Be Sure To Check Out Lion Rock Group Limited (HKG:1127) Before It Goes Ex-Dividend

Readers hoping to buy Lion Rock Group Limited (HKG:1127) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is commonly two business days before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. This means that investors who purchase Lion Rock Group's shares on or after the 11th of April will not receive the dividend, which will be paid on the 29th of April.

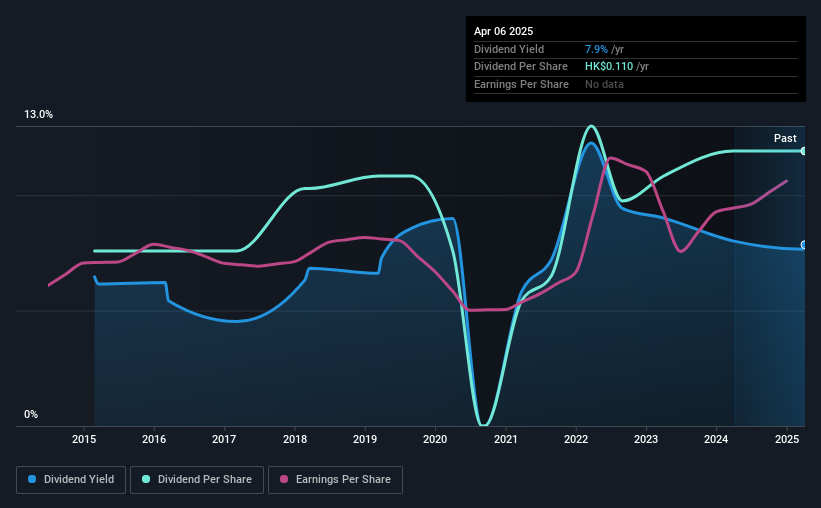

The company's next dividend payment will be HK$0.10 per share. Last year, in total, the company distributed HK$0.11 to shareholders. Calculating the last year's worth of payments shows that Lion Rock Group has a trailing yield of 7.9% on the current share price of HK$1.40. If you buy this business for its dividend, you should have an idea of whether Lion Rock Group's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Lion Rock Group paid out a comfortable 38% of its profit last year.

View our latest analysis for Lion Rock Group

Click here to see how much of its profit Lion Rock Group paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. This is why it's a relief to see Lion Rock Group earnings per share are up 9.1% per annum over the last five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Lion Rock Group has delivered 4.6% dividend growth per year on average over the past 10 years. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

The Bottom Line

Is Lion Rock Group worth buying for its dividend? It has been growing its earnings per share somewhat in recent years, although it reinvests more than half its earnings in the business, which could suggest there are some growth projects that have not yet reached fruition. In summary, Lion Rock Group appears to have some promise as a dividend stock, and we'd suggest taking a closer look at it.

On that note, you'll want to research what risks Lion Rock Group is facing. In terms of investment risks, we've identified 1 warning sign with Lion Rock Group and understanding them should be part of your investment process.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

If you're looking to trade Lion Rock Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10