Returns At Vulcan Materials (NYSE:VMC) Appear To Be Weighed Down

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. With that in mind, the ROCE of Vulcan Materials (NYSE:VMC) looks decent, right now, so lets see what the trend of returns can tell us.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Vulcan Materials is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.10 = US$1.4b ÷ (US$14b - US$774m) (Based on the trailing twelve months to September 2024).

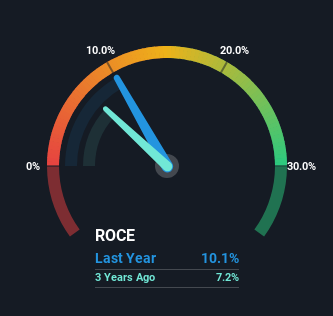

Therefore, Vulcan Materials has an ROCE of 10%. That's a relatively normal return on capital, and it's around the 12% generated by the Basic Materials industry.

See our latest analysis for Vulcan Materials

Above you can see how the current ROCE for Vulcan Materials compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Vulcan Materials .

So How Is Vulcan Materials' ROCE Trending?

While the current returns on capital are decent, they haven't changed much. Over the past five years, ROCE has remained relatively flat at around 10% and the business has deployed 36% more capital into its operations. Since 10% is a moderate ROCE though, it's good to see a business can continue to reinvest at these decent rates of return. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

Our Take On Vulcan Materials' ROCE

The main thing to remember is that Vulcan Materials has proven its ability to continually reinvest at respectable rates of return. On top of that, the stock has rewarded shareholders with a remarkable 106% return to those who've held over the last five years. So while investors seem to be recognizing these promising trends, we still believe the stock deserves further research.

While Vulcan Materials doesn't shine too bright in this respect, it's still worth seeing if the company is trading at attractive prices. You can find that out with our FREE intrinsic value estimation for VMC on our platform.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10