Jupiter Overtakes Raydium Amidst Strong JUP Rally, Becomes Solana’s Second-Biggest Protocol

- Jupiter’s TVL surged to $2.87B, surpassing Raydium and becoming Solana’s second-largest protocol.

- The JUP token rose 24% in 24 hours, driven by high buying pressure and strategic protocol developments.

- On-balance volume and Chaikin Money Flow suggest bullish momentum, with price predictions ranging from $1.08 to $1.46.

Jupiter’s total value locked (TVL) has now surpassed Raydium’s, positioning it as the second-largest protocol on the Solana blockchain. This comes after a series of positive developments within the decentralized exchange (DEX) over the past week.

Its JUP token has grown significantly, emerging as the market’s top gainer over the past 24 hours. With growing activity on the DEX and surging demand for JUP, it appears poised to extend these gains.

Jupiter Outranks Raydium on Solana

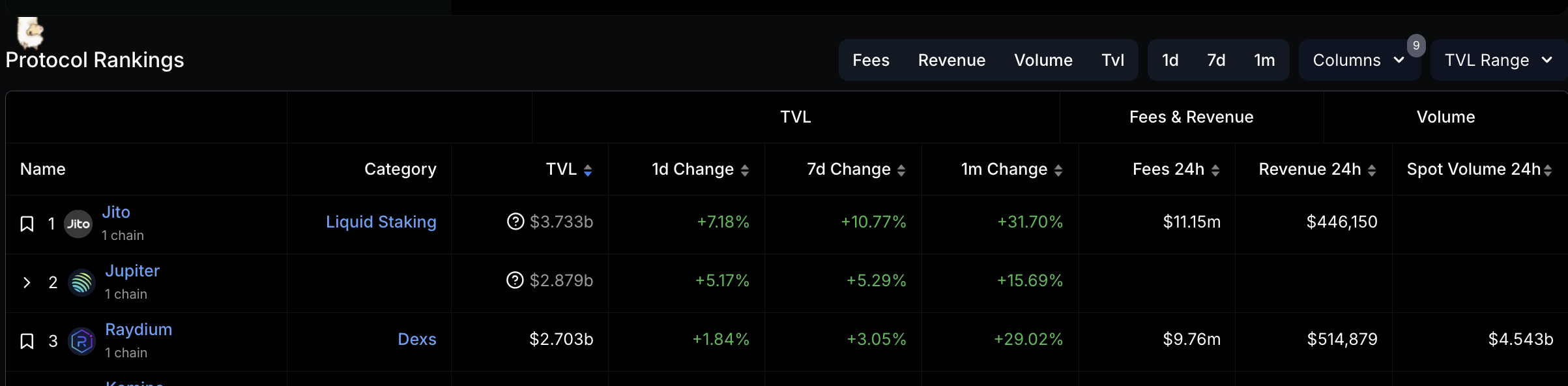

Jupiter’s TVL has surged by 5% over the past week. According to DefiLlama, it now stands at $2.87 billion, securing its place as the second-largest protocol on Solana by TVL. This recent surge has displaced Raydium, which now sits in third place with a TVL of $2.70 billion.

he surge in TVL follows a series of positive developments announced by the DEX at the Catstanbul 2025 event. Notably, Jupiter revealed its acquisition of a majority stake in Moonshot and SonarWatch to create a Solana portfolio tracker. Additionally, the DEX committed to allocating 50% of its protocol fees toward JUP buybacks and a planned burn of 3 billion tokens.

These announcements have driven increased activity on the DEX, boosting its TVL significantly over the past few days.

JUP Bulls Drive Up Value

Jupiter’s JUP token has reacted positively to these developments. It has seen increased demand in recent days, driving up its value. The altcoin trades at $1.19 at press time, noting a 24% price uptick in the past 24 hours. During the review period, it has outperformed the top 100 cryptos, making it the market’s top gainer.

