1. How to Purchase Through the APP?

Ensure Tiger Trade APP is Up-to-Date

1. Before trading on the Tiger Trade APP, ensure your mobile APP is updated to version Tiger Trade v9.1.0.1 or later. If not, some features may be missing or trading may not be possible.

2. You can update the APP automatically by clicking “Profile,” then “Settings,” followed by “About,” and finally “Check for New Version” in the APP. Alternatively, you can download the update manually from the Tiger International official website.

Confirm Account Setup and Fund Deposit

1. After verifying the version, ensure that you have completed the account opening process on the Tiger Trade APP and that your cash account has been funded.

2. Where to Find U.S. Treasury Bonds

Search Bar

1. Enter “US-T” in the search bar to view related U.S. Treasury bond products.

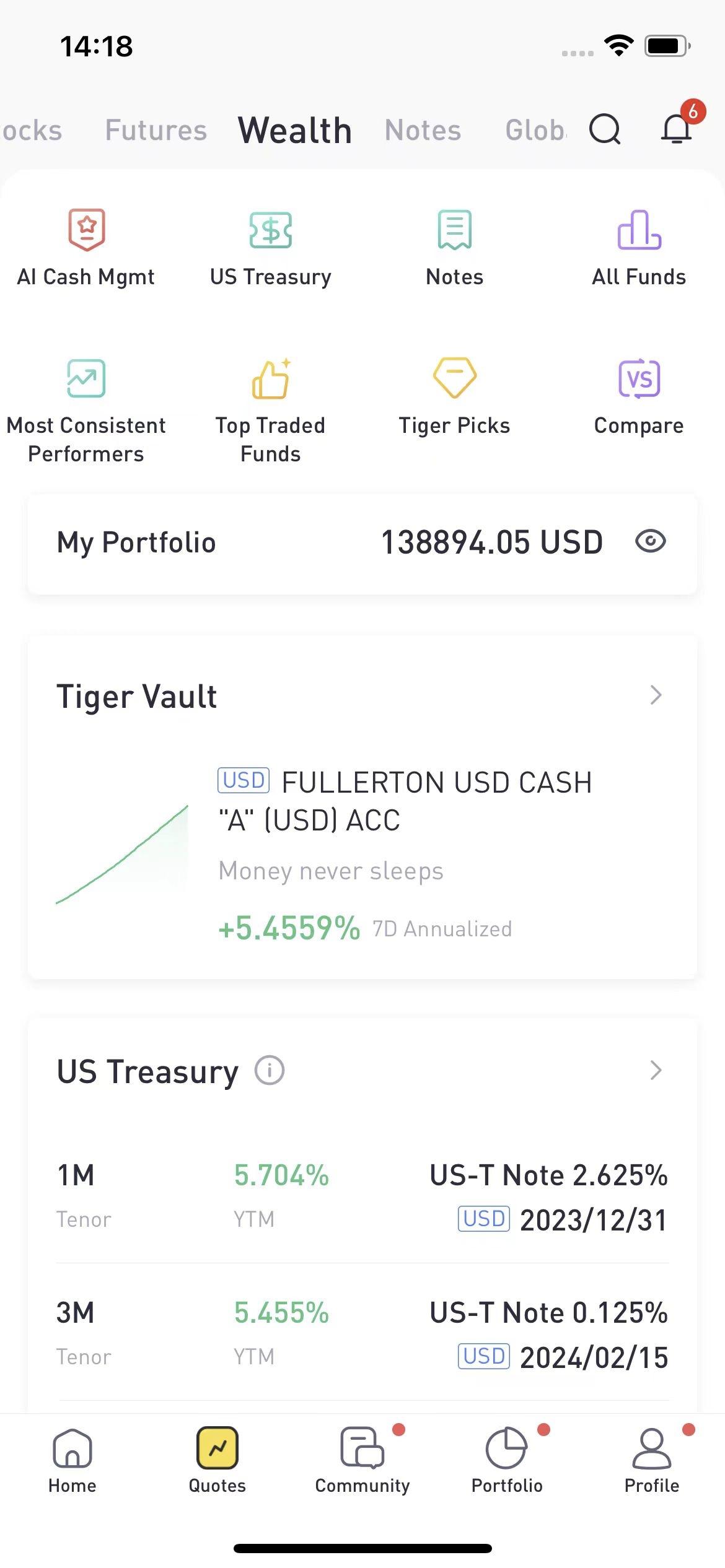

2. Wealth Tab

1. Locate the "Wealth" tab then click on "U.S. Treasury" to enter the bond product details interface.

3. Selecting the APPropriate U.S. Treasury Bond

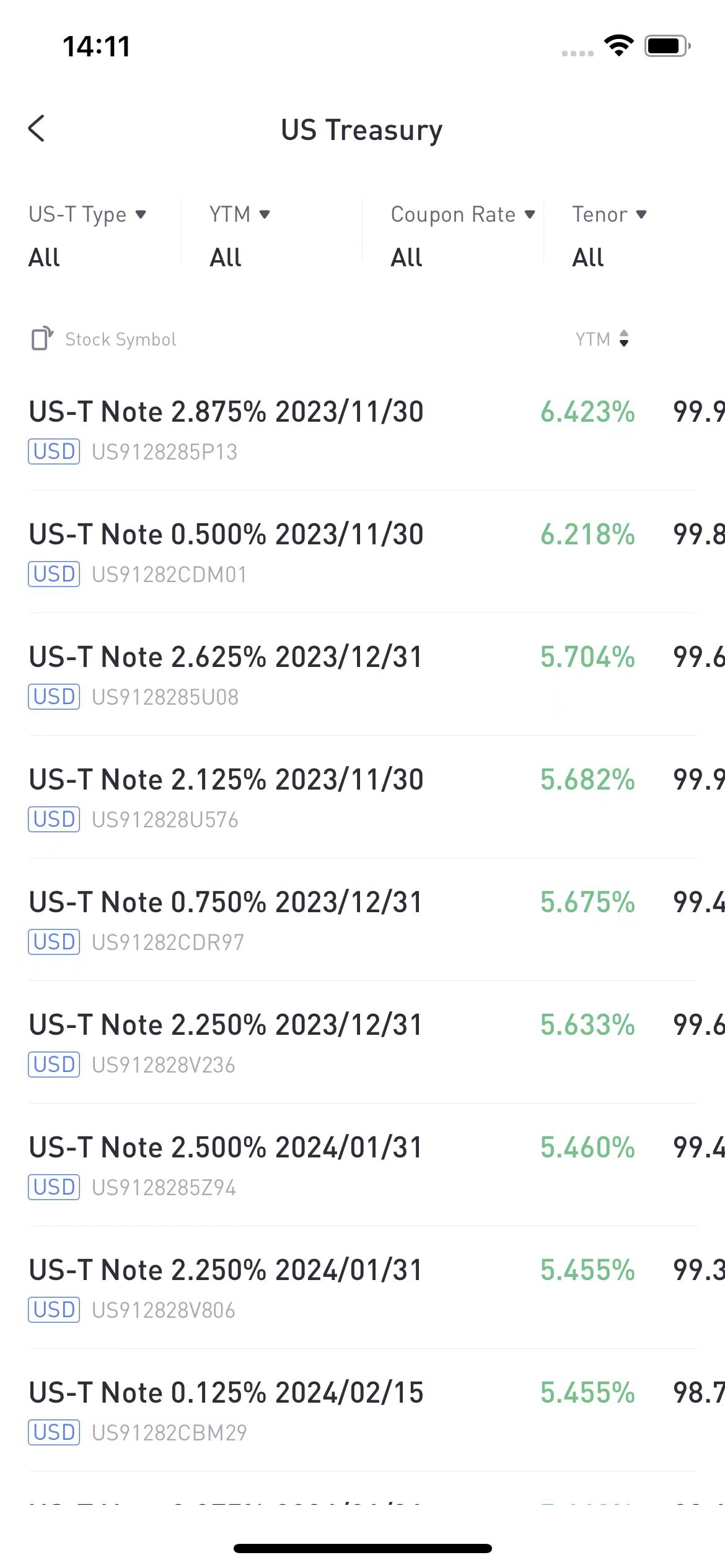

After entering the bond product interface, you will see a list of various types of Treasury bond products:

