Uncovering Undiscovered Gems in the US This January 2025

Over the last 7 days, the United States market has experienced a 2.6% drop, yet it has shown resilience with a 23% rise over the past year and an anticipated annual earnings growth of 15%. In this dynamic environment, identifying stocks that are undervalued or have unique growth potential can be key to uncovering undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Click here to see the full list of 244 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

Let's uncover some gems from our specialized screener.

John Marshall Bancorp (NasdaqCM:JMSB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: John Marshall Bancorp, Inc. is the bank holding company for John Marshall Bank, offering a range of banking products and financial services with a market capitalization of approximately $290.99 million.

Operations: JMSB generates revenue primarily from its banking segment, totaling $53.07 million. The company's market capitalization is approximately $290.99 million.

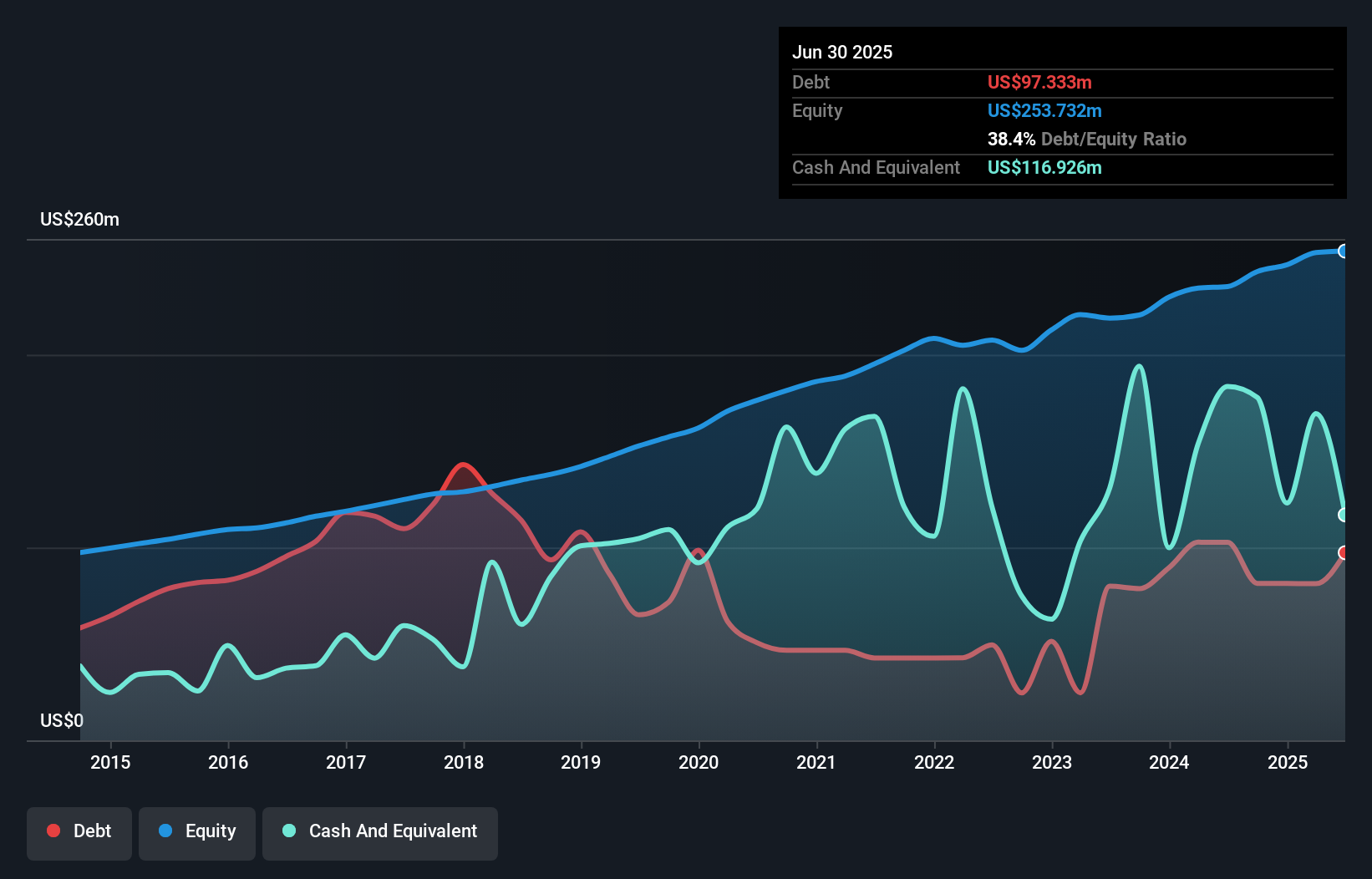

John Marshall Bancorp, with assets totaling $2.3 billion and equity of $243.1 million, stands out for its robust earnings growth of 90.3% over the past year, significantly outperforming the banking industry's -11.7%. Despite trading at 52.8% below its estimated fair value, concerns linger due to significant insider selling in recent months and a lack of data on bad loan allowances. The company's liabilities are 95% funded by low-risk sources like customer deposits, enhancing financial stability. Recent earnings reports show a turnaround with net income at $4.24 million compared to a loss last year, indicating potential resilience ahead.

