High Growth Tech Stocks in Asia to Watch for Promising Growth

As global markets face challenges such as trade policy uncertainties and inflation concerns, Asian tech stocks have been drawing attention for their potential to navigate these turbulent waters. In this environment, identifying promising high-growth tech stocks involves looking at companies with strong innovation capabilities and adaptability to shifting economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Zhongji Innolight | 29.20% | 29.62% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| PharmaResearch | 23.41% | 26.41% | ★★★★★★ |

| Bioneer | 26.13% | 104.84% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 520 stocks from our Asian High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Everest Medicines (SEHK:1952)

Simply Wall St Growth Rating: ★★★★★☆

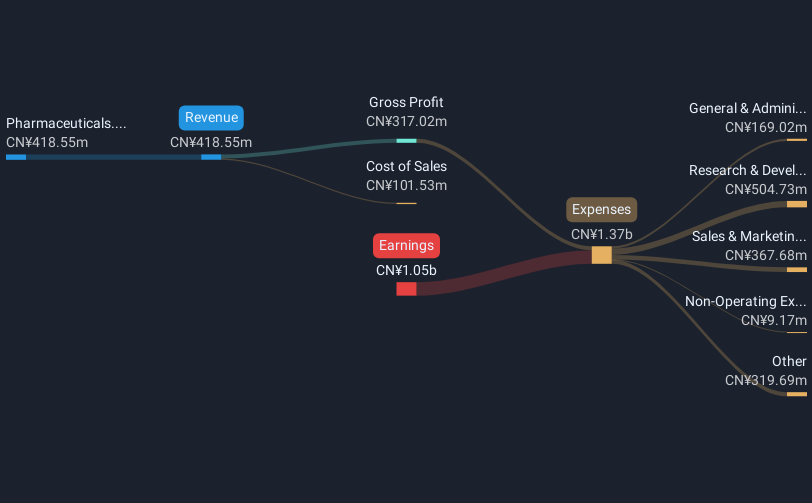

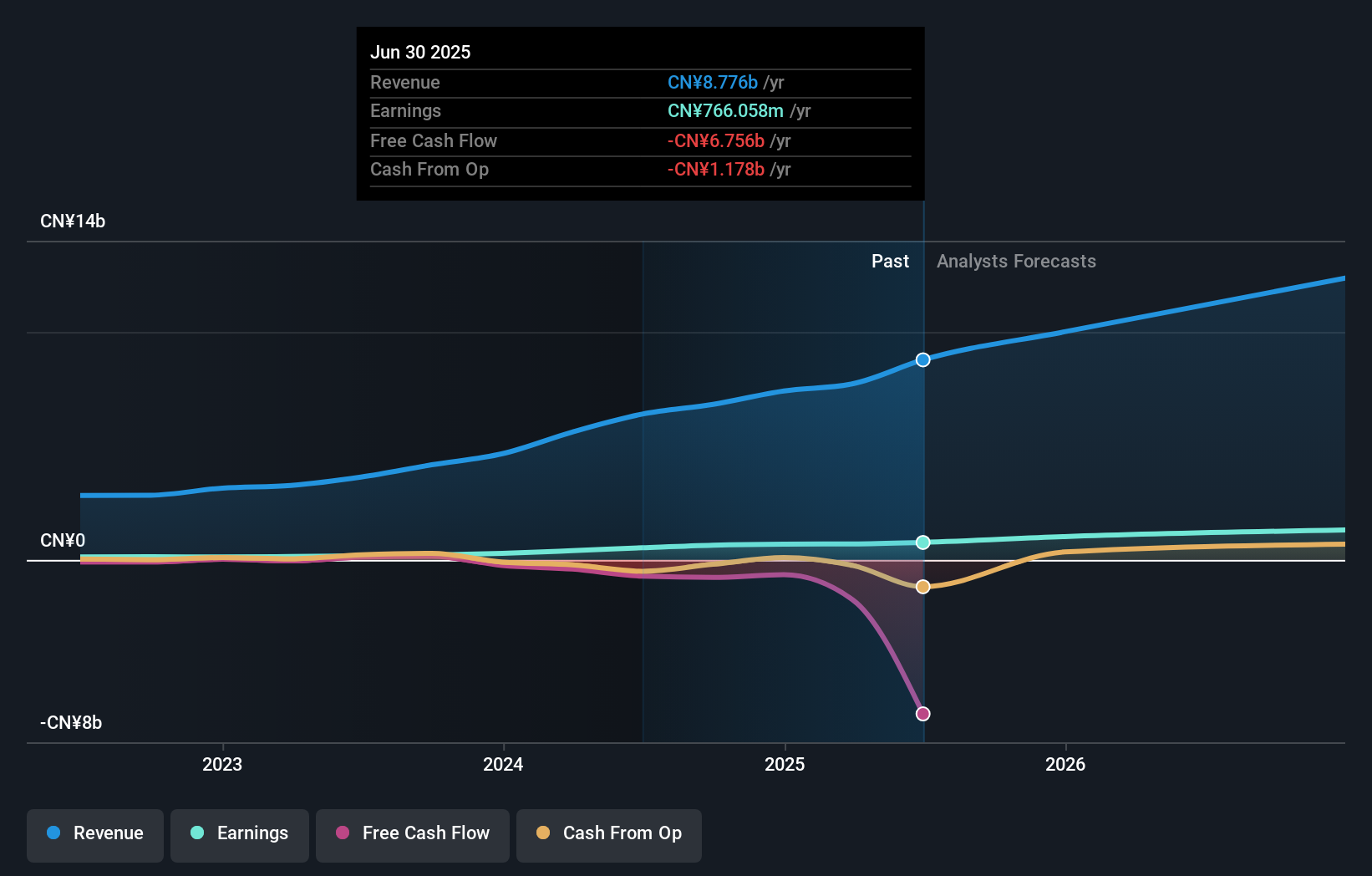

Overview: Everest Medicines Limited is a biopharmaceutical company focused on the discovery, license-in, development, and commercialization of therapies and vaccines for critical unmet medical needs in Greater China and other Asia Pacific markets, with a market cap of approximately HK$19.53 billion.