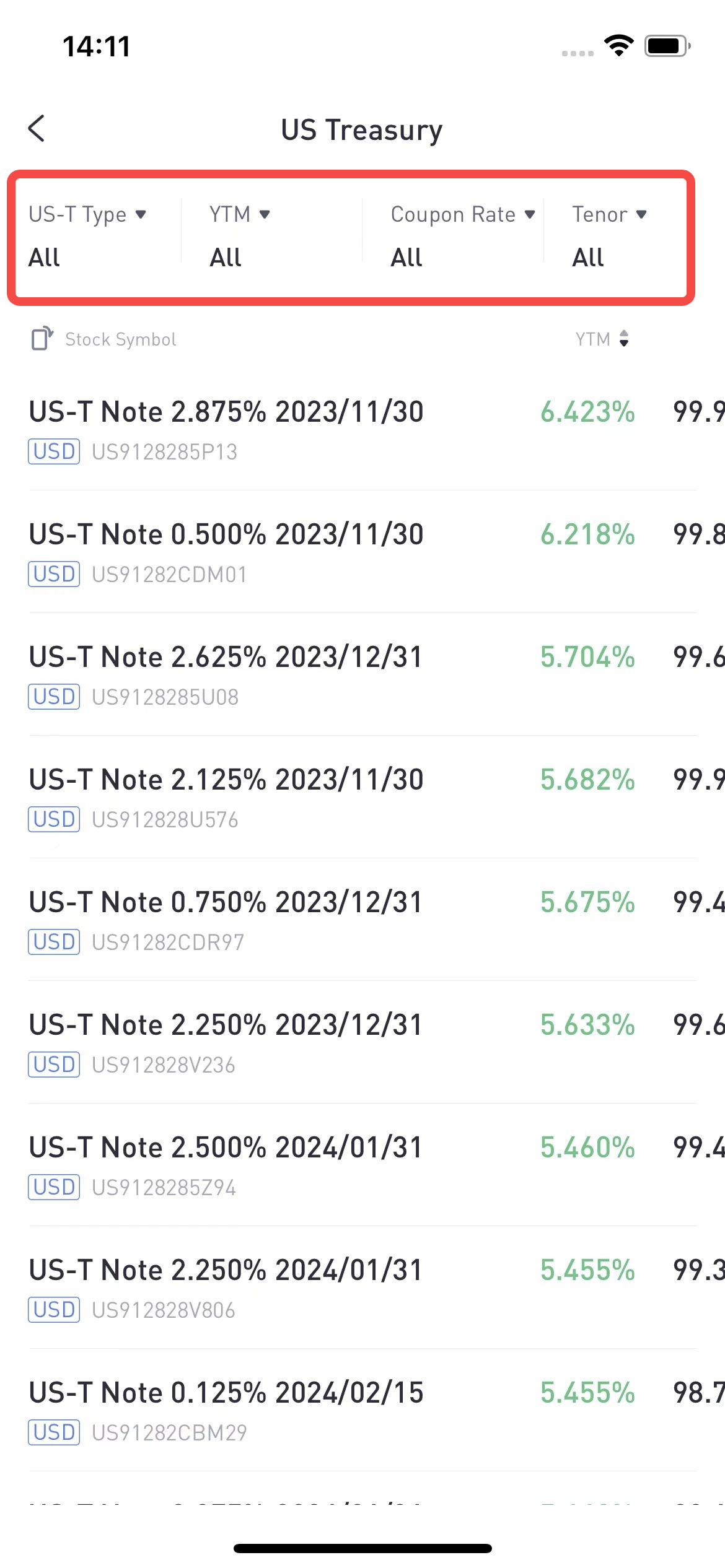

Next, you have two ways to filter these products:

1、Filtering in the Filter Bar

In the filter bar, enter the type of Treasury bond, select the desired yield to maturity and coupon rate, and determine the remaining term of the product. This way, you can find the Treasury bond product that meets your needs.

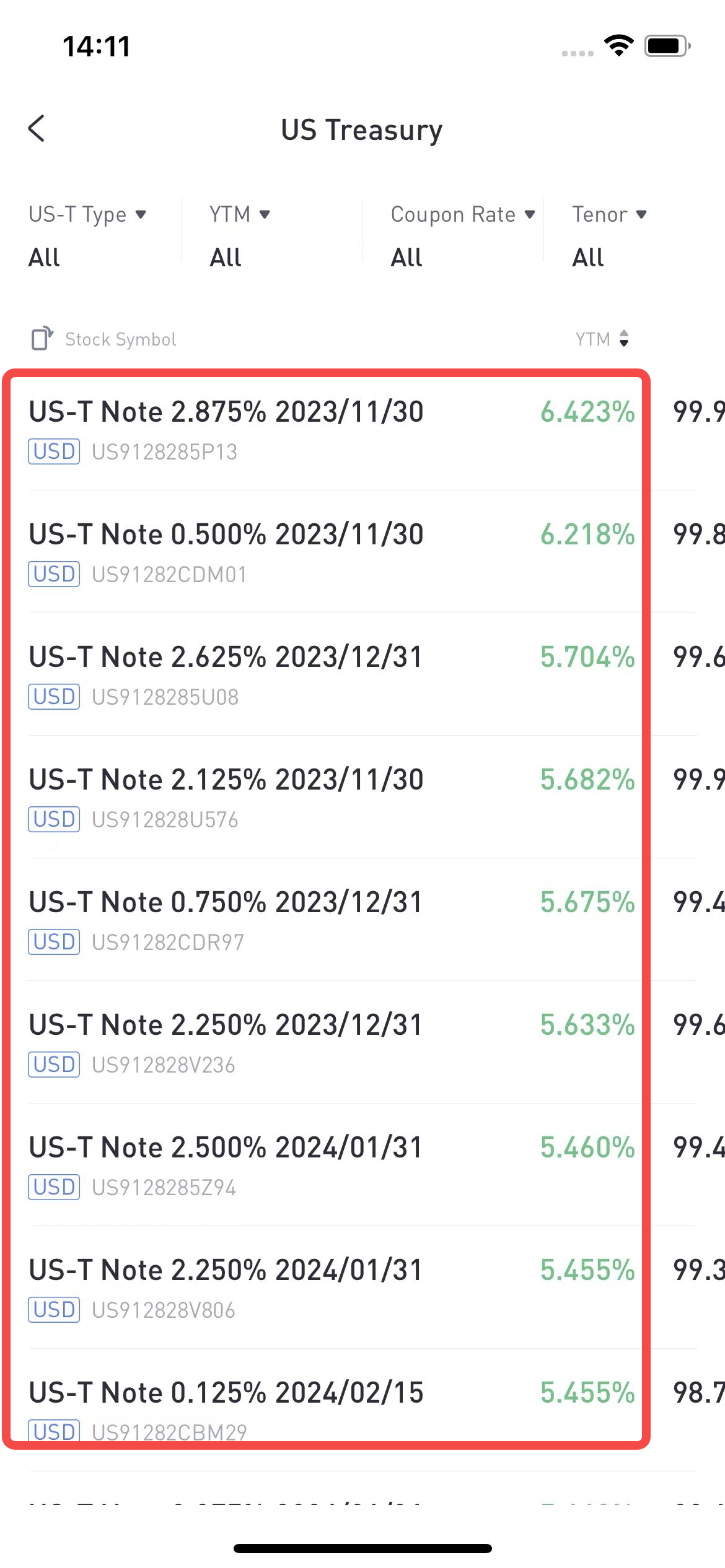

2、Filter Directly from the List

Alternatively, you can filter directly from the list displayed on the page to find the Treasury bond product that satisfies your requirements. The display here shows the bonds with the highest current yield to maturity for each maturity month.

