2 Breakout Growth Stocks You Can Buy and Hold for the Next Decade

-

Though the stock market is having a rocky year, investors would do well to keep fast-growing companies with solid growth potential on their radars.

-

The two companies discussed in this article are on track to take advantage of multibillion-dollar markets in the long run that could send their shares soaring.

The stock market has been in turmoil so far this year amid the tariff-related issues that threaten to send the U.S. economy into a potential recession, and a big drop in consumer sentiment this month has added to the overall negativity.

According to the University of Michigan's latest survey, consumer sentiment dropped a remarkable 11% in April 2025 to its second-lowest level since 1952. The Trump administration's tariffs on global trade partners and the economic conflict with China could lead to higher inflation as manufacturing costs rise.

As such, it won't be surprising to see stocks remaining under pressure until there is a concrete resolution to the ongoing economic developments. However, this also seems like a good time for savvy investors to add some top growth stocks to their portfolios that could deliver solid returns in the long run. After all, the secular growth opportunities in areas such as cybersecurity and artificial intelligence (AI) should help companies operating in these sectors enjoy solid growth going forward.

We will take a closer look at two names that have been growing at impressive rates and have big growth opportunities ahead, making them worth buying and holding on to for the next decade.

1. SoundHound AI

Shares of SoundHound AI (SOUN 0.86%) plunged 58% in 2025 as of this writing, giving investors an opportunity to buy a rapidly growing company at a relatively cheaper valuation. Of course, SoundHound isn't exactly dirt-cheap right now as it is trading at 32.5 times sales, but that's well below its price-to-sales ratio of 90 at the end of 2024.

Moreover, SoundHound is in a position to justify its premium sales multiple because of its accelerating growth. After finishing 2024 with an 85% increase in revenue, SoundHound is expecting its top line to nearly double this year. This impressive growth in the company's revenue can be attributed to the fast-growing demand for the company's voice AI solutions, which are finding traction in multiple industries ranging from automotive to restaurants to healthcare to retail to financial services, among others.

The good part is that the voice AI market that SoundHound serves is forecast to grow at a solid annual rate of 24% through the next decade, generating a whopping $136 billion in annual revenue in 2035. So, SoundHound is at the beginning of a terrific growth curve, considering that it expects to generate $167 million in revenue this year at the midpoint of its guidance range.

The impressive thing to note here is that SoundHound's potential revenue pipeline is already strong enough to help it maintain impressive growth levels for a long time to come. The company ended 2024 with a cumulative subscriptions and bookings backlog of $1.2 billion. This metric, which SoundHound calculates based on the contracts that it has signed, is an indicator of the company's revenue generation potential over the long run. What's worth noting is that this metric shot up an impressive 75% year over year last quarter.

SoundHound's potential revenue pipeline could continue improving as the company is focused on expanding its presence in multiple markets where it sees multibillion-dollar revenue opportunities. All this makes SoundHound AI an impressive growth stock to buy in light of its recent slide, as the huge addressable opportunity in the voice AI market could send the stock soaring over the next decade.

2. Zscaler

The cybersecurity industry is expected to generate $500 billion in revenue in 2035, a jump from $191 billion last year. Zscaler (ZS 2.61%) gives investors an avenue to capitalize on this massive market as it targets fast-growing niches within the cybersecurity industry. The company provides zero-trust solutions, data protection, and AI security.

It sees a serviceable addressable market worth $96 billion for its services, which is significantly larger than the $2.65 billion revenue that it expects to generate in the current fiscal year. The good part is that Zscaler is setting itself up to make the most of its large addressable market. The company's customer base is swelling thanks to the fast-growing demand for the cybersecurity services that it provides, and that's evident from the impressive growth in its contractual obligations.

Zscaler's remaining performance obligations (RPO) increased 28% year over year in the second quarter of fiscal 2025 to $4.6 billion. That was higher than the 23% growth in its revenue for the quarter. Faster growth in the RPO bodes well for Zscaler since this metric refers to the total value of a company's contracts that have yet to be fulfilled. The RPO will be recognized as revenue once Zscaler delivers those services, so the fact that it is winning more contracts than it is fulfilling is a green flag.

Even better, Zscaler's existing customers are increasing their spending on its offerings. Its dollar-based net retention rate stood at 115% in the previous quarter, up by 1 percentage point sequentially. This metric compares the spending by Zscaler's customers in a quarter to the spending by those same customers in the year-ago period. So, a reading of more than 100% means that its existing customers either increased their usage of its services or adopted additional services.

Not surprisingly, Zscaler's operating margin increased by 2 percentage points last quarter to 22% on a year-over-year basis. Importantly, investors can expect the company's margins to head higher in the long run because of its sizable addressable market, expanding customer base, and ability to win a bigger share of existing customers' wallets.

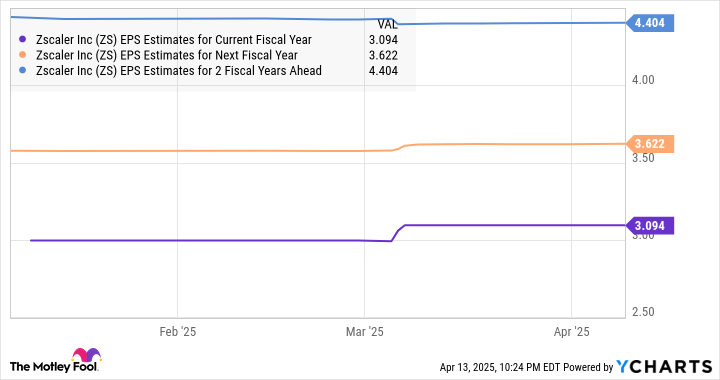

This explains why analysts are projecting Zscaler's bottom-line growth rate to pick up going forward.

ZS EPS Estimates for Current Fiscal Year data by YCharts

Zscaler's stronger earnings growth could be rewarded with healthy gains on the stock market in the future. That's why it may be a good idea to buy this cybersecurity stock before it steps on the gas following a mediocre performance so far this year.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10