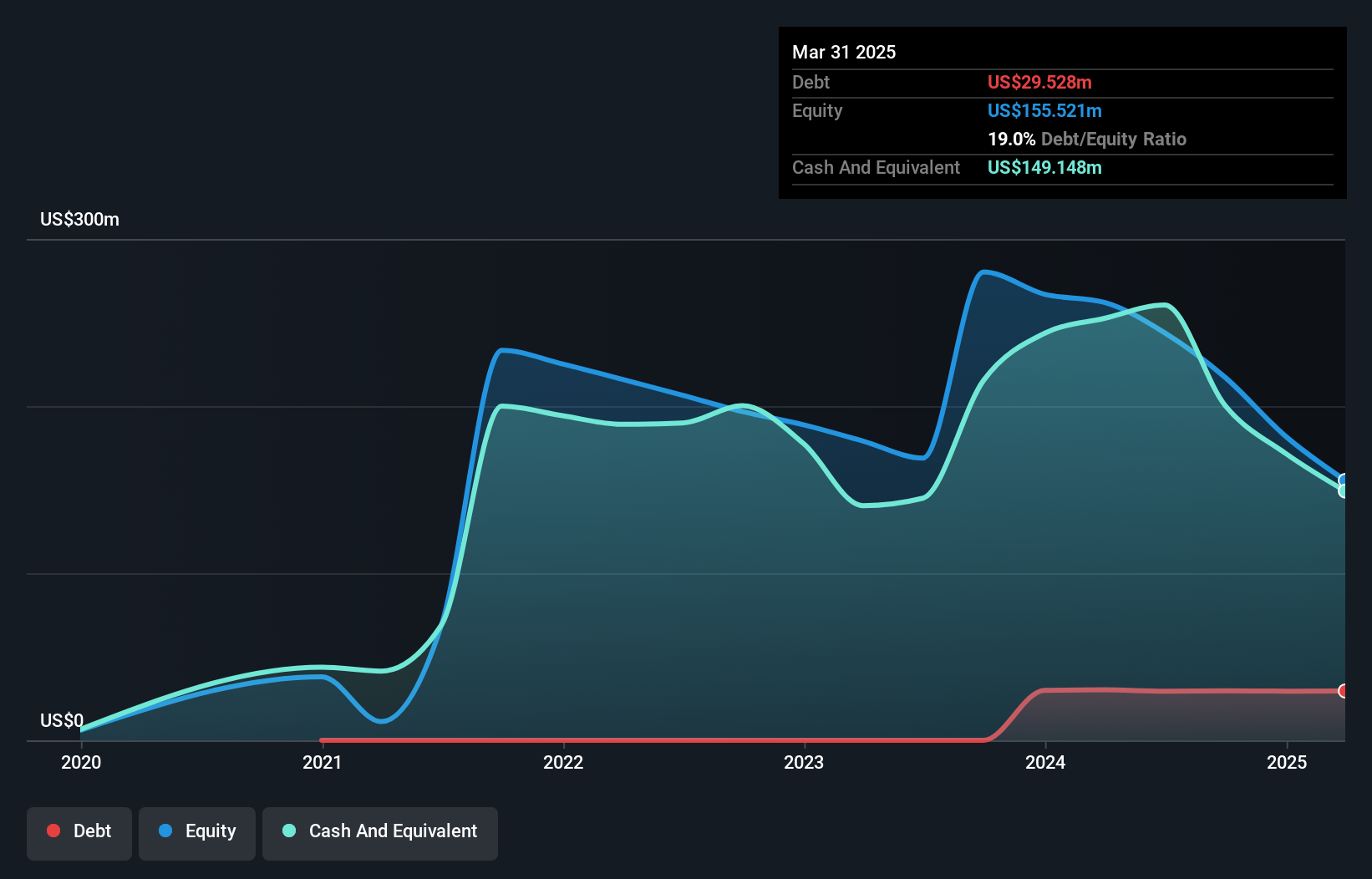

Acumen Pharmaceuticals, with a market cap of US$141.19 million, is a pre-revenue biopharmaceutical firm focused on Alzheimer's therapies. Despite having more cash than debt and sufficient short-term assets (US$207.6M) to cover liabilities, the company faces challenges with increasing losses, reporting a net loss of US$29.77 million for Q3 2024 compared to US$12.96 million the previous year. Shareholder dilution has occurred recently, and volatility remains high relative to other stocks in the U.S., though its management team is experienced with recent strategic appointments such as Amy Schacterle as Chief Regulatory Officer enhancing its regulatory capabilities.

- Click to explore a detailed breakdown of our findings in Acumen Pharmaceuticals' financial health report.

- Understand Acumen Pharmaceuticals' earnings outlook by examining our growth report.

