Insiders Sold KLX Energy Services Holdings At US$6.93, Meanwhile Stock Sits Near US$4.54

Despite the fact that KLX Energy Services Holdings, Inc.'s (NASDAQ:KLXE) value has dropped 10% in the last week insiders who sold US$54k worth of stock in the past 12 months have had less success. Given that the average selling price of US$6.93 is still lower than the current share price, insiders would probably have been better off keeping their shares.

While insider transactions are not the most important thing when it comes to long-term investing, we do think it is perfectly logical to keep tabs on what insiders are doing.

See our latest analysis for KLX Energy Services Holdings

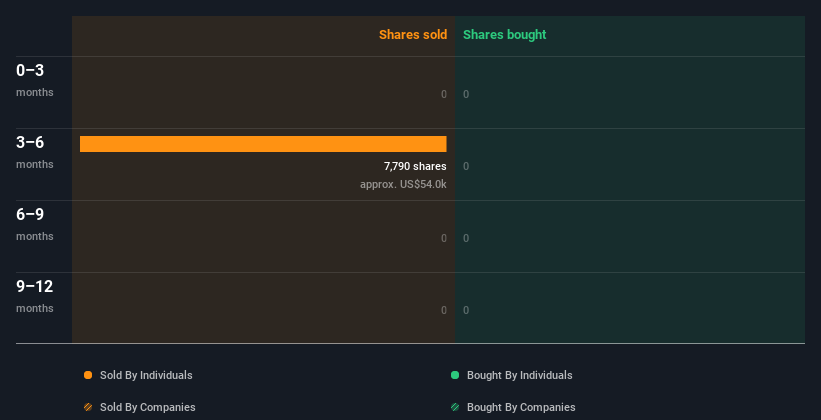

The Last 12 Months Of Insider Transactions At KLX Energy Services Holdings

Over the last year, we can see that the biggest insider sale was by the Senior VP & Chief Accounting Officer, Geoffrey Stanford, for US$54k worth of shares, at about US$6.93 per share. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. It's of some comfort that this sale was conducted at a price well above the current share price, which is US$4.54. So it may not shed much light on insider confidence at current levels. The only individual insider seller over the last year was Geoffrey Stanford.

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

For those who like to find hidden gems this free list of small cap companies with recent insider purchasing, could be just the ticket.

Insider Ownership Of KLX Energy Services Holdings

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. From our data, it seems that KLX Energy Services Holdings insiders own 5.8% of the company, worth about US$4.5m. Whilst better than nothing, we're not overly impressed by these holdings.

So What Do The KLX Energy Services Holdings Insider Transactions Indicate?

There haven't been any insider transactions in the last three months -- that doesn't mean much. The insider transactions at KLX Energy Services Holdings are not inspiring us to buy. And we're not picking up on high enough insider ownership to give us any comfort. While it's good to be aware of what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. While conducting our analysis, we found that KLX Energy Services Holdings has 3 warning signs and it would be unwise to ignore these.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if KLX Energy Services Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10