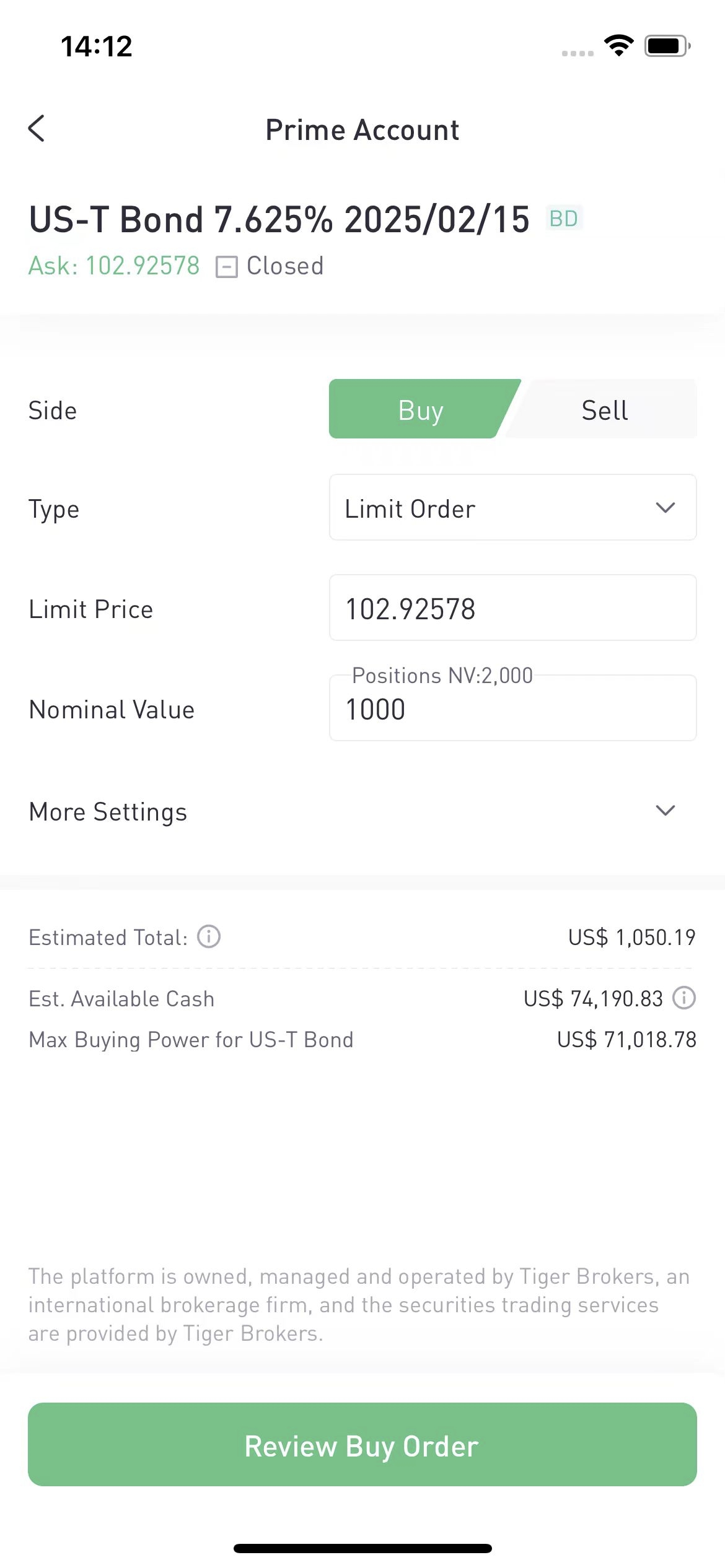

4. Introduction to the U.S. Treasury Bond Order Page

After understanding the above trading information, click "Buy" to enter the order page for Treasury bonds.

On this page, there are a few steps you need to be aware of:

Option | Explanation |

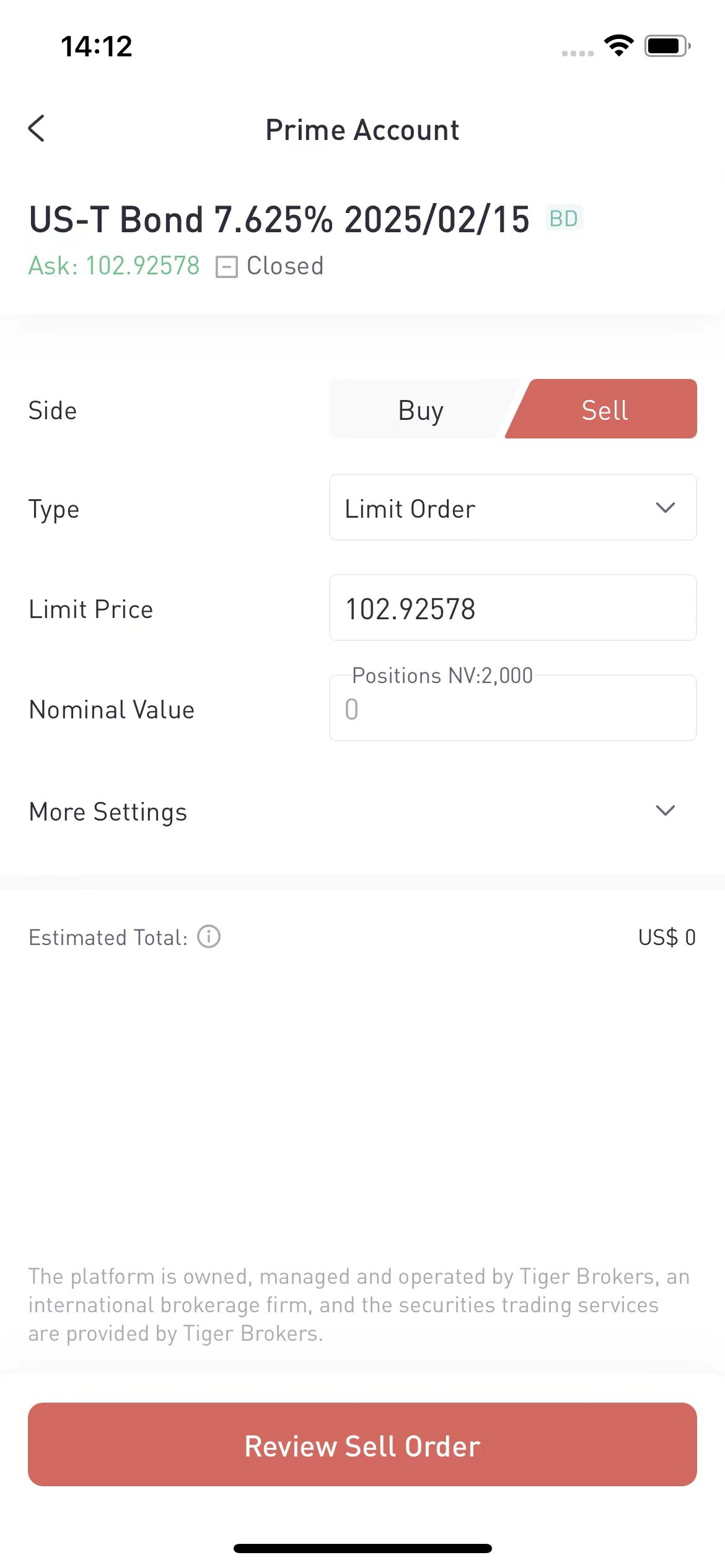

Trading Direction | The trading directions are either buy or sell. If you do not hold any Treasury bonds, click 'buy' to proceed. If you already hold Treasury bonds and wish to sell them, click 'sell'. |

Order Type | When trading Treasury bonds in the Tiger Trade APP, you can currently choose between two types of orders: Limit Order and Market Order. A Limit Order aims to buy or sell a certain amount of Treasury bonds at a specific price. Once submitted to the market, it will execute at the specified price or better, or not at all. Its main feature is to help investors better control the trading price, but it does not guarantee the trade will be successful. A Market Order requires immediate purchase or sale of a certain amount of Treasury bonds at the current market price. Its main feature is its quick execution, as it immediately matches with the best available price on the market. However, a Market Order does not guarantee the trading price, meaning it may execute at a price higher or lower than the current market quote. |

Face Value | The face value of a bond is the amount the issuer returns to investors at maturity. Whether you buy at above or below face value, you can only recover the face value amount at maturity. (Note: When trading Treasury bonds on the Tiger Trade APP, the minimum face value is $1,000.) |

Order Validity | Order Validity refers to how long an investor's trade order can be retained after being placed. In Treasury bond trading, there are generally two options: Day (DAY) and Good 'Til Canceled (GTC). Choosing Day means that if the order is not executed by the end of the trading day, it will automatically expire. Good 'Til Canceled allows the order to be retained and kept on the Tiger Trade APP for up to 90 days. |

Estimated Amount | The estimated amount is the expected outlay of funds after inputting the limit price and face value. However, it may differ from the actual executed amount, and the actual amount should be considered final. |