Operations: Everest Medicines Limited generates revenue primarily from its pharmaceuticals segment, amounting to CN¥418.55 million. The company is engaged in the discovery, license-in, development, and commercialization of therapies and vaccines targeting critical unmet medical needs across Greater China and other Asia Pacific regions.

Everest Medicines has demonstrated a robust entry into the high-growth tech sector in Asia, particularly with its innovative ulcerative colitis treatment, VELSIPITY®. The drug's recent approval across multiple regions including Macau and Singapore underscores its potential, bolstered by strong Phase III trial results showing significant mucosal healing rates. With a revenue growth forecast at 33.4% annually and earnings expected to surge by 90.77% per year, Everest is positioning itself as a formidable player in addressing the escalating demand for advanced therapeutic solutions in Asia's biotech landscape. This strategic expansion is further evidenced by its proactive engagements such as the recent special calls discussing mRNA vaccine developments and consistent regulatory successes that enhance its market presence and patient reach in crucial areas like China’s Greater Bay Area.

- Delve into the full analysis health report here for a deeper understanding of Everest Medicines.

Review our historical performance report to gain insights into Everest Medicines''s past performance.

OFILM Group (SZSE:002456)

Simply Wall St Growth Rating: ★★★★☆☆

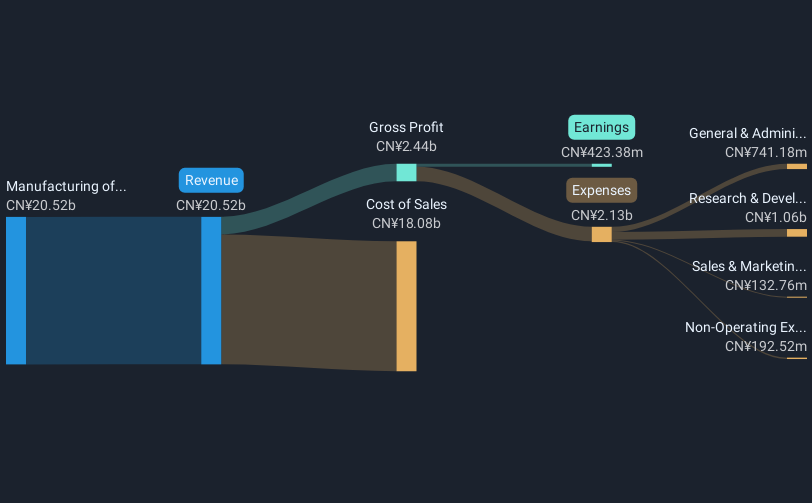

Overview: OFILM Group Co., Ltd. engages in the manufacturing and sale of optic and optoelectronic products both domestically in China and internationally, with a market cap of approximately CN¥47.28 billion.

Operations: The company generates revenue primarily from the manufacturing of optics and optoelectronic components, amounting to approximately CN¥20.52 billion.

OFILM Group, transitioning into profitability this year, illustrates a dynamic shift in Asia's high-tech landscape. With revenue growth outpacing the Chinese market at 15.6% annually and earnings expected to surge by 31.2% each year, OFILM is navigating its sector adeptly despite challenges like significant one-off gains of CN¥371.7M skewing recent financial results. The company's strategic focus was evident in its latest shareholders meeting aimed at bolstering 2025 projections, reflecting an aggressive push towards sustaining innovations and market competitiveness in electronic components amidst evolving technological demands.

- Take a closer look at OFILM Group's potential here in our health report.

Examine OFILM Group's past performance report to understand how it has performed in the past.

Sharetronic Data Technology (SZSE:300857)

Simply Wall St Growth Rating: ★★★★★★

Overview: Sharetronic Data Technology Co., Ltd. is a provider of wireless IoT products operating both in China and internationally, with a market capitalization of CN¥30.39 billion.

Operations: The company specializes in wireless IoT products, focusing on both domestic and international markets. With a market capitalization of CN¥30.39 billion, it leverages its expertise to cater to diverse technological needs across various regions.

Sharetronic Data Technology, recently added to major indices in the Shenzhen Stock Exchange, demonstrates robust growth prospects with a 26.2% annual revenue increase and a remarkable 29.1% expected earnings growth per year. This performance outstrips the broader Chinese tech sector's average, positioning Sharetronic at the forefront of innovation and market expansion. The company's recent shareholders meeting highlighted strategic initiatives aimed at expanding business scope and enhancing governance structures to support sustained growth and connectivity in high-tech industries across Asia.

- Click here to discover the nuances of Sharetronic Data Technology with our detailed analytical health report.

Assess Sharetronic Data Technology's past performance with our detailed historical performance reports.

Summing It All Up

- Click this link to deep-dive into the 520 companies within our Asian High Growth Tech and AI Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everest Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10