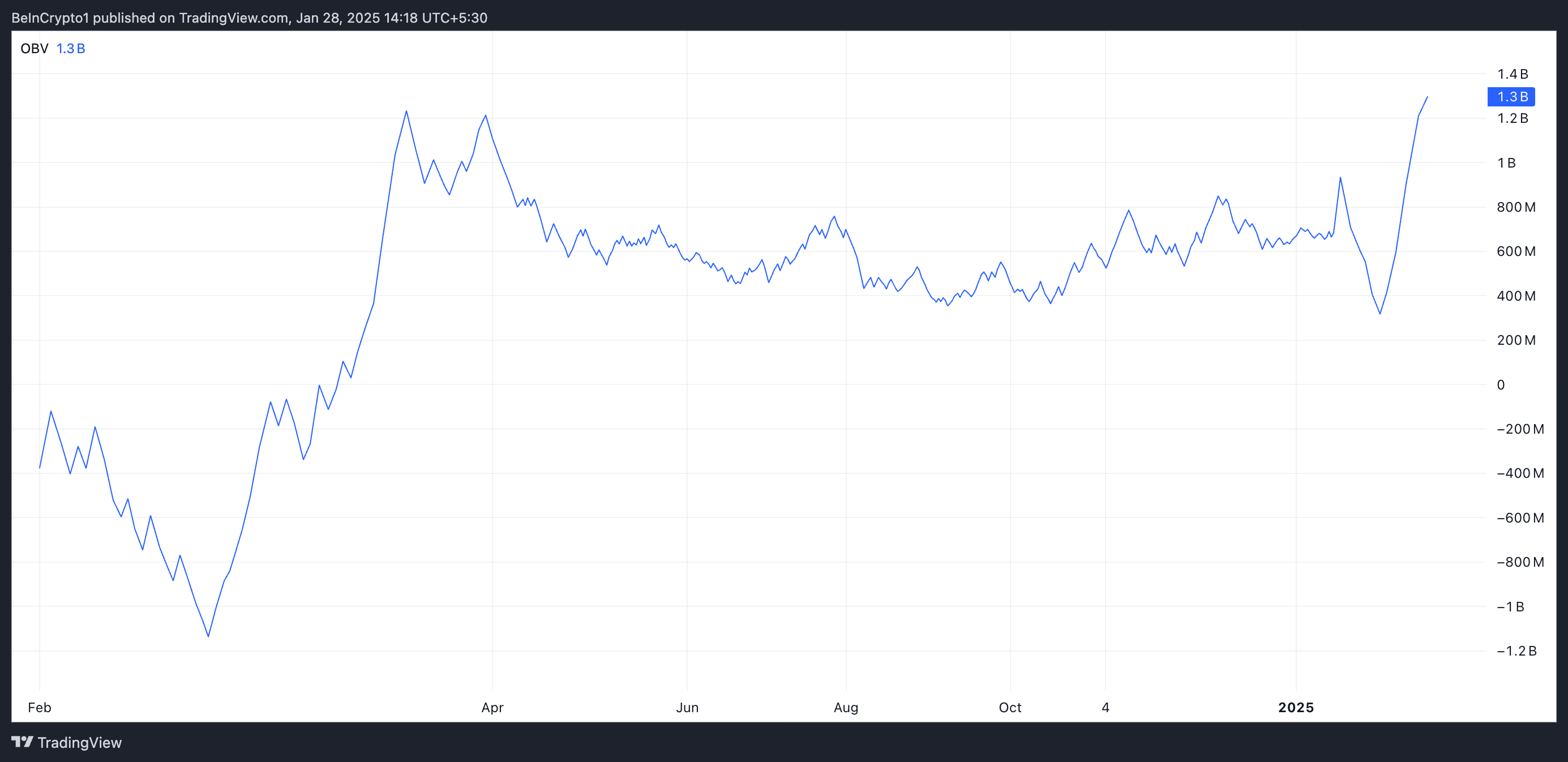

An assessment of the JUP/USD one-day chart reveals the possibility of an extended rally. At press time, the token’s on-balance volume (OBV) is in an upward trend, sitting at an all-time high of 1.3 billion.

An asset’s OBV measures money flow into and out of it to predict price movements. It suggests increasing buying pressure when it climbs like this, as more volume is associated with upward price movement, indicating a potential bullish trend.

