Discounted Walmart Shares Could Be Opportunity

WMT is a retailing giant. It offers low-cost options and household necessities, meaning it’s a top option even when shoppers pull back on nonessential items

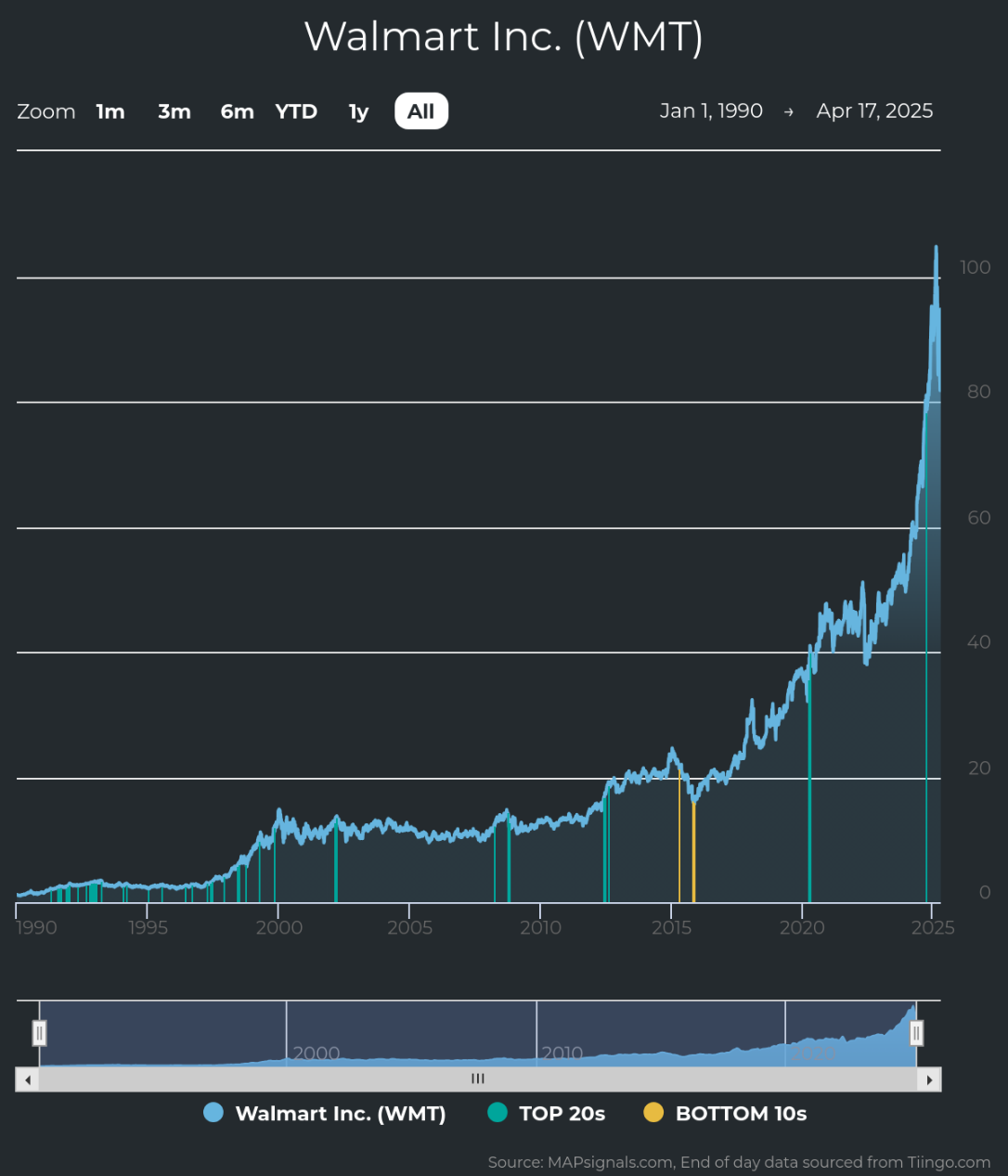

But like many other stocks, WMT has gone through a bad period of forced selling recently. Each red bar in the chart below signals unusually large volumes in WMT shares. They reflect our proprietary Big Money outflow signal, pushing the stock lower:

So, WMT shares are up only 1% this year, whereas they’ve beaten the market handily over three-, five-, 10-, and 15-year periods. But now MAPsignals data shows how Big Money investors have sold this quality name.

Walmart Shares Down, Time to Buy?

When best-of-breed stocks are sold hard, history shows it’s often a buying opportunity for long-term investors. Institutional volumes reveal plenty. Each red bar below signals unusually large outflow volumes in WMT shares:

Look at the stretch in early 2021 until mid-2022 – mostly red bars for more than a year. Capitulation was in full effect and share values fell. But those who bought during that time have profited handsomely since, even with the latest dips.

See, despite the near-term volatility, there’s a powerful fundamental story happening with Walmart.

Walmart Fundamental Analysis

A healthy fundamental backdrop makes this company worth investigating. As you can see, WMT has had solid sales and earnings growth, as well as an enormous market capitalization:

- 3-year sales growth rate (+5.9%)

- 3-year EPS growth rate (+15.9%)

- Market capitalization ($731.1 billion)

Source: FactSet

Also, EPS is estimated to ramp higher this year by +12.5%.

WMT has a track record of strong financial performance.

Marrying great fundamentals with our proprietary software has found some big winning stocks over the long term.

Walmart has been a top-rated stock at MAPsignals. That means the stock has unusual buy pressure and growing fundamentals. We have a ranking process that showcases stocks like this on a weekly basis.

It’s made the rare Top 20 report multiple times since MAPsignals data began in 1990. The blue bars below show when WMT was a top pick…the growth is obvious:

There are several long stretches without Top 20 signals. Also notice around 2015 the amber bars, which indicate Top 20 Big Money sells – huge selling in the shares. Since then, share values have soared. So, those brave enough to buy when the stock was capitulating were rewarded.

Tracking unusual volumes reveals the power of money flows.

This is a trait that most outlier stocks exhibit…the best of the best. Big Money demand drives stocks upward.

Walmart Price Prediction

Given the fundamentals, it wouldn’t surprise to see the stock rise once again with Big Money support. Great companies don’t stay down forever.

Big Money selling in the shares is signaling to take notice. Given the historical gains, strong fundamentals, and recent big selling, this stock could be worth a spot in a diversified portfolio.

Disclosure: the author holds long positions in WMT in personal and managed accounts at the time of publication.

If you are a Registered Investment Advisor (RIA) or are a serious investor, take your investing to the next level, learn more about the MAPsignals process here.

This article was originally posted on FX Empire

More From FXEMPIRE:

- Discounted Walmart Shares Could Be Opportunity

- NVIDIA Selloff Could Be Long-Term Opportunity

- Sovereign Credit: US Policy Shifts Point to Tariff-light, Trade-war, Economic-crisis Scenarios

- To The New World Order and Back

- More Losses for the Dollar Amid Sweeping Tariffs

- Republic Services Transforming and Growing

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10