PetMed Express (NasdaqGS:PETS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PetMed Express, Inc. operates as a pet pharmacy in the United States, with a market cap of $94.30 million.

Operations: The company's revenue segment consists of Online Retailers, generating $259.34 million.

Market Cap: $94.3M

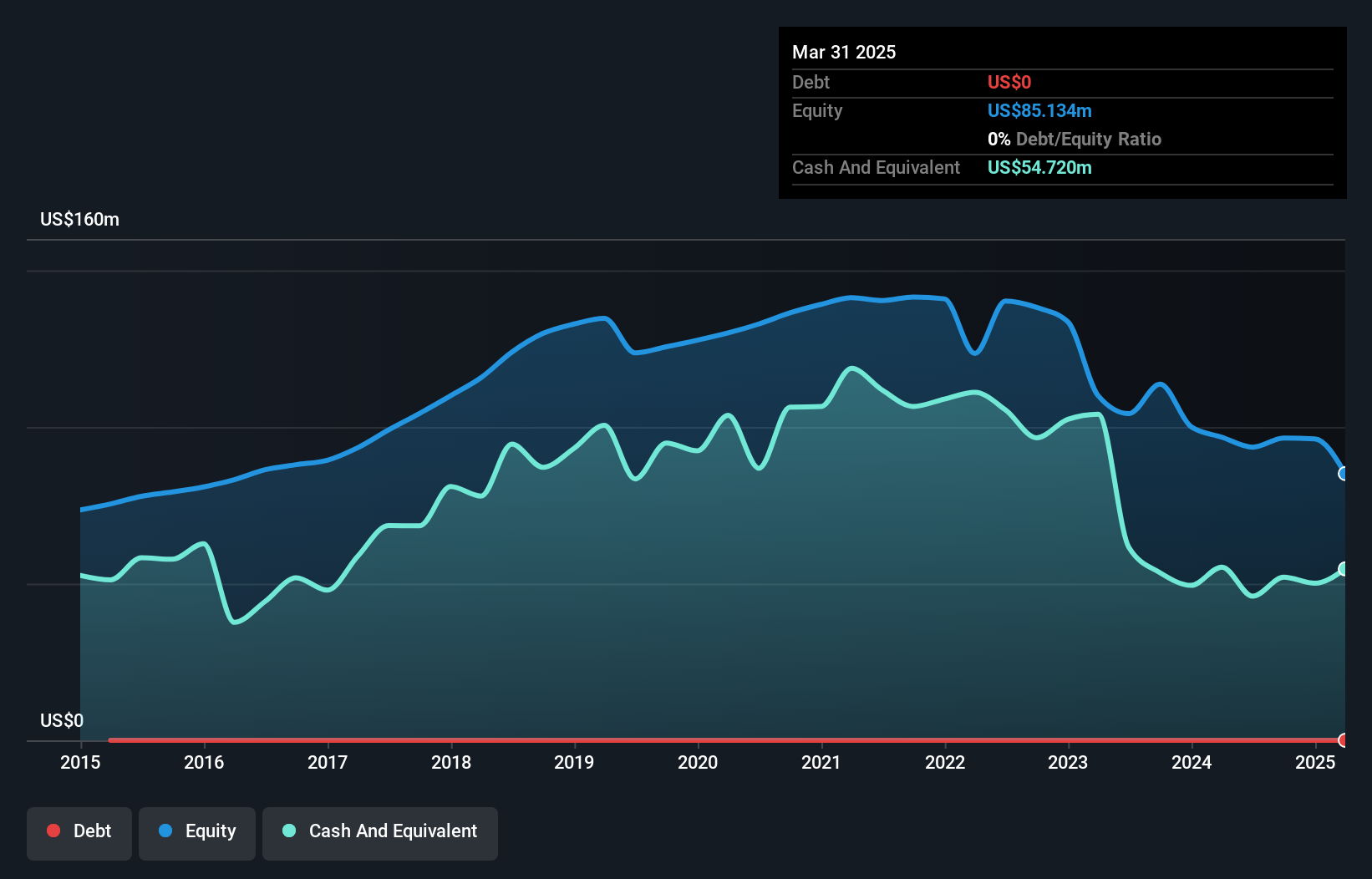

PetMed Express, with a market cap of US$94.30 million, is currently unprofitable but has no debt, mitigating financial risk. Short-term assets of US$70.8 million exceed liabilities, providing some stability despite earnings forecast to decline by 22.8% annually over the next three years. Recent earnings reports show improved net income for the second quarter and six months ending September 2024 compared to previous periods, indicating potential operational improvements. The company's management and board are relatively new with limited tenure; however, recent strategic appointments like CFO Robyn DElia bring substantial industry experience that could influence future performance positively.

- Navigate through the intricacies of PetMed Express with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into PetMed Express' future.

Next Steps

- Access the full spectrum of 709 US Penny Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10