3 Prominent Dividend Stocks Yielding Up To 6.1%

As global markets navigate a mixed start to the new year, with U.S. stocks closing out a strong 2024 despite recent volatility and economic indicators showing varied signals, investors are increasingly looking towards stable income sources amid uncertainty. In such an environment, dividend stocks can offer appealing opportunities for consistent returns, as they provide regular income streams that can help balance market fluctuations and economic shifts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.95% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.35% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.89% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.07% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

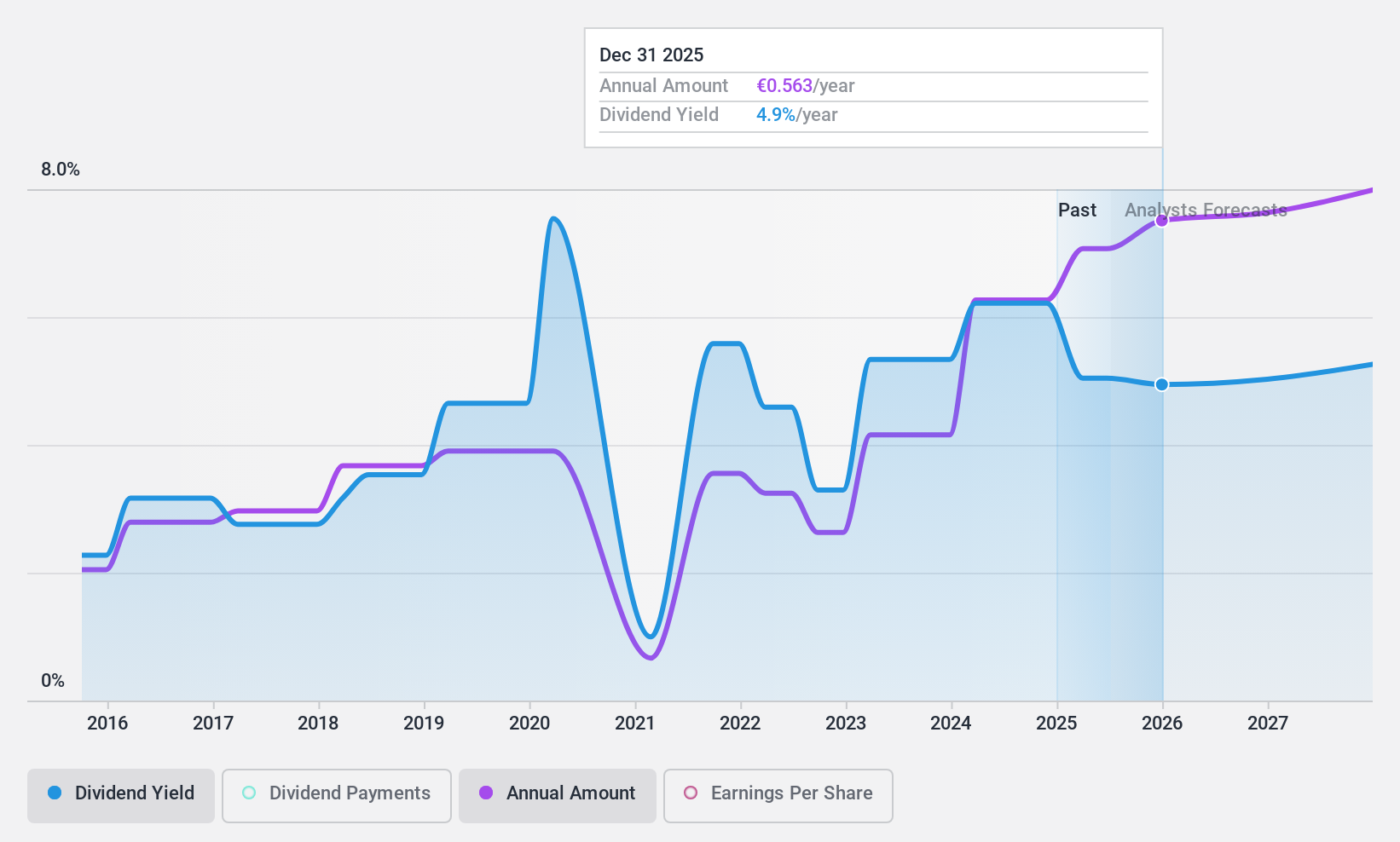

Bankinter (BME:BKT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bankinter, S.A. is a financial institution offering a range of banking products and services to individuals, corporate customers, and small- to medium-sized enterprises in Spain, with a market cap of €6.92 billion.

Operations: Bankinter, S.A. generates revenue through several segments: BK Portugal (€301.43 million), Corporate Banking (€1.10 billion), Bankinter Consumer Finance Group (€161.93 million), and Commercial Retail and Private Banking (€1.14 billion).

