Sushi DAO Proposes Strategy to Increase Liquidity By Selling All SUSHI Tokens

- Sushi DAO proposes diversifying its treasury by selling all SUSHI tokens to reduce volatility and enhance liquidity.

- Jared Grey's plan reallocates treasury to 70% stablecoins, 20% blue-chip crypto, and 10% other DeFi tokens.

- Community feedback will shape specifics before a governance vote decides on full implementation.

Sushi DAO, the organization governing the Sushi Swap decentralized exchange, has proposed diversifying its treasury assets. Under the proposal, Sushi’s treasury will go from 100% SUSHI tokens to a mix of stablecoins and other assets.

This non-binding proposal will seek community feedback from the DAO, especially on specific variables, before an official vote.

SUSHI Tokens Could Face Liquidation

This proposal comes from Jared Grey, the “Head Chef” at Sushi. He plans to sell all of the exchange’s SUSHI tokens and use the proceeds to acquire new assets. Gery claims that this operation would reduce the platform’s volatility risks, enhance liquidity, and generate higher returns.

“As the Sushi DAO continues to evolve, it is crucial to ensure the sustainability and growth of our treasury. The DAO ultimately holds its treasury in SUSHI tokens, which exposes it to high volatility and liquidity challenges. This proposal outlines a strategy for diversifying the treasury assets to mitigate risks and enhance long-term stability,” Grey stated.

Although this token was initially created for governance, the DAO operates under different rules today. A governance vote will decide the proposal’s success or failure.

If implemented, all these tokens will gradually sold, and the proceeds will acquire a new treasury: 70% stablecoins, 20% “blue chip” cryptoassets (BTC, ETH), and possibly 10% other DeFi tokens.

The proposal also specifies that any remaining emergency fund will consist of stablecoins. These assets will also cover future strategic investments and operational expenses of Sushi Swap.

In other words, it’s quite clear that there is no remaining proviso to retain any SUSHI token holdings. This complete liquidation would create a remarkable policy shift.

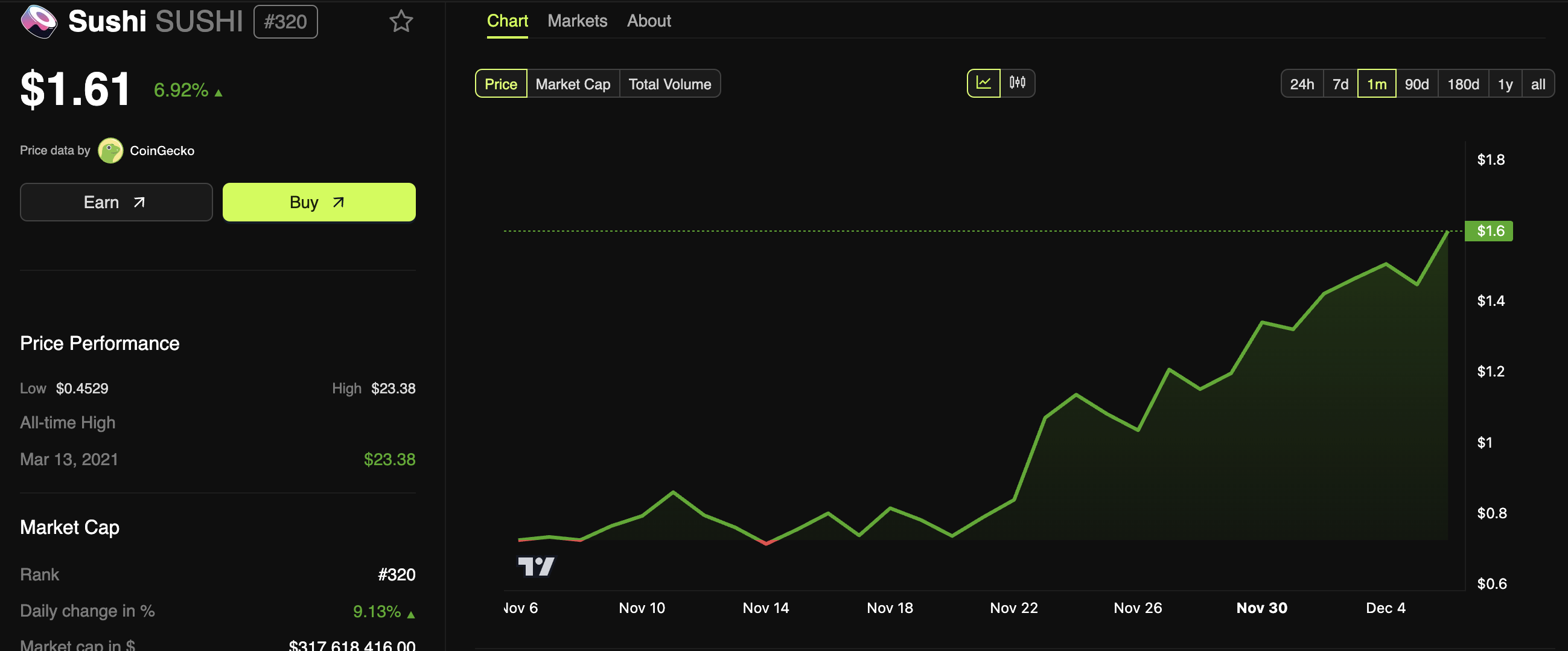

Grey also defended a controversial restructure at Sushi DAO in April this year. Around this time, the price of the SUSHI token plummeted nearly 20%, but it has been steadily recovering recently. The token is up nearly 130% in the last month, and this proposal hasn’t arrested the trend.

At the moment, the policy’s chances of success are unclear. This proposal is an attempt to receive community feedback to refine a fully-binding governance vote.

For example, some variables, like the SUSHI liquidation rate or the DeFi tokens’ inclusion, are currently unspecified. For now, these and other practical questions are up for debate in the DAO.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10