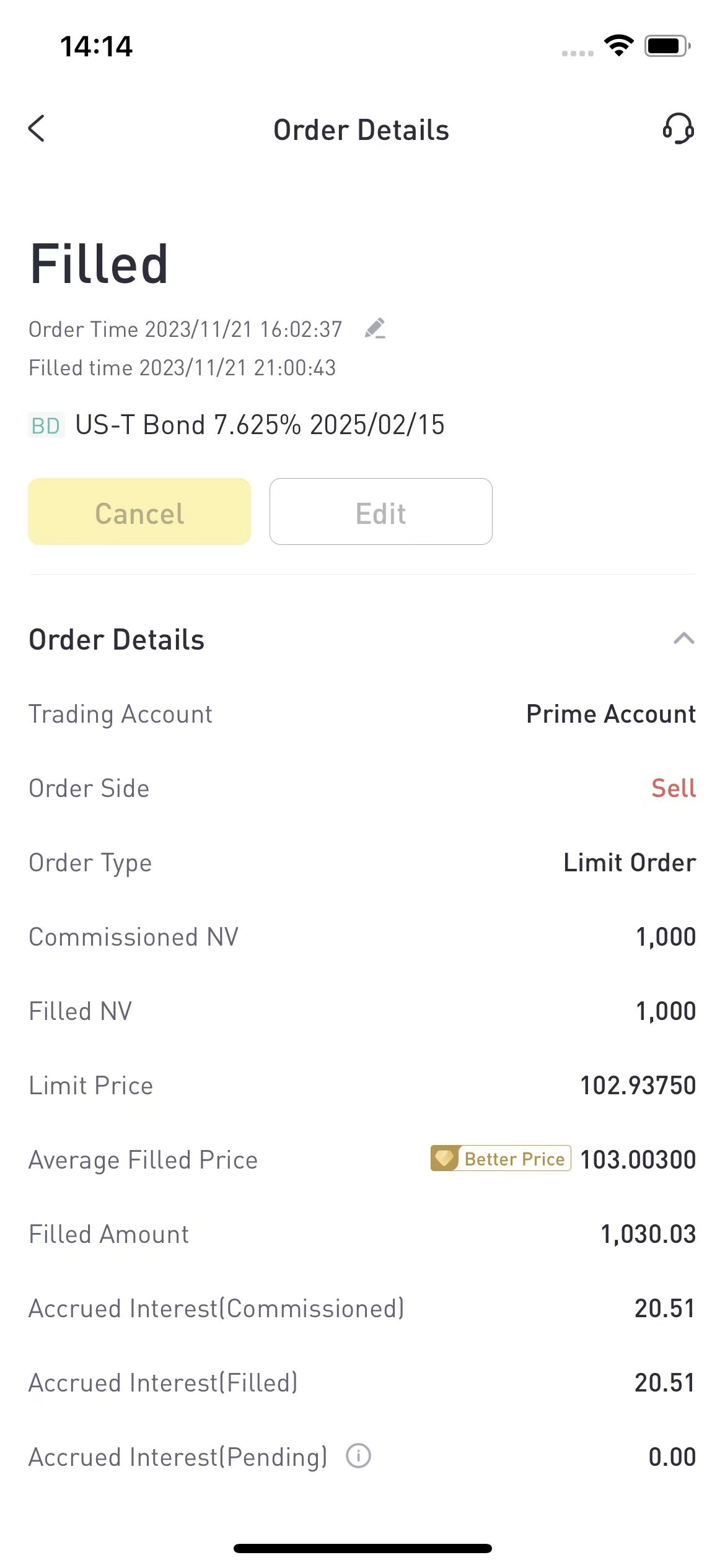

Order Details | After you enter the correct order information and click 'Buy Order,' if the transaction is successful, you can view the executed interface. This includes all information about the transaction, including order details, transaction details, and fee breakdown. |

5. How are Transaction Fees Calculated?

Trading U.S. Treasury Bonds on the Tiger Trade APP generally incurs three main types of transaction fees: commission, platform fees, and custody fees. The current fee structure is as follows:

Commission: 0.08% of the Face Value of your order

Platform Fees: 0.04% of the Face Value of your order ($5 minimum, $15 max)

Custody Fees: US Treasury's Debt Instruments held and valued at daily closing multiplied by 0.08% and divided by 365, incurs daily but paid monthly

Transfer Fee:

Transfer In: $0

Transfer Out: $1000 or 1% of Holding Value on the Transfer Request Day, whichever is greater

Third Party Fees

FINRA Trading Activity Fee:

$0.00092 multiplied by the Face Value of your order ($0.92 max per trade)

External Fees:

External fees are passed on at cost

Please note:

Holding Value is valued with the most recent closing price only on Settled Positions.

Face Value is determined by the number of bond contracts traded, multiplied by USD 100 per bond (10 bonds per transaction minimum).

For example:

Face Value | Commission | Platform Fee | 90 Day Custody Fee | Total Fee | Total Fee in Percentage | Total Annualized Fee Rate |

$10,000 | $8 | $5 | $1.97 | $14.97 | 0.15% | 0.61% |

$100,000 | $80 | $15 | $19.73 | $114.73 | 0.11% | 0.47% |

$1,000,000 | $800 | $15 | $197.26 | $1,012.26 | 0.10% | 0.41% |

All fees and sales charges quoted are exclusive of Goods and Services Tax (GST).

(*The cost estimate is for reference only. The actual costs depend on factors such as bond price fluctuations and holding duration, and will not exactly match the estimated values.)

In the above table, I have conducted a rate calculation for you. From the data in the table, it is evident that the larger the face value of the Treasury bonds you purchase, the lower the total rate and annualized rate you will bear. Therefore, for Treasury bond products, the more capital you invest, the lower the cost.

6. How are U.S. Treasury Bond Orders Executed?

All U.S. Treasury bonds are issued in "book-entry" form — a record in a central electronic ledger.

U.S. resident Treasury bond investors can hold their bonds in one of two systems: TreasuryDirect or the commercial book-entry system.

Non-U.S. residents generally participate in the secondary market for Treasury bonds only through the commercial book-entry system. This is an indirect holding system where investors hold securities through brokers, dealers, or financial institutions. The commercial book-entry system involves multiple levels, including the Treasury, the Federal Reserve System (acting as the Treasury's agent), brokers, dealers, or financial institutions. Therefore, in this system, there might be one or more entities between the investor and the Treasury.

(1)TreasuryDirect is a direct holding system, limited to U.S. residents. People can open an account by providing a valid address, social security number, bank account, and email. Transactions are directly debited from and credited to the individual's bank account. In TreasuryDirect transactions, the investor has a direct relationship with the issuer, the U.S. Treasury Department, which pays interest and principal directly to the investor's chosen financial account.

(2)For non-U.S. residents in the commercial book-entry system, the Treasury's interest and principal payments may pass through several institutions before reaching the investor. For example, a payment might flow from the Federal Reserve System to a large bank, then to a smaller bank, and finally to a broker, dealer, or financial institution before reaching the investor.

