archTIS And 2 Other ASX Penny Stocks To Watch

After a rocky start to the week, the Australian market appears to be on an upswing, with ASX 200 futures indicating a potential rise. In this context of fluctuating markets and economic pressures, investors often seek opportunities that offer growth at lower entry points. Penny stocks, though an older term, continue to attract attention as they represent smaller or newer companies that may provide value and potential upside when backed by solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.89 | A$239.61M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.94 | A$108.78M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.95 | A$317.49M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$235.35M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.265 | A$108M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.525 | A$747.37M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.89 | A$482.47M | ★★★★☆☆ |

Click here to see the full list of 1,024 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

archTIS (ASX:AR9)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: archTIS Limited designs and develops products, solutions, and services for secure information sharing and collaboration both in Australia and internationally, with a market cap of A$20.06 million.

Operations: The company generates revenue from selling software and services, amounting to A$9.80 million.

Market Cap: A$20.06M

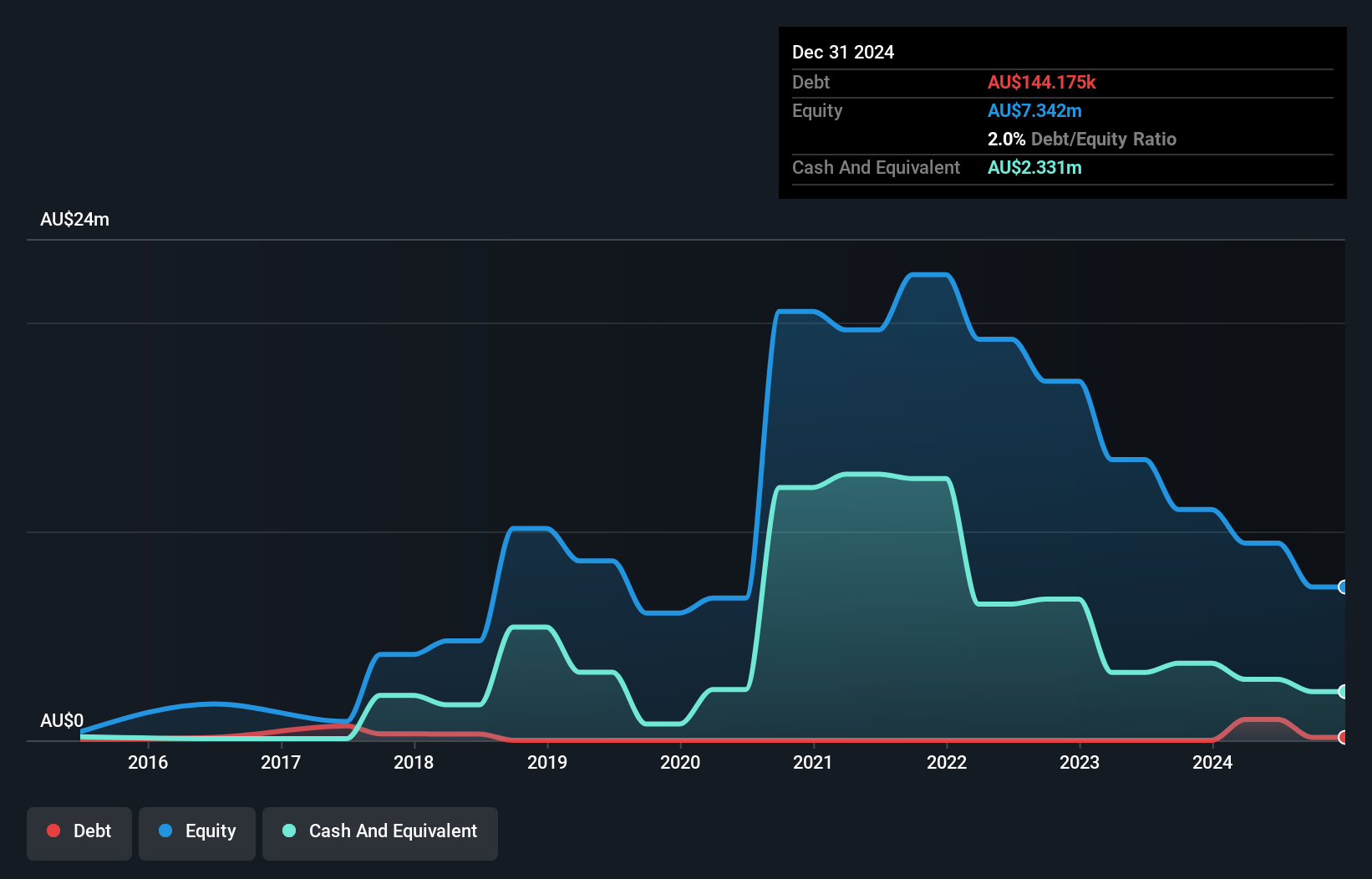

archTIS Limited, with a market cap of A$20.06 million, is focused on secure information sharing and collaboration, generating A$9.80 million in revenue. Despite being unprofitable and having a negative return on equity of -45.07%, the company has more cash than debt and sufficient cash runway for over a year based on current free cash flow. Recent strategic moves include seeking M&A opportunities to bolster growth while maintaining stable weekly volatility at 7%. The appointment of Dr. Marcus Thompson as a non-executive director adds significant expertise in cybersecurity and defense to the board's capabilities.

