Domino’s Pizza, Inc. (NASDAQ:DPZ) will release its fourth-quarter financial results, before the opening bell, on Monday, Feb. 24, 2025.

Analysts expect the Ann Arbor, Michigan-based company to report quarterly earnings at $4.91 per share, up from $4.48 per share in the year-ago period. Domino’s projects quarterly revenue of $1.48 billion, compared to $1.4 billion a year earlier, according to data from Benzinga Pro.

On Oct. 10, the company reported sales growth of 5.1% Y/Y to $1.08 billion, missing the analyst consensus estimate of $1.10 billion. EPS of $4.19 beat the consensus estimate of $3.68.

Domino’s shares fell 2% to close at $462.37 on Friday.

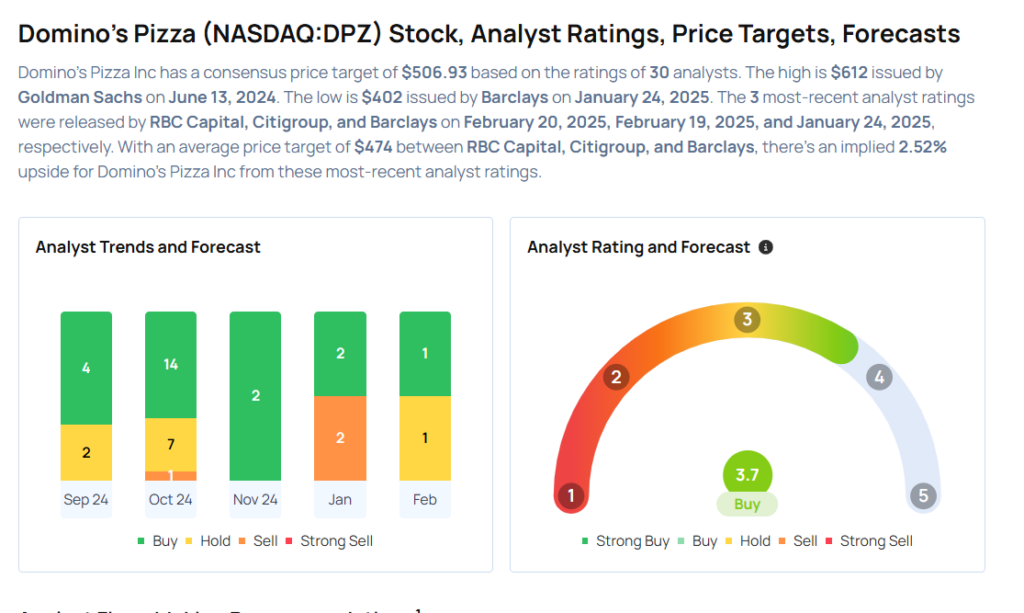

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Citigroup analyst Jon Tower maintained a Neutral rating and raised the price target from $440 to $520 on Feb. 19, 2025. This analyst has an accuracy rate of 72%.

- Barclays analyst Jeffrey Bernstein maintained an Underweight rating and lowered the price target from $412 to $402 on Jan. 24, 2025. This analyst has an accuracy rate of 64%.

- Morgan Stanley analyst Brian Harbour maintained an Overweight rating and cut the price target from $510 to $496 on Jan. 21, 2025. This analyst has an accuracy rate of 65%.

- Oppenheimer analyst Brian Bittner maintained an Outperform rating and raised the price target from $490 to $495 on Jan. 7, 2025. This analyst has an accuracy rate of 66%.

- TD Cowen analyst Andrew Charles maintained a Buy rating and raised the price target from $475 to $515 on Nov. 25, 2024. This analyst has an accuracy rate of 73%.

Considering buying DPZ stock? Here’s what analysts think:

Read This Next:

- Top 2 Health Care Stocks That May Rocket Higher This Month