Franklin Templeton Eyes Solana ETF – Can SOL Reach a New High?

- Franklin Templeton files for a Solana ETF, aiming to track its price performance, signaling growing institutional interest in crypto assets.

- Solana’s ETF filing amidst shifting crypto regulations boosts its market potential, with analysts predicting a 70% chance of approval this year.

Franklin Templeton has filed with the Securities and Exchange Commission (SEC) for a new exchange-traded fund (ETF) focused on Solana (SOL). The move shows the firm’s strong interest in digital assets, particularly Solana, the sixth-largest cryptocurrency by market capitalization.

The Franklin Solana ETF will hold Solana as its asset, with all assets securely stored by Coinbase Custody Trust Company. In addition to Solana, the ETF will maintain separate custodians for its cash holdings. The fund’s shares will be continuously issued and redeemed in large blocks called Creation Units. These transactions will involve Solana, cash, or a combination of both, allowing investors to buy into fractional ownership of Solana through the fund.

The filing, submitted on Friday, outlines the fund’s goal to track Solana’s price performance. With multiple other firms, including Grayscale and Bitwise, already seeking SEC approval for Solana-related funds, Franklin Templeton’s application puts it in direct competition within the emerging Solana ETF space.

However, the SEC has seen a rise in applications for crypto-based ETFs, with Solana now leading the pack. As reported in our previous post, analysts estimate a 70% chance that Solana ETFs will gain approval this year. However, the timeline remains uncertain due to ongoing regulatory reviews and the evolving crypto market. Alongside Solana, XRP has also seen many ETF filings, with five companies applying for XRP-based ETFs.

Our official alt coin ETF approval odds are out. Litecoin leads w 90% chance, then Doge, followed by Solana and XRP. We are only doing for 33 Act $IBIT-esque filings. But def poss to see futures or Cayman-subsidiary type 40 Act stuff get through as well. https://t.co/JSaNnifjbu

— Eric Balchunas (@EricBalchunas) February 10, 2025

As regulatory clarity around crypto ETFs continues to shift, the recent developments in the Solana market suggest that the digital asset may be poised for more growth. Solana’s price movements have been volatile, yet its growing presence in the ETF filings hints at a possible surge in demand from institutional and retail investors alike.

The Impact of Regulatory Changes

The Franklin Templeton Solana ETF filing comes during shifts in U.S. crypto regulations. With the SEC’s changing stance on crypto products, including possible changes to how staking is handled within ETFs, there are expectations that more proof-of-stake assets like Solana could be included in crypto-focused investment products. This aligns with recent comments from analysts predicting that staking will be permitted within ETF wrappers, paving the way for yield-enhanced crypto exposure.

Additionally, according to ETHNews, a letter from U.S. Senators has urged the SEC to provide clearer guidelines on staking in crypto ETFs, which could further solidify the regulatory environment for such products. These regulatory movements could give the necessary foundation for an increase in the approval and adoption of crypto ETFs.

Solana’s Market Position

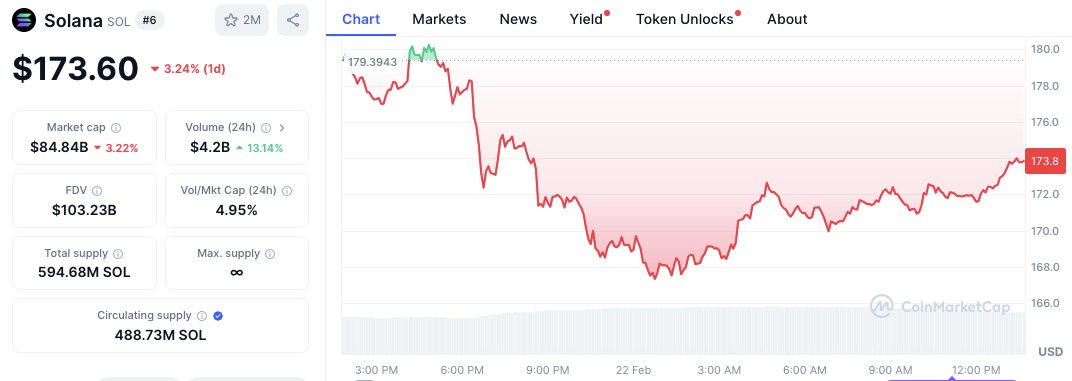

As of February 22, 2025, Solana’s market performance displays a period of fluctuations, with its price sitting at $173.60, a 3.24% decrease in the past 24 hours. However, despite recent volatility, Solana’s strong market capitalization of $84.84 billion and its consistent trading volume of $4.2 billion show strong investor interest.

Solana’s performance may influence investor sentiment in the coming months. With the possibility of an ETF that tracks Solana’s price, the digital asset could see new highs as more investors gain exposure through regulated financial products.

The post Franklin Templeton Eyes Solana ETF – Can SOL Reach a New High? appeared first on ETHNews.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10