Is China Infrastructure & Logistics Group Ltd.'s (HKG:1719) Recent Price Movement Underpinned By Its Weak Fundamentals?

With its stock down 26% over the past three months, it is easy to disregard China Infrastructure & Logistics Group (HKG:1719). It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Fundamentals usually dictate market outcomes so it makes sense to study the company's financials. Specifically, we decided to study China Infrastructure & Logistics Group's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for China Infrastructure & Logistics Group is:

1.6% = HK$13m ÷ HK$814m (Based on the trailing twelve months to December 2024).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each HK$1 of shareholders' capital it has, the company made HK$0.02 in profit.

See our latest analysis for China Infrastructure & Logistics Group

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of China Infrastructure & Logistics Group's Earnings Growth And 1.6% ROE

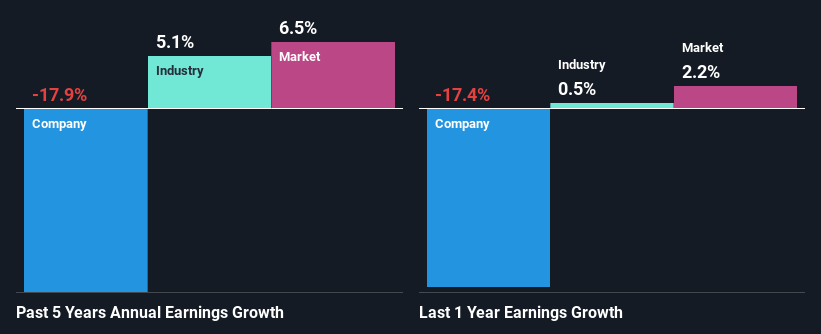

It is quite clear that China Infrastructure & Logistics Group's ROE is rather low. Not just that, even compared to the industry average of 7.8%, the company's ROE is entirely unremarkable. For this reason, China Infrastructure & Logistics Group's five year net income decline of 18% is not surprising given its lower ROE. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. Such as - low earnings retention or poor allocation of capital.

However, when we compared China Infrastructure & Logistics Group's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 5.1% in the same period. This is quite worrisome.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about China Infrastructure & Logistics Group's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is China Infrastructure & Logistics Group Making Efficient Use Of Its Profits?

China Infrastructure & Logistics Group doesn't pay any regular dividends, meaning that the company is keeping all of its profits, which makes us wonder why it is retaining its earnings if it can't use them to grow its business. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

Summary

On the whole, we feel that the performance shown by China Infrastructure & Logistics Group can be open to many interpretations. While the company does have a high rate of reinvestment, the low ROE means that all that reinvestment is not reaping any benefit to its investors, and moreover, its having a negative impact on the earnings growth. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. To know the 1 risk we have identified for China Infrastructure & Logistics Group visit our risks dashboard for free.

If you're looking to trade China Infrastructure & Logistics Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10