Two Reasons to Avoid DOCN and One Stock to Buy Instead

DigitalOcean has been treading water for the past six months, holding steady at $33.48. This is close to the S&P 500’s 4.1% gain during that period.

Is now the time to buy DigitalOcean, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

We don't have much confidence in DigitalOcean. Here are two reasons why DOCN doesn't excite us and a stock we'd rather own.

Why Is DigitalOcean Not Exciting?

Started by brothers Ben and Moisey Uretsky, DigitalOcean (NYSE: DOCN) provides a simple, low-cost platform that allows developers and small and medium-sized businesses to host applications and data in the cloud.

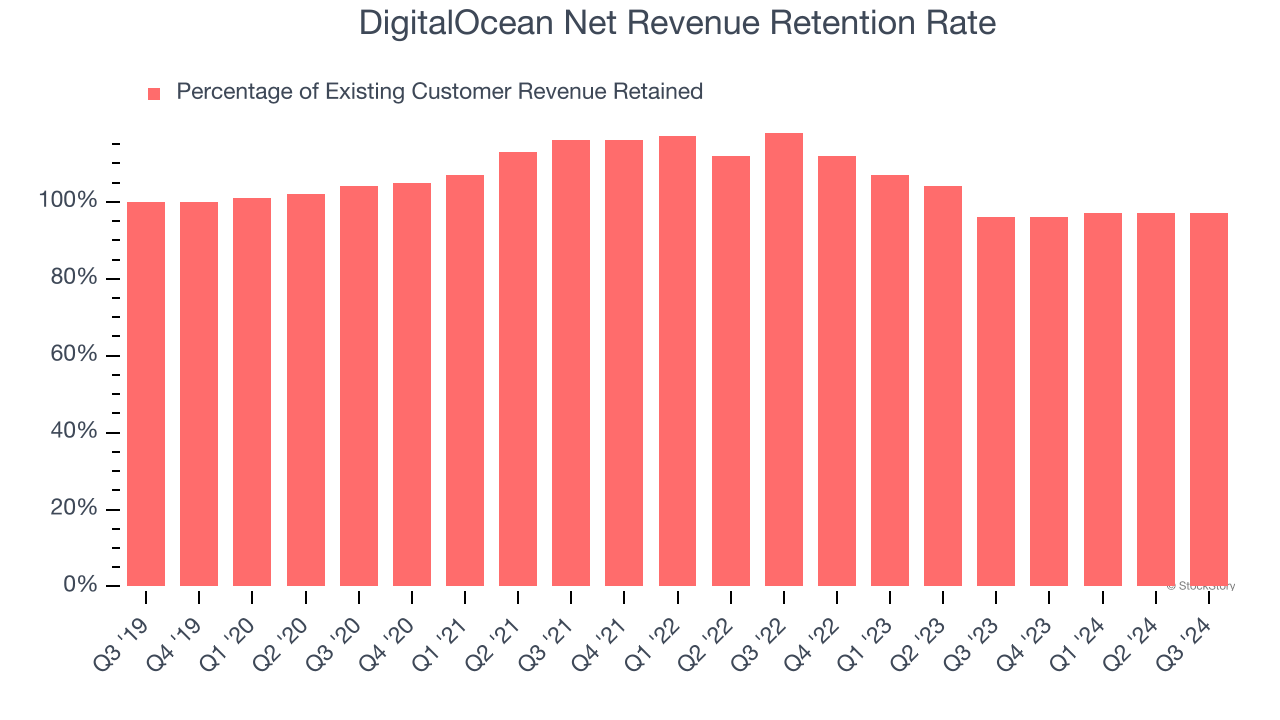

1. Customer Churn Hurts Long-Term Outlook

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

DigitalOcean’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 96.8% in Q3. This means DigitalOcean’s revenue would’ve decreased by 3.2% over the last 12 months if it didn’t win any new customers.

DigitalOcean has a weak net retention rate, signaling that some customers aren’t satisfied with its products, leading to lost contracts and revenue streams.

2. Low Gross Margin Reveals Weak Structural Profitability

For software companies like DigitalOcean, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

DigitalOcean’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 60.2% gross margin over the last year. Said differently, DigitalOcean had to pay a chunky $39.82 to its service providers for every $100 in revenue.

Final Judgment

DigitalOcean isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 4.1× forward price-to-sales (or $33.48 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at Meta, a top digital advertising platform riding the creator economy.

Stocks We Like More Than DigitalOcean

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10