Dividend Yield: 6.1%

Bankinter's dividend payments have been volatile over the past decade, with a high level of bad loans at 2.3% and a low allowance for them at 69%. Despite this, dividends are well-covered by earnings with a current payout ratio of 25.8%, forecast to rise to 51.5% in three years. Trading below estimated fair value, Bankinter offers a strong yield in Spain's top quarter but lacks reliability due to its unstable dividend history.

- Click here to discover the nuances of Bankinter with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Bankinter is priced higher than what may be justified by its financials.

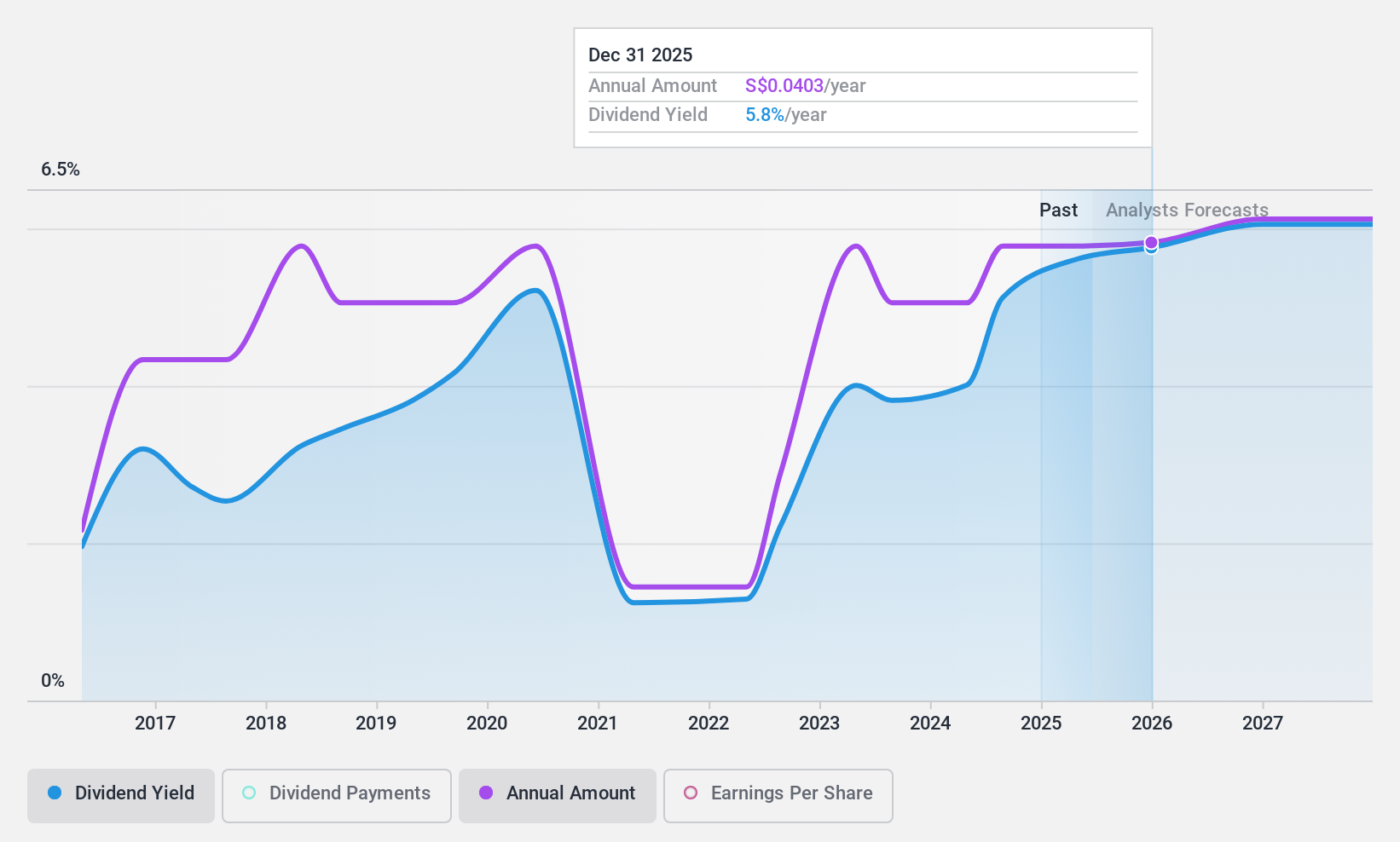

Genting Singapore (SGX:G13)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Genting Singapore Limited is an investment holding company focused on the construction, development, and operation of integrated resort destinations in Asia, with a market cap of SGD9.36 billion.

Operations: Genting Singapore Limited generates its revenue from the development and operation of integrated resort destinations in Asia.

Dividend Yield: 5.2%

Genting Singapore's dividend payments are well-covered by earnings and cash flows, with payout ratios of 69.8% and 72.3%, respectively. Despite a volatile dividend history over the past decade, recent increases in dividends indicate growth potential. The stock trades at a favorable price-to-earnings ratio of 13.5x compared to industry peers and is expected to rise further according to analysts' consensus. Recent executive changes may impact operations but do not directly affect dividend sustainability.

- Dive into the specifics of Genting Singapore here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Genting Singapore is trading behind its estimated value.