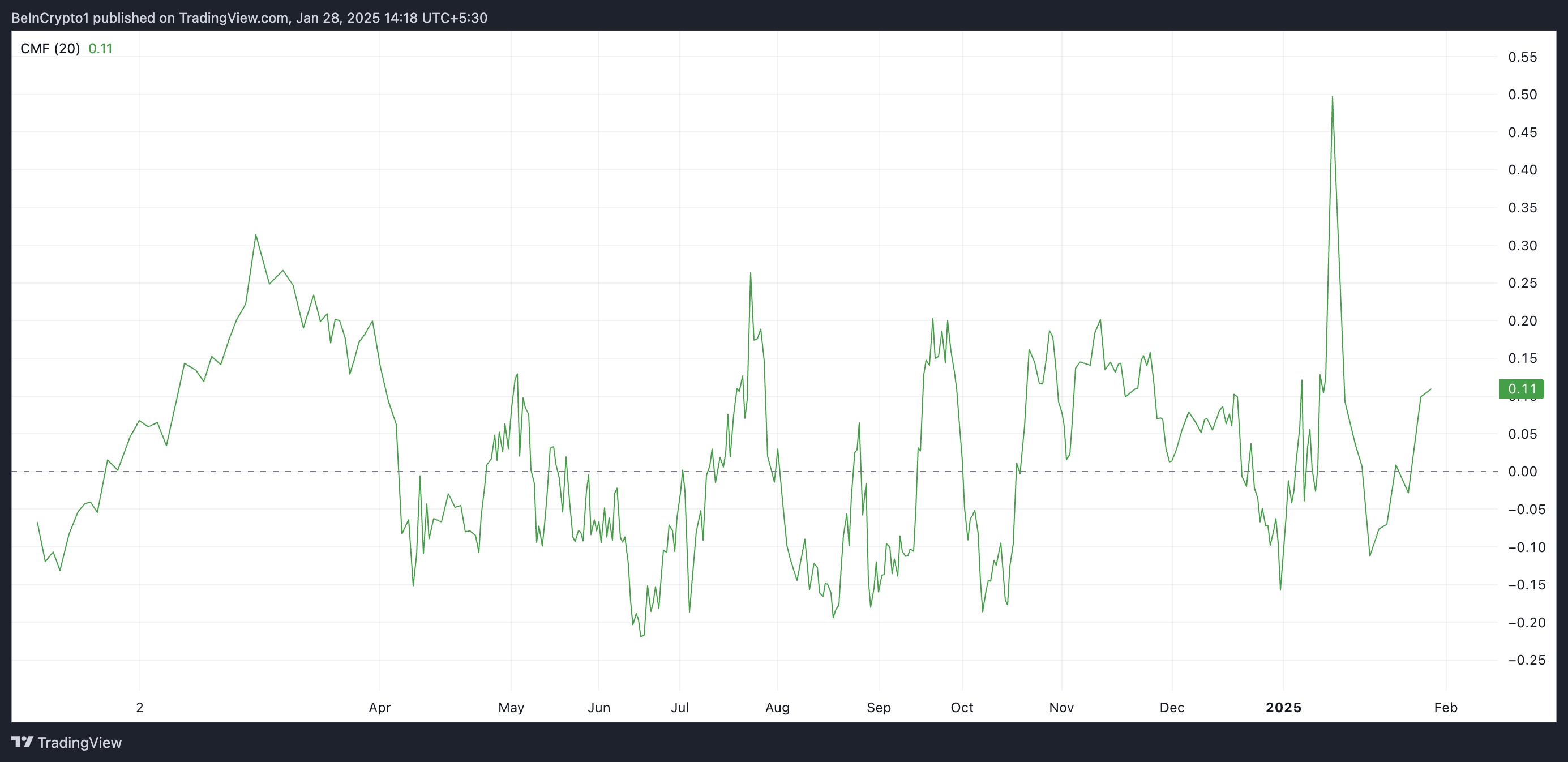

Furthermore, JUP’s Chaikin Money Flow (CMF) sits above the zero line at 0.11 as of this writing. This indicator also measures how money flows into and out of an asset.

When this indicator is positive, it indicates buying pressure in the market, suggesting that the asset is experiencing accumulation.

JUP Price Prediction: Token Hangs Between $1.46 and $1.08

At press time, JUP trades at $1.19. If it continues to see a surge in demand, this could drive its value above the resistance formed at $1.22 and toward $1.46.

Conversely, this bullish outlook will be invalidated if the token witnesses a resurgence in selloffs. In that case, JUP’s price could drop to $1.08.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10