Redsun Services Group Full Year 2024 Earnings: EPS: CN¥0.035 (vs CN¥0.026 in FY 2023)

Redsun Services Group (HKG:1971) Full Year 2024 Results

Key Financial Results

- Revenue: CN¥1.03b (down 3.5% from FY 2023).

- Net income: CN¥14.4m (up 32% from FY 2023).

- Profit margin: 1.4% (up from 1.0% in FY 2023). The increase in margin was driven by lower expenses.

- EPS: CN¥0.035 (up from CN¥0.026 in FY 2023).

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

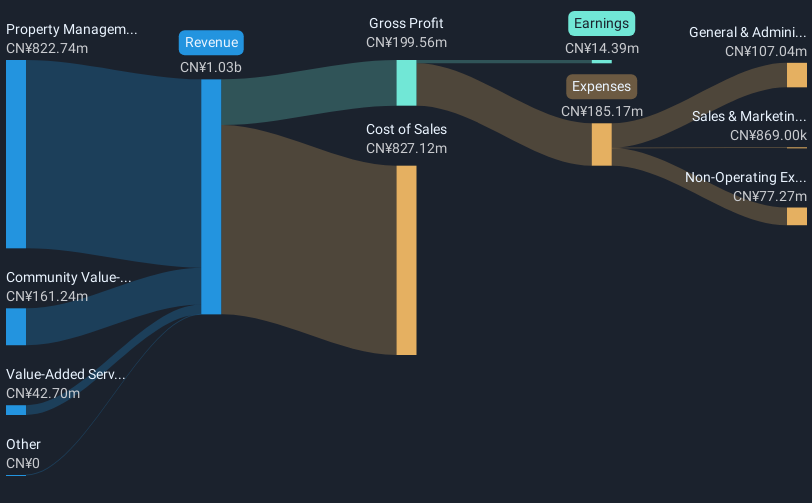

All figures shown in the chart above are for the trailing 12 month (TTM) period

The primary driver behind last 12 months revenue was the Property Management Services segment contributing a total revenue of CN¥822.7m (80% of total revenue). Notably, cost of sales worth CN¥827.1m amounted to 81% of total revenue thereby underscoring the impact on earnings. The largest operating expense was General & Administrative costs, amounting to CN¥107.0m (58% of total expenses). Explore how 1971's revenue and expenses shape its earnings.

Redsun Services Group's share price is broadly unchanged from a week ago.

Risk Analysis

We should say that we've discovered 2 warning signs for Redsun Services Group (1 can't be ignored!) that you should be aware of before investing here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10