7. What is the Difference Between an Order and a Trade?

Orders and trades are important concepts in the stock and securities market. An order represents an investor's intention to buy or sell a certain number of shares or securities at a specific price. In contrast, a trade is the actual process of execution, where a buyer and seller agree, and the ownership of the stock or security is transferred.

Let's explain how an order becomes a trade with an example:

Suppose there is a stock market where investor A wants to buy 100 shares of a company, and investor B wants to sell 100 shares of the same stock. Here is how the order and trade process works:

1. Investor A's Order: Investor A enters a buy order on the trading platform, indicating a willingness to purchase 100 shares at $10 per share. This order is known as a "buy limit order" because the investor has specified the purchase price.

2. Investor B's Order: Simultaneously, investor B enters a sell order in the same market, willing to sell 100 shares at $10 per share. This order is also a "sell limit order."

3. Matching Process: The exchange or brokerage's matching engine starts working to find matching buy and sell orders. Since investor A and B's orders have the same price and quantity, they are matched.

4. Execution: The exchange or brokerage pairs investor A's buy order with investor B's sell order, then executes the trade. This means investor A buys 100 shares at $10 per share, and investor B sells 100 shares at the same price. This successful transaction is known as a "trade."

In this example, the process from order to trade is automatically completed through the matching engine. The matched prices and quantities in the orders result in a trade. This is a typical operation in the stock market, where thousands of orders and trades occur daily.

It's important to note that the price and quantity in an order might not match. If no matching order is found, the order may remain in the market until a matching one APPears, or the investor chooses to cancel it. Orders can have different types and validity periods, such as limit orders, market orders, day orders, etc., which determine how the order is executed.

Finally, it's worth mentioning that the execution method for trading Treasury bonds on the Tiger Trade APP is the same as that for stocks, through order matching, currently supporting limit and market orders.

8. Bond Interest Payment Rules

The interest payment rules of bonds involve the manner and schedule by which the issuer pays interest to bondholders. These rules are usually detailed in the bond issuance documents.

Key points about interest payment rules include:

(1)Interest Payment Frequency: The bond's issuance documents often specify the frequency of interest payments, annually or semi-annually, defining the schedule for investors to receive interest.

(2)Interest Payment Dates: The documents will specify the exact dates of interest payments, commonly referred to as "payment dates." On each date, the issuer pays the due interest to bondholders.

(3)Interest Calculation Rules: Interest is typically calculated at a fixed rate, known as the coupon rate. However, some bonds may combine interest with variable indices, like a benchmark rate plus a spread.

(4)Interest Calculation Coefficient: The issuance documents usually define the coefficient for interest calculation, which is the calendar used to calculate interest. Common coefficients include actual days/360, actual days/365, or 30/360.

(5)Method of Interest Payment: This depends on the type of bond and includes methods like electronic deposits, checks, or distribution through a custodial bank. Some bonds may offer automatic reinvestment, using the interest to purchase more bonds.

(6)Method of Interest Payment: This depends on the type of bond and includes methods like electronic deposits, checks, or distribution through a custodial bank. Some bonds may offer automatic reinvestment, using the interest to purchase more bonds.

(7)Zero-Coupon Bonds: Some bonds, like zero-coupon bonds, don’t pay regular interest. Instead, they are issued at a lower price and redeemed at face value at maturity.

Note that interest payment rules can vary based on the bond type, issuer, and market standards. You should read the bond issuance documents carefully before purchasing to ensure you understand the payment rules.

9. U.S. Treasury Bond Interest Payment Rules

Are all T-Bills zero-coupon?

Yes. T-Bills are zero-coupon bills, meaning their face coupon rate is 0.

Do all Treasury Notes pay interest twice a year?

Yes. Historically, all Treasury Notes issued by the U.S. Treasury have paid interest semi-annually. This biannual payment pattern has always been the standard for the U.S. Treasury’s medium and long-term debt instruments.

Do all Treasury Bonds pay interest twice a year?

Yes. All Treasury Bonds pay interest semi-annually. There are no Treasury Bonds that pay interest annually. This biannual payment pattern has always been the standard for the U.S. Treasury’s medium and long-term debt instruments.

10. Tax Considerations for Investing in U.S. Treasury Bonds

In most cases, purchasing U.S. Treasury bonds does not require paying taxes, especially for non-U.S. residents. However, specific tax regulations may vary depending on individual circumstances and the type of Treasury bond invested in. Therefore, it is advisable to consult with tax professionals to obtain accurate tax information.

