Is Douglas Elliman (NYSE:DOUG) Using Debt In A Risky Way?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Douglas Elliman Inc. (NYSE:DOUG) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Douglas Elliman

What Is Douglas Elliman's Net Debt?

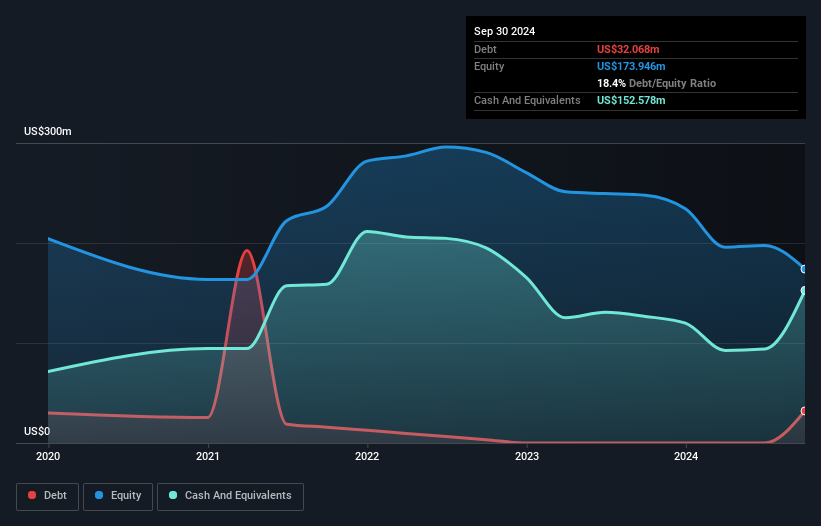

The image below, which you can click on for greater detail, shows that at September 2024 Douglas Elliman had debt of US$32.1m, up from none in one year. However, it does have US$152.6m in cash offsetting this, leading to net cash of US$120.5m.

How Strong Is Douglas Elliman's Balance Sheet?

The latest balance sheet data shows that Douglas Elliman had liabilities of US$89.7m due within a year, and liabilities of US$239.1m falling due after that. Offsetting this, it had US$152.6m in cash and US$40.9m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$135.3m.

This deficit is considerable relative to its market capitalization of US$167.6m, so it does suggest shareholders should keep an eye on Douglas Elliman's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. While it does have liabilities worth noting, Douglas Elliman also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Douglas Elliman's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Douglas Elliman saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that's not too bad, we'd prefer see growth.

So How Risky Is Douglas Elliman?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that Douglas Elliman had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of US$25m and booked a US$85m accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of US$120.5m. That kitty means the company can keep spending for growth for at least two years, at current rates. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Douglas Elliman (1 is a bit unpleasant) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10