- Unlock comprehensive insights into our analysis of archTIS stock in this financial health report.

- Gain insights into archTIS' historical outcomes by reviewing our past performance report.

Motio (ASX:MXO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Motio Limited is an audience experience and digital place-based media company in Australia with a market cap of A$9.29 million.

Operations: The company's revenue is derived from two segments: Media, contributing A$6.99 million, and Non-media, generating A$1.38 million.

Market Cap: A$9.29M

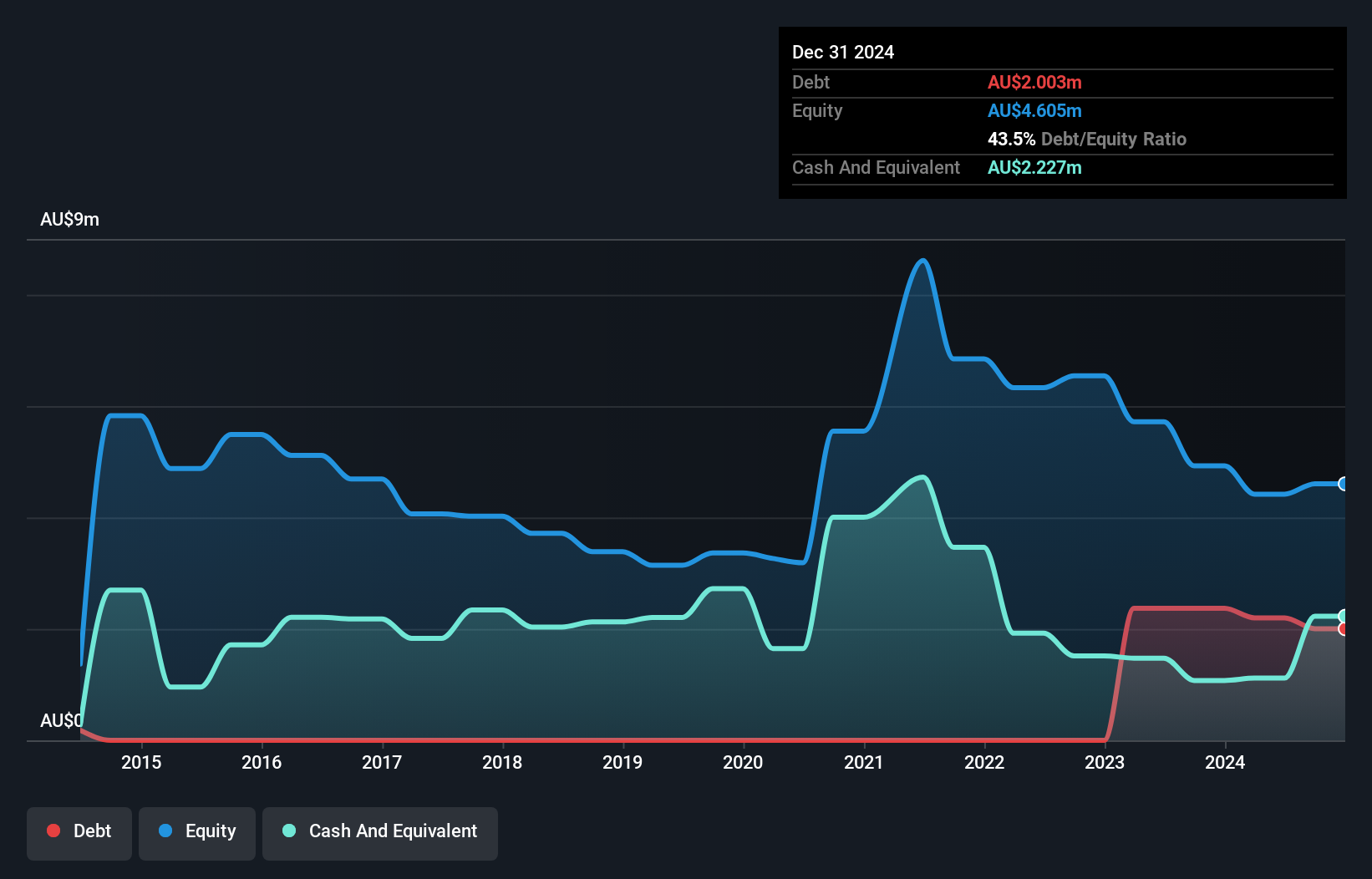

Motio Limited, with a market cap of A$9.29 million, derives revenue from its media (A$6.99 million) and non-media (A$1.38 million) segments but remains unprofitable with a negative return on equity of -47.14%. The company has a satisfactory net debt to equity ratio of 24.5% and sufficient cash runway for over three years despite declining free cash flow. Motio's short-term assets exceed both its short-term and long-term liabilities, providing some financial stability amidst high share price volatility over the past three months. The board is experienced, yet the management team's tenure data is insufficient for assessment.