- Click here to discover the nuances of John Marshall Bancorp with our detailed analytical health report.

Gain insights into John Marshall Bancorp's past trends and performance with our Past report.

Value Line (NasdaqCM:VALU)

Simply Wall St Value Rating: ★★★★★★

Overview: Value Line, Inc. is involved in producing and selling investment periodicals and related publications, with a market cap of $505.26 million.

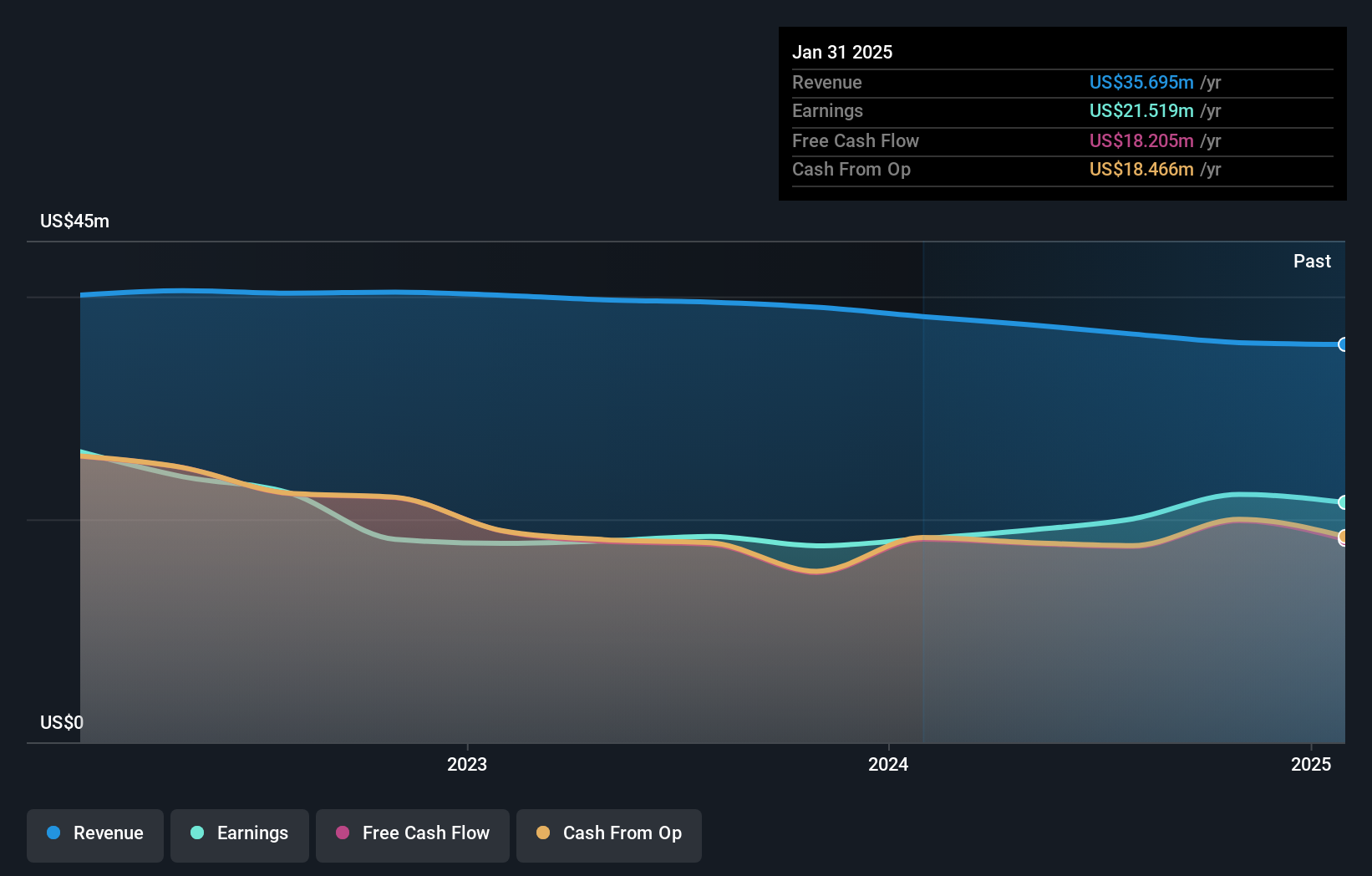

Operations: The company's revenue primarily comes from its publishing segment, which generated $35.86 million. It has a market cap of $505.26 million.

Value Line, with its nimble market presence, showcases a robust financial profile by being debt-free and maintaining a price-to-earnings ratio of 22.4x, slightly below the industry average. This company has experienced impressive earnings growth of 26.2% over the past year, outpacing its peers in the Capital Markets sector. Despite a dip in quarterly revenue to US$8.84 million from US$9.61 million last year, net income surged to US$5.69 million from US$3.49 million due to high-quality earnings and effective cost management strategies likely contributing to this performance boost amidst challenging conditions in their industry landscape.

- Navigate through the intricacies of Value Line with our comprehensive health report here.

