Verizon Communications (NYSE:VZ) Declares Quarterly Dividend Of US$0.68 Payable May 2025

Verizon Communications (NYSE:VZ) saw a 7% increase in its stock price over the past month, likely influenced by recent events such as the dividend affirmation, where the board declared a consistent quarterly dividend of 67.75 cents per share. Additionally, the announcement of redeeming $487 million in Floating Rate Notes and achieving a 480 Mbps uplink speed in collaboration with Ericsson and Qualcomm reflect the company's steady financial management and technological advancements. The unveiling of new product promotions with the pre-order of iPhone 16e and enhanced cybersecurity measures through Verizon Business partnerships also highlight its ongoing innovation and client-focused strategies. While these developments occurred against a backdrop of overall market volatility, with major indexes experiencing fluctuations as inflation figures eased concerns, Verizon's recent moves might have contributed positively to investor sentiment, aligning with its broader engagement in cutting-edge tech and improved infrastructure offerings.

Dig deeper into the specifics of Verizon Communications here with our thorough analysis report.

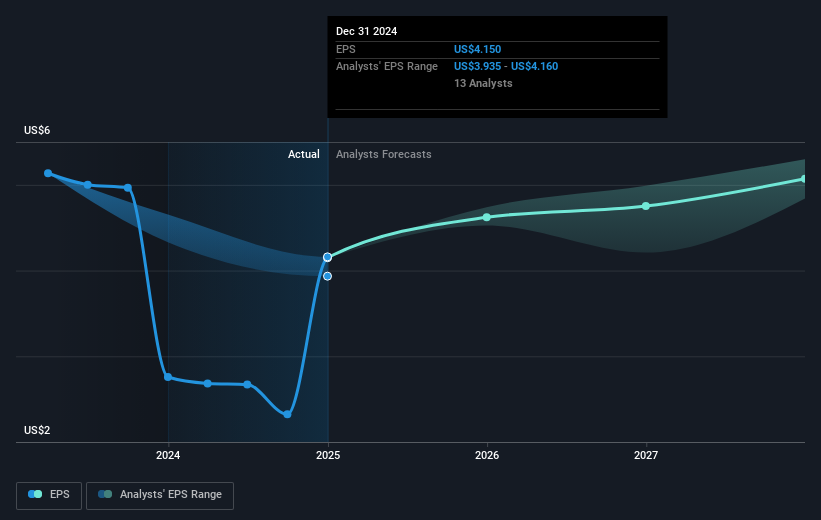

Verizon Communications' total shareholder returns were 14.45% over the past year. Despite this gain, the company underperformed the US Telecom industry, which saw a 29.1% return and also trailed the US Market, which returned 15.3%. Noteworthy was Verizon's substantial earnings growth over the year, with a 50.7% increase, contrasting its 5-year average decline. The company also maintained a strong dividend yield of 6.29%, which may have attracted income-oriented investors.

Among significant developments, Verizon faced a legal challenge with a new complaint filed by VoIP-Pal.com, though its immediate impact on financials remains speculative. The company's partnerships, like the one with AT&T for Open RAN deployment, highlighted efforts to enhance technological capabilities. Additionally, redeeming US$487 million in debt indicated prudent financial management aimed at strengthening its balance sheet, likely supporting investor confidence in its long-term stability.

- Get the full picture of Verizon Communications' valuation metrics and investment prospects—click to explore.

- Assess the downside scenarios for Verizon Communications with our risk evaluation.

- Already own Verizon Communications? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10