- Click here and access our complete financial health analysis report to understand the dynamics of Motio.

- Assess Motio's previous results with our detailed historical performance reports.

Sugar Terminals (NSX:SUG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sugar Terminals Limited offers storage and handling solutions for bulk sugar and other commodities in Australia, with a market cap of A$379.80 million.

Operations: The company generates revenue primarily from the sugar industry, amounting to A$115.38 million.

Market Cap: A$379.8M

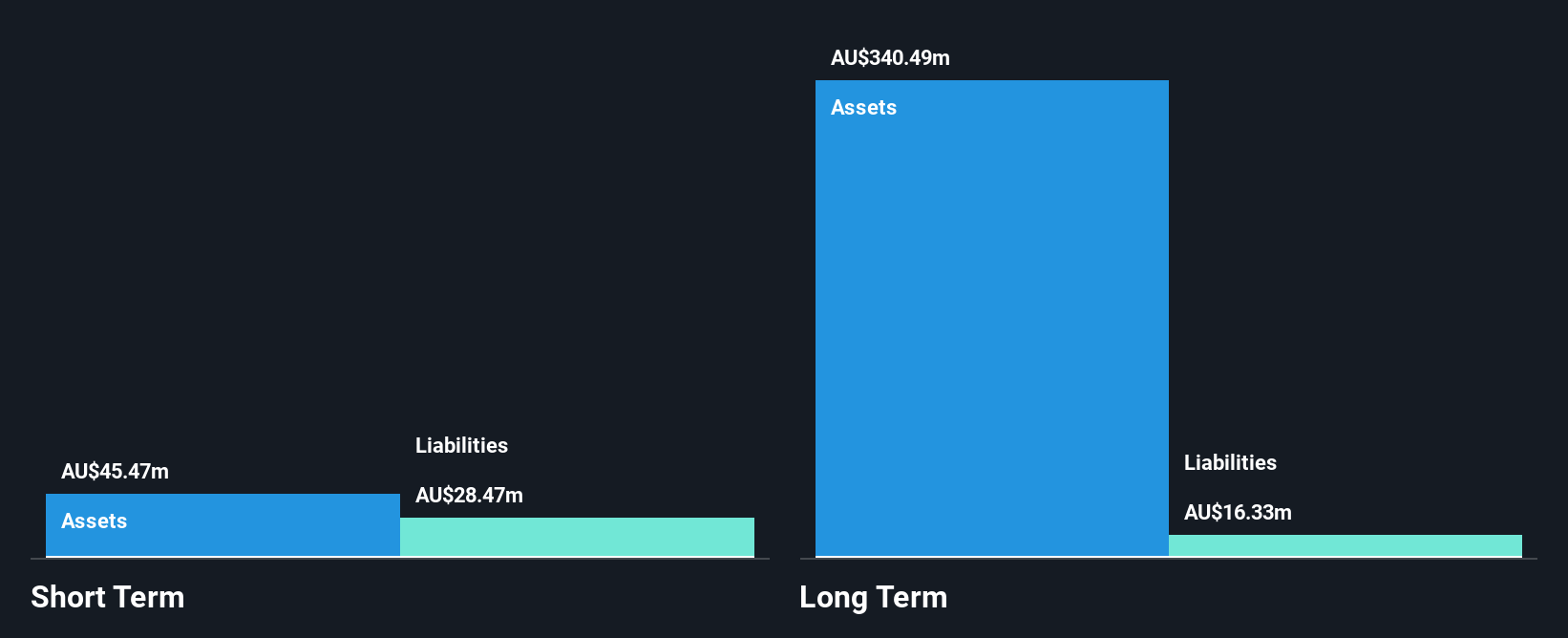

Sugar Terminals Limited, with a market cap of A$379.80 million, benefits from high-quality earnings and solid financial health, evidenced by its debt-free status and coverage of liabilities by short-term assets (A$37.7M). The company's earnings grew 11.4% over the past year, outpacing the industry average of 9.1%, although its return on equity remains low at 9.5%. Trading at a significant discount to estimated fair value enhances its appeal as an investment opportunity in the penny stock category. Recent board changes include retirements that may impact governance dynamics moving forward but are unlikely to affect operational stability significantly.

- Click to explore a detailed breakdown of our findings in Sugar Terminals' financial health report.

- Evaluate Sugar Terminals' historical performance by accessing our past performance report.

Seize The Opportunity

- Investigate our full lineup of 1,024 ASX Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10