Loss-Making Genmin Limited (ASX:GEN) Expected To Breakeven In The Medium-Term

With the business potentially at an important milestone, we thought we'd take a closer look at Genmin Limited's (ASX:GEN) future prospects. Genmin Limited, an exploration and development company, produces iron ores in Africa. The AU$26m market-cap company’s loss lessened since it announced a US$13m loss in the full financial year, compared to the latest trailing-twelve-month loss of US$12m, as it approaches breakeven. The most pressing concern for investors is Genmin's path to profitability – when will it breakeven? In this article, we will touch on the expectations for the company's growth and when analysts expect it to become profitable.

View our latest analysis for Genmin

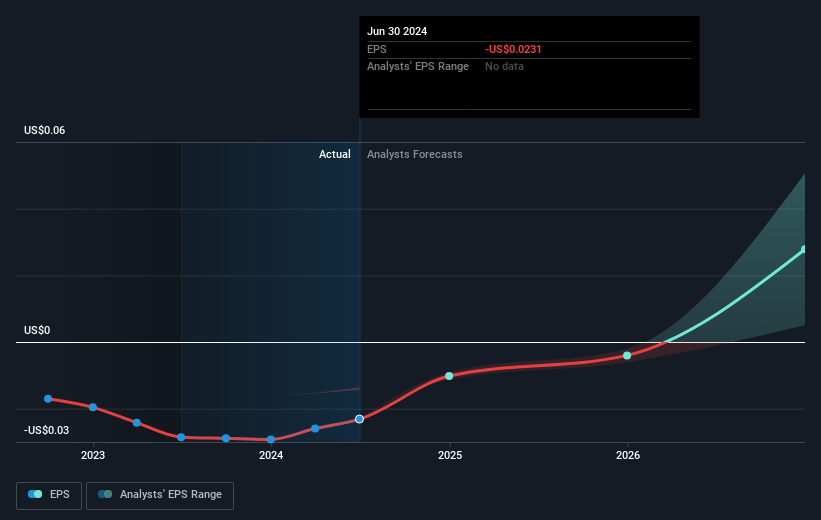

Genmin is bordering on breakeven, according to the 2 Australian Metals and Mining analysts. They anticipate the company to incur a final loss in 2025, before generating positive profits of US$36m in 2026. Therefore, the company is expected to breakeven just over a year from now. In order to meet this breakeven date, we calculated the rate at which the company must grow year-on-year. It turns out an average annual growth rate of 118% is expected, which is extremely buoyant. If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

Given this is a high-level overview, we won’t go into details of Genmin's upcoming projects, however, keep in mind that typically a metal and mining business has lumpy cash flows which are contingent on the natural resource mined and stage at which the company is operating. This means, large upcoming growth rates are not abnormal as the company is beginning to reap the benefits of earlier investments.

Before we wrap up, there’s one aspect worth mentioning. The company has managed its capital judiciously, with debt making up 39% of equity. This means that it has predominantly funded its operations from equity capital, and its low debt obligation reduces the risk around investing in the loss-making company.

Next Steps:

There are key fundamentals of Genmin which are not covered in this article, but we must stress again that this is merely a basic overview. For a more comprehensive look at Genmin, take a look at Genmin's company page on Simply Wall St. We've also compiled a list of pertinent aspects you should further examine:

- Valuation: What is Genmin worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Genmin is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Genmin’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10