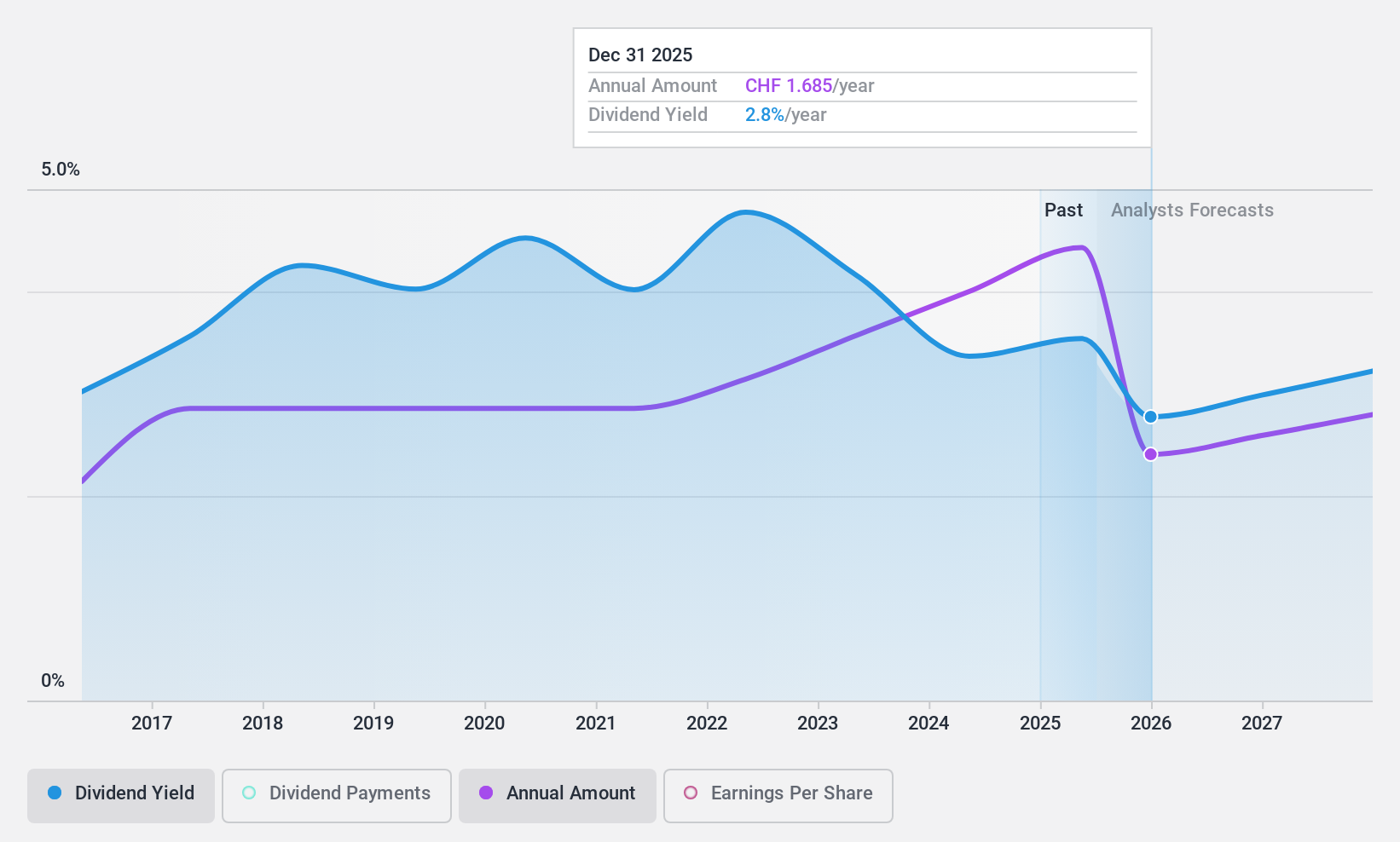

Holcim (SWX:HOLN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Holcim AG, along with its subsidiaries, operates as a global building materials and solutions company with a market cap of CHF49.71 billion.

Operations: Holcim AG generates revenue through its key segments, including Cement (CHF13.39 billion), Aggregates (CHF4.31 billion), Ready-Mix Concrete (CHF5.84 billion), and Solutions & Products (CHF5.91 billion).

Dividend Yield: 3.2%

Holcim's dividend is well-supported by earnings and cash flows, with payout ratios of 52.3% and 39.7%, respectively. The company has maintained stable and growing dividends over the past decade, though its yield of 3.16% trails the top Swiss dividend payers. Recent guidance confirms a robust EBIT margin above 18.5%. Holcim's potential dual listing in the US and Switzerland could impact investor dynamics but aims to optimize shareholder value amidst strategic restructuring efforts.

- Take a closer look at Holcim's potential here in our dividend report.

- Upon reviewing our latest valuation report, Holcim's share price might be too pessimistic.

Summing It All Up

- Unlock our comprehensive list of 1981 Top Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10