Exploring 3 High Growth Tech Stocks In The United States

Over the last 7 days, the United States market has experienced a 2.7% drop, yet it remains up by 23% over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks involves focusing on companies that demonstrate strong potential for innovation and adaptability in response to evolving market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 24.09% | 42.97% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 238 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

MannKind

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MannKind Corporation is a biopharmaceutical company that develops and commercializes inhaled therapeutic products for endocrine and orphan lung diseases in the United States, with a market cap of approximately $1.89 billion.

Operations: The company generates revenue primarily through its pharmaceuticals segment, which amounts to $267.20 million.

MannKind Corporation has demonstrated a robust trajectory in the biotech sector, notably with its recent advancements in diabetes management and pulmonary treatments. The company reported a substantial increase in quarterly revenue to $70.08 million from $51.25 million year-over-year and turned profitable with net income reaching $11.55 million compared to a loss previously. These financial improvements coincide with promising clinical results from their INHALE-1 study, showing non-inferiority of Afrezza inhalable insulin compared to traditional methods, which could potentially enhance patient compliance and outcomes in diabetes care. MannKind's commitment to R&D is evident as they prepare for an FDA submission, setting the stage for continued growth driven by innovation and market needs.

- Get an in-depth perspective on MannKind's performance by reading our health report here.

Gain insights into MannKind's past trends and performance with our Past report.

Rhythm Pharmaceuticals

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rhythm Pharmaceuticals, Inc. is a commercial-stage biopharmaceutical company that specializes in developing therapies for rare neuroendocrine diseases, with a market cap of approximately $3.45 billion.

Operations: Rhythm Pharmaceuticals focuses on the development and commercialization of therapies for patients with rare neuroendocrine diseases, generating $112.53 million in revenue.

Rhythm Pharmaceuticals has recently made significant strides in addressing rare genetic disorders related to obesity, with the FDA's approval of IMCIVREE® for children as young as 2. This expansion underscores Rhythm's focus on precision medicine tailored to specific genetic markers, a niche but crucial area in healthcare technology. The company’s dedication is further exemplified by its robust R&D investment, aligning with its revenue growth of 47.6% annually. Moreover, the anticipation surrounding their upcoming PDUFA date suggests potential for continued impact in pediatric obesity management, positioning Rhythm at the forefront of specialized medical treatments within tech-driven biopharma sectors.

- Click here and access our complete health analysis report to understand the dynamics of Rhythm Pharmaceuticals.

Learn about Rhythm Pharmaceuticals' historical performance.

Legend Biotech

Simply Wall St Growth Rating: ★★★★★☆

Overview: Legend Biotech Corporation is a clinical-stage biopharmaceutical company focused on discovering, developing, manufacturing, and commercializing novel cell therapies for oncology and other indications globally, with a market cap of approximately $6.25 billion.