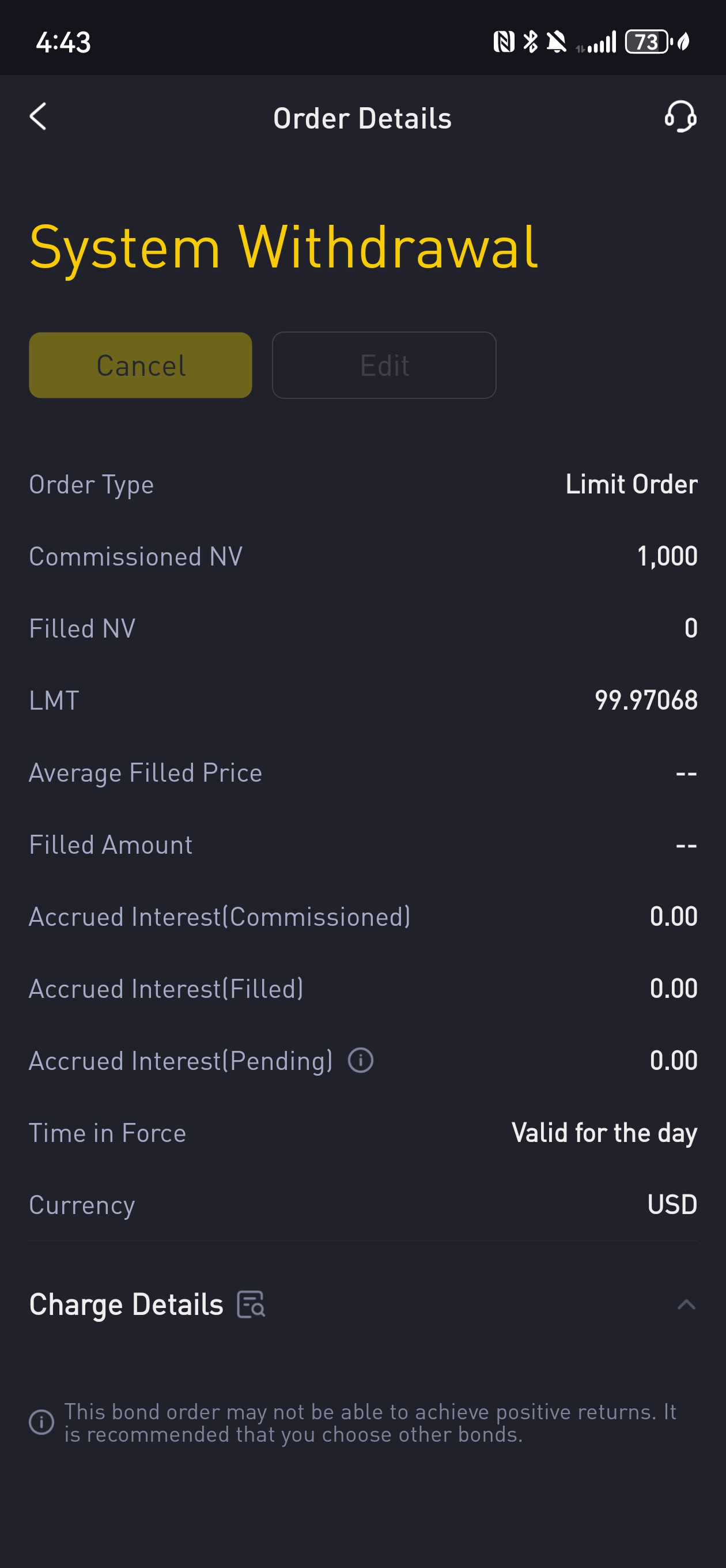

11. Why does the system prompt "This bond order may not be able to achieve positive returns. It is recommended that you choose other bonds?

The main reasons for such prompts are as follows: the system determines that, after calculating transaction commissions, platform fees, custody fees, and other costs, the trade may not generate positive returns.

Therefore, it automatically cancels the order and advises against the transaction.

However, why can't this transaction generate positive returns?

On the revenue side, the total return on Treasuries products held to maturity consists of two parts: A. The price difference between the face value and the purchase price. B. The total interest obtained from holding to maturity.

The specific calculation formulas are as follows: (1) Price difference between face value and purchase price = (Face Value - Purchase Price) * Quantity of Bonds. (2) Total interest obtained from holding to maturity = Quantity of Bonds * (Coupon Rate * Face Value / Frequency of Interest Payments) * (Remaining Full Interest Periods + (Next Interest Payment Date - Current Settlement Date) / Total Days in the Current Interest Period).

On the cost side, costs associated with trading government bond products may include commission fees, custody fees, platform fees, etc. (Refer to Section 6 of the Treasuries help center for specific rates).

When purchasing Treasuries with a small face value and a short holding period, it is possible that the total cost may exceed the final revenue from the bond. In other words, Total Return at Maturity - Total Cost < 0.

Suppose a customer purchased a US Midterm Treasury (2.250% 2023/12/31) with a face value of $1,000 and a purchase price of $99.78125 on 2023/12/06. The system prompts that the transaction cannot be completed, and the reasons are as follows:

Calculate the return on this order: (1) Price difference between face value and purchase price: Price difference = ($1,000 - $997.81) * 1 bond = $2.19. (2) Total interest obtained from holding to maturity: Calculate annual interest: 2.25% * $1,000 = $22.50. Calculate actual interest within the holding period: $22.5 * (25/365 days) ≈ $0.68. Overall, Total Return = Price difference + Total interest obtained from holding to maturity = $2.19 + $0.68 = $2.87.

Calculate the cost of this order: When purchasing this bond, according to the fee schedule, with a commission of 0.08%, platform fee of 0.04% (USD5-USD15), and custody fee of 0.08% annually, the customer incurs the following costs: Total cost = Commission Fee + Custody Fee + Platform Fee = $0.8 + $0.01 + $5 = $5.81.

Determine if there is a positive net return: Total Return - Total Cost = $2.87 - $5.81 = -$2.94.

After deducting the commission, custody fee, and platform fee incurred during the purchase, the actual net return is -$2.94.

Although the bond itself has positive returns, the higher cost incurred during the purchase compared to the returns results in a negative net return.

Therefore, to avoid a loss in this transaction, the system automatically cancels the order and advises you to "choose other bonds."