Trump’s World Liberty Financial Drives 30% Surge in LINK, AAVE After $12 Million Swap

- Trump-backed World Liberty Financial sparks a 30% surge in LINK and AAVE prices by acquiring $12 million in ETH, LINK, and AAVE tokens.

- The project’s strategic purchases highlight its focus on DeFi integration, leveraging Chainlink and Aave for lending and cross-chain operations.

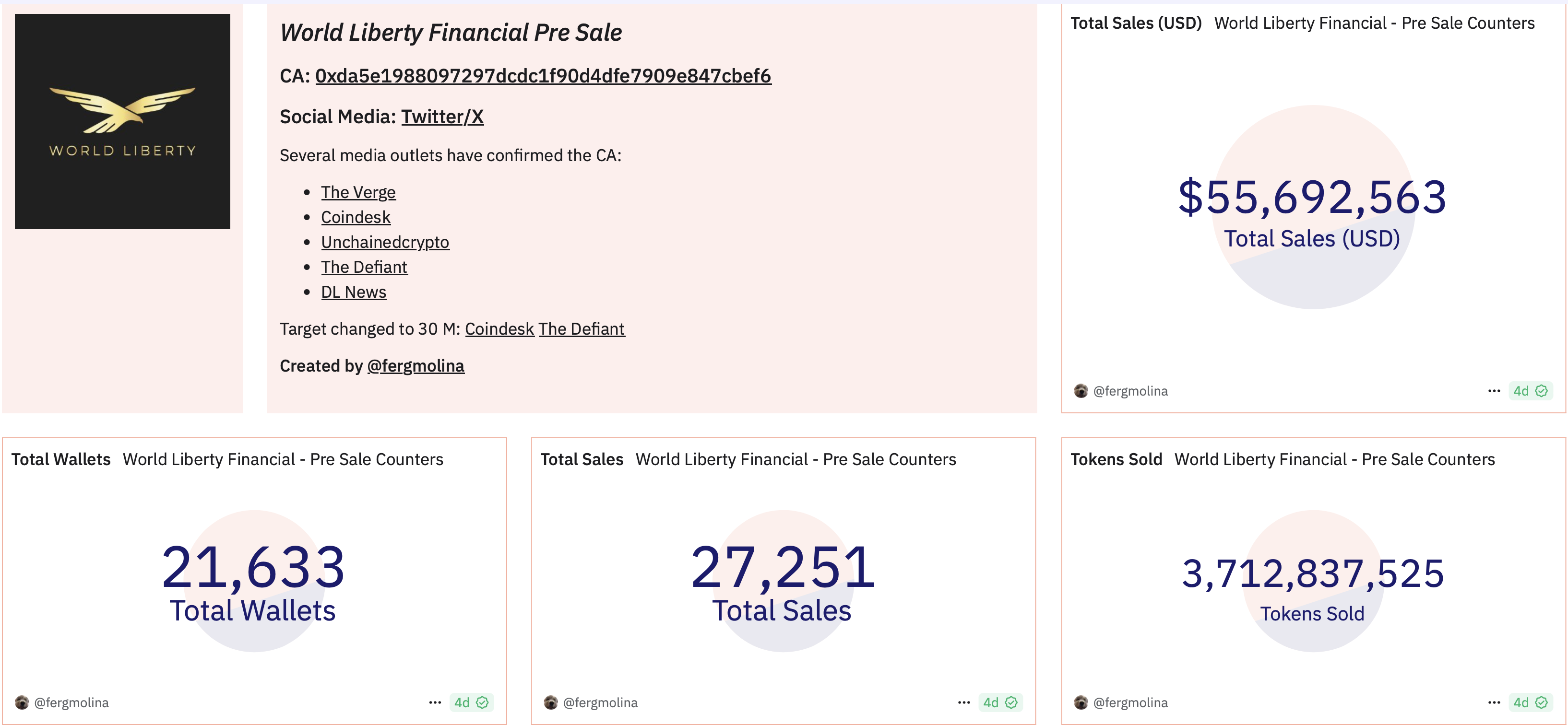

- Despite raising $55 million in WLFI token sales, the project faces hurdles in meeting its $300M fundraising goal amid mixed investor sentiment.

World Liberty Financial (WLFI), a cryptocurrency project supported by President-elect Donald Trump, sparked significant market movements early Thursday by purchasing millions of dollars in Ethereum (ETH), Chainlink (LINK), and Aave (AAVE).

The project’s multisig wallet spent $10 million on ETH and $1 million each on LINK and AAVE, causing LINK and AAVE prices to jump 30% and ETH to rise nearly 7%.

World Liberty Financial Makes Strategic Token Acquisitions

Web3 on-chain analytics tool Lookonchain revealed that World Liberty Financial’s multisig wallet acquired 2,631 ETH at an average price of $3,801, 41,335 LINK at $24.2, and 3,357 AAVE at $297.8. This marked the project’s first purchase of AAVE and LINK tokens, signaling a strategic diversification of its holdings.

Spot On Chain also reported that the project had spent $30 million in the past 12 days to acquire 8,105 ETH at an average price of $3,700. The purchases are viewed as part of broader strategic initiatives for World Liberty Financial’s platform, which integrates with DeFi protocols to offer borrowing, lending, and liquidity services.

“Trump’s account is buying the crypto pairs that are set to benefit heavily from his plans,” speculated a prominent crypto trader, @TheFlowHorse, on X.

World Liberty Financial utilizes Chainlink’s data services to enhance integration with the broader crypto ecosystem. The platform relies on Chainlink’s pricing data and cross-chain interoperability tools.

Additionally, World Liberty Financial’s decentralized autonomous organization (DAO) has proposed deploying an Aave v3 instance on Ethereum. This deployment would leverage external risk managers and aims to attract first-time DeFi users while sharing revenue with liquidity providers. The proposal, which has already met quorum, reflects the platform’s ambition to scale its offerings.

“Trump’s World Liberty Financial is adopting Chainlink Price Feeds for their Aave V3 instance, so it makes sense. But the value of LINK goes far beyond that, connecting the global financial system to blockchains. Nobody is better positioned to benefit from a positive US regulatory environment,” Chainlink community liaison Zach Rynes commented.

Market Impact for ETH, LINK, and AAVE

The strategic purchases by World Liberty Financial have reverberated across the market. LINK and AAVE’s 30% price surges reflect investor confidence in the tokens’ roles within the platform’s ecosystem. Meanwhile, ETH’s 7% gain bolsters its position as a reserve asset, with over $50 million of ETH held by the project.

Meanwhile, the ongoing accumulation of ETH, among others, aligns with the project’s vision of deeper engagement with the crypto economy. President-elect Donald Trump’s leadership as “chief crypto advocate” has brought high-profile attention to World Liberty Financial.

His sons, Eric and Donald Trump Jr., serve as “Web3 ambassadors,” while Barron Trump holds the title of “DeFi visionary.” Together, they aim to position the US as a global leader in crypto adoption.

“This platform will help make America the crypto capital of the world,” Eric Trump declared during the project’s launch.

Since October, the initiative has raised over $55 million through its WLFI token sale, accepting ETH, USDC, and USDT from accredited investors. However, this figure remains far below its $300 million fundraising goal.

The project’s treasury, managed through a limited liability company, holds nearly $73 million in cryptocurrencies, including wrapped Bitcoin (cbUSD), USDC, USDT, and altcoins. Onchain activity shows frequent trades via CoW Swap, a decentralized exchange optimized for cost-efficient transactions.

Despite these efforts, the project faces challenges in meeting its fundraising targets after failing to impress crypto investors during its debut.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10