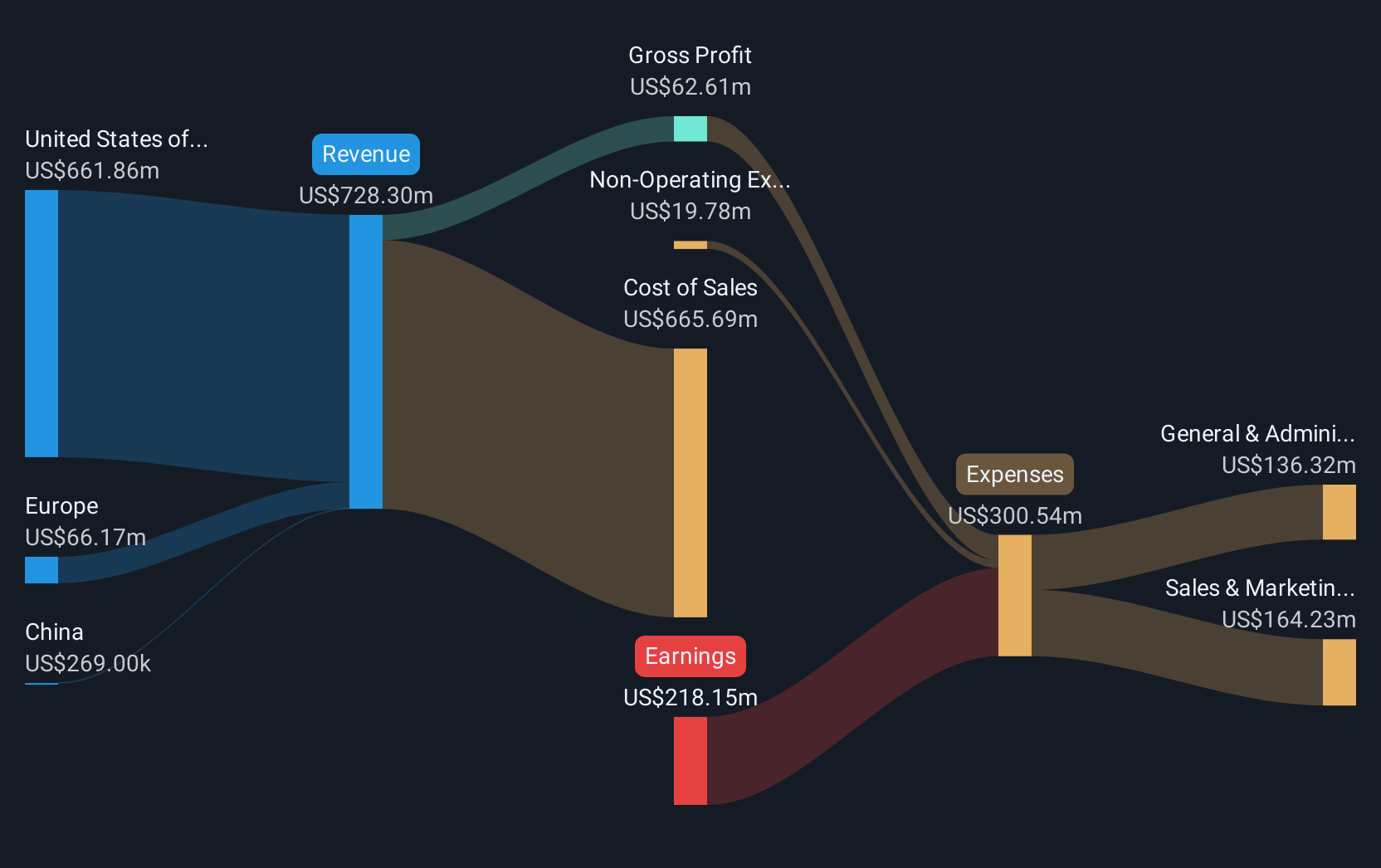

Operations: Legend Biotech generates revenue primarily from its biotechnology segment, amounting to $520.18 million. The company's operations span the United States, China, and international markets, focusing on innovative cell therapies for oncology and other medical needs.

Legend Biotech, amidst a challenging landscape for unprofitable biotechs, shows promise with its projected revenue growth at 35.6% annually, outpacing the US market's 9.1%. This growth is underpinned by recent breakthroughs in multiple myeloma treatment with CARVYKTI®, which demonstrated significant survival benefits in phase 3 trials. Despite a current net loss of $125.32 million for Q3 2024, the strategic R&D investments and expected profitability within three years highlight Legend's potential to redefine therapeutic standards and secure a competitive edge in high-stakes oncology markets.

- Click here to discover the nuances of Legend Biotech with our detailed analytical health report.

Assess Legend Biotech's past performance with our detailed historical performance reports.

Seize The Opportunity

- Get an in-depth perspective on all 238 US High Growth Tech and AI Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGM:MNKD NasdaqGM:RYTM and NasdaqGS:LEGN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10