Bitcoin and Ethereum ETFs Experience Distinct Market Movements

You can also read this news on COINTURK NEWS: Bitcoin and Ethereum ETFs Experience Distinct Market Movements

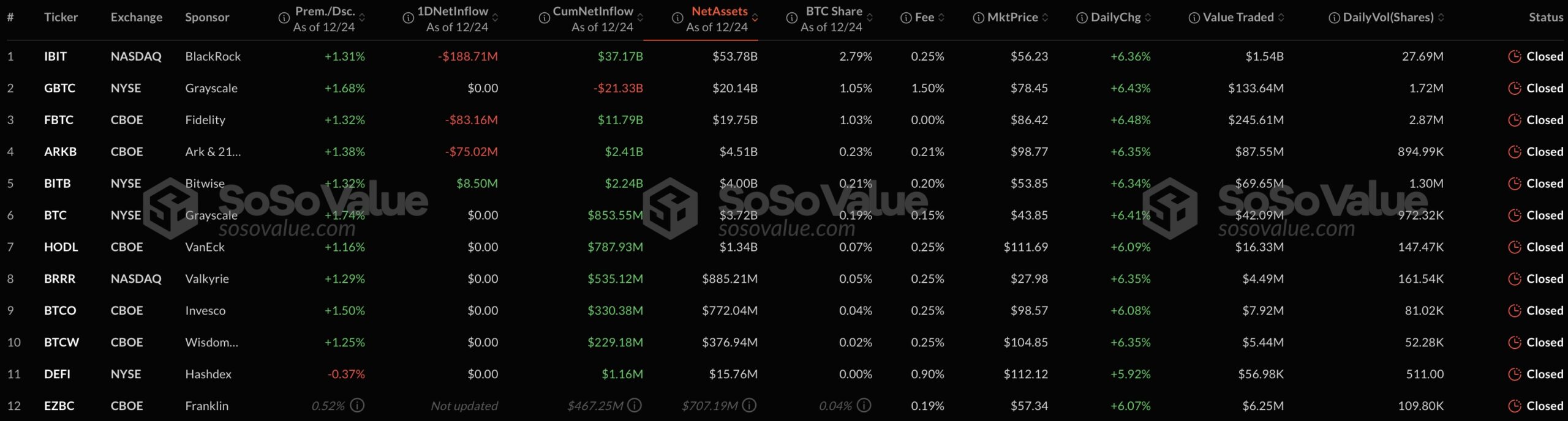

On December 24, 2024, significant inflows and outflows were observed in Bitcoin (BTC) and Ethereum (ETH) based spot ETFs in the United States. Bitcoin ETFs recorded net outflows, while Ethereum ETFs stood out with net inflows.

Remarkable Outflows in Bitcoin ETFs

According to data, there was a total net outflow of 338 million from spot Bitcoin ETFs. BlackRock’s iShares Bitcoin Trust ETF experienced the largest outflow with a decrease of 1,989 BTC (approximately 188.7 million dollars). Currently, the total assets of this ETF amount to 521,181 BTC (around 51.3 billion dollars).

The Fidelity Wise Origin Bitcoin Fund also attracted attention with an outflow of 877 BTC (approximately 83.2 million dollars). Its total assets have decreased to 196,941 BTC, which is equivalent to 19.3 billion dollars. Additionally, the ARK 21Shares Bitcoin ETF reported an outflow of 791 BTC (about 75 million dollars) and currently holds 44,567 BTC (4.36 billion dollars).

Ethereum ETFs Gain Attention with Inflows

In contrast to the outflows in Bitcoin ETFs, spot Ethereum ETFs displayed a positive picture. Ethereum recorded a total net inflow of 53 million, with the majority coming from BlackRock, which led with an inflow of 43 million dollars. Bitwise also contributed significantly with an inflow of 6.2 million dollars into spot Ethereum ETFs.

The data indicates a notable divergence in the cryptocurrency ETF market as the year ends. While Bitcoin investors are leaning towards sales, Ethereum investors are increasing their market interest. This volatility before the new year suggests varied strategies in the cryptocurrency market.

The post Bitcoin and Ethereum ETFs Experience Distinct Market Movements appeared first on COINTURK NEWS.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10