Review our historical performance report to gain insights into Value Line's's past performance.

Willdan Group (NasdaqGM:WLDN)

Simply Wall St Value Rating: ★★★★★★

Overview: Willdan Group, Inc. offers professional, technical, and consulting services primarily in the United States with a market capitalization of $541.83 million.

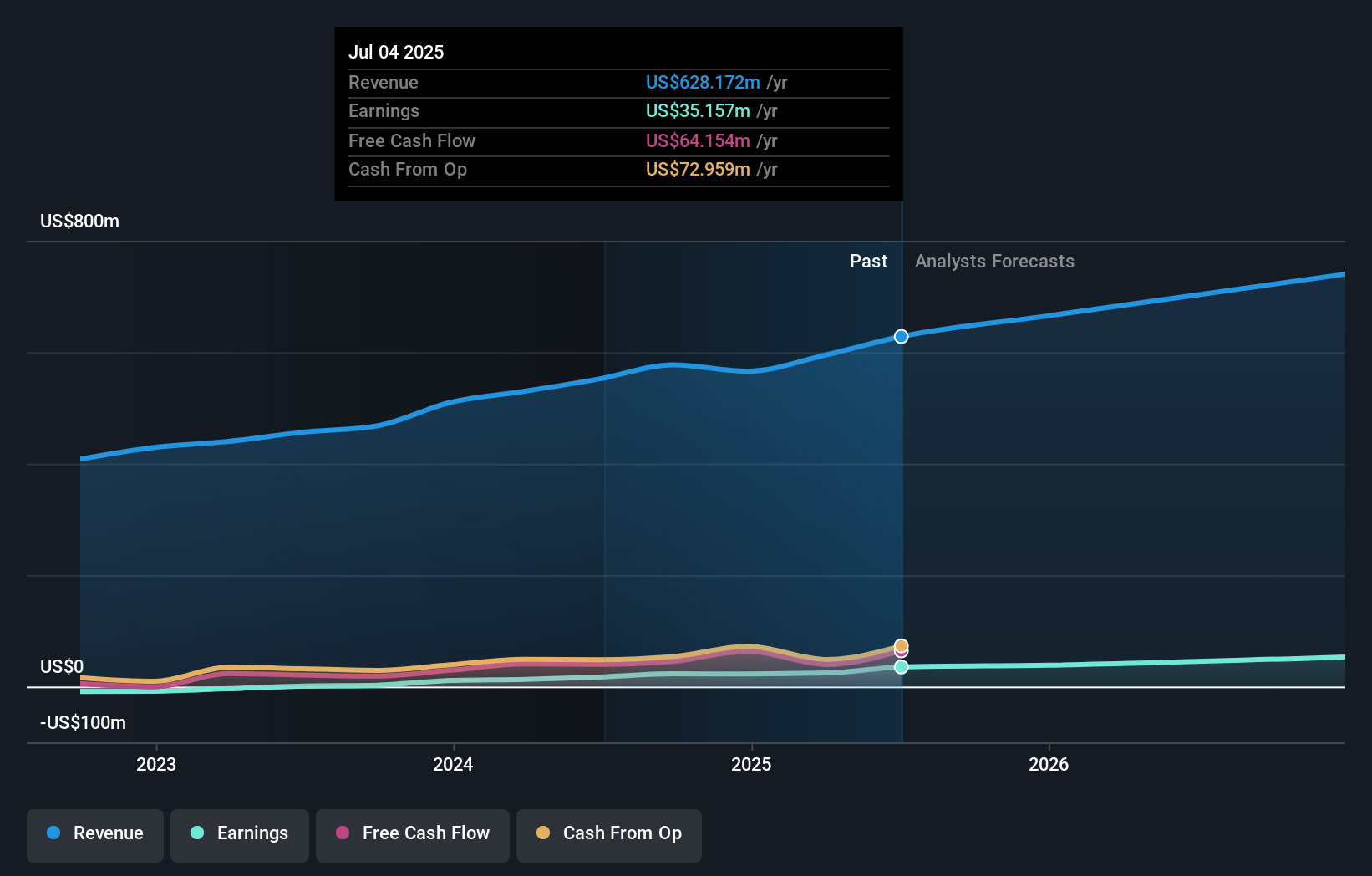

Operations: The company generates revenue primarily from its Energy segment, contributing $487.28 million, and its Engineering and Consulting segment, which adds $90.13 million.

Willdan Group, a promising player in the professional services sector, has shown substantial growth with earnings surging 840.1% over the past year, far outpacing industry averages. The company's debt to equity ratio improved significantly from 67% to 41.3% over five years, indicating stronger financial health. Trading at 84.8% below estimated fair value suggests potential undervaluation opportunities for investors. Recent contracts like the $4.5 million agreement with Bellflower and involvement in SnoPUD's energy efficiency program highlight its expanding footprint in energy solutions and smart city initiatives, despite some insider selling and shareholder dilution concerns recently noted.

- Willdan Group's strategic acquisitions enhance capabilities in high-demand sectors like data centers. Click here to explore the full narrative on Willdan Group's potential.

Taking Advantage

- Discover the full array of